United Airlines 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

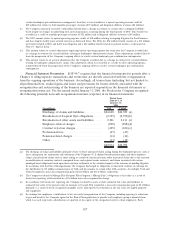

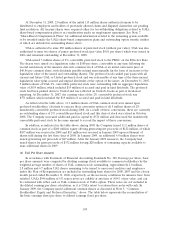

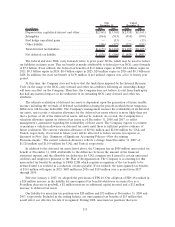

certain bankruptcy pre-confirmation contingencies; therefore, it was classified as a special operating revenue credit of

$45 million that relates to both mainline passenger revenues ($37 million) and Regional affiliates revenues ($8 million).

(c) The Company separately recorded a $26 million benefit from a change in estimate to certain other contingent liabilities

based largely on changes in underlying facts and circumstances occurring during the third quarter of 2007. This benefit was

recorded as a credit to mainline passenger revenues of $22 million and to Regional affiliates revenues of $4 million.

(d) The 2007 amount relates to special operating expense credits of $30 million relating to ongoing litigation for San Francisco

and Los Angeles facility lease secured interests as discussed above. For 2006, the $36 million benefit consists of a $12 million

net benefit related to SFO and LAX lease litigation and a $24 million benefit related to pension matters, as discussed in

Note 19, “Special Items.”

(e) This amount relates to accrual adjustments impacting various operating expense line items that the Company recorded due

to a change in estimate for certain liabilities relating to bankruptcy administrative claims. These adjustments resulted directly

from the progression of the Company’s ongoing efforts to resolve certain bankruptcy pre-confirmation contingencies.

(f) This amount relates to an accrual adjustment that the Company recorded due to a change in estimate for certain liabilities

relating to bankruptcy administrative claims. This adjustment, which was recorded as a credit to other operating expense,

resulted directly from the progression of the Company’s ongoing efforts to resolve certain bankruptcy pre-confirmation

contingencies.

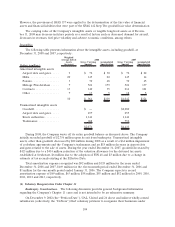

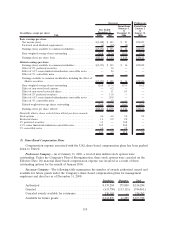

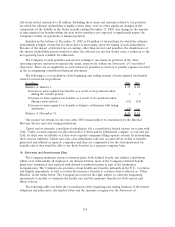

Financial Statement Presentation. SOP 90-7 requires that the financial statements for periods after a

Chapter 11 filing separate transactions and events that are directly associated with the reorganization

from the ongoing operations of the business. Accordingly, all transactions (including, but not limited to,

all professional fees, realized gains and losses and provisions for losses) directly associated with the

reorganization and restructuring of the business are reported separately in the financial statements as

reorganization items, net. For the month ended January 31, 2006, the Predecessor Company recognized

the following primarily non-cash reorganization income (expense) in its financial statements:

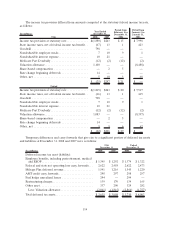

(In millions) UAL United

Period from

January 1 to

January 31,

2006

Discharge of claims and liabilities ........... $24,628 $24,389 (a)

Revaluation of frequent flyer obligations ..... (2,399) (2,399)(b)

Revaluation of other assets and liabilities ..... 2,106 2,111 (c)

Employee-related charges . . ............... (898) (898)(d)

Contract rejection charges . . ............... (429) (421)(e)

Professional fees ........................ (47) (47)

Pension-related charges ................... (14) (14)

Other................................. (13) (12)

$22,934 $22,709

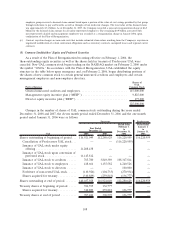

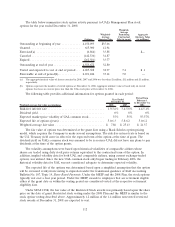

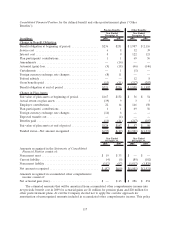

(a) The discharge of claims and liabilities primarily relates to those unsecured claims arising during the bankruptcy process, such as

those arising from the termination and settlement of the Company’s U.S. defined benefit pension plans and other employee

claims; aircraft-related claims, such as those arising as a result of aircraft rejections; other unsecured claims due to the rejection

or modification of executory contracts, unexpired leases and regional carrier contracts; and claims associated with certain

municipal bond obligations based upon their rejection, settlement or the estimated impact of the outcome of pending litigation.

In accordance with the Plan of Reorganization, the Company discharged its obligations to unsecured creditors in exchange for

the distribution of 115 million common shares of UAL and the issuance of certain other UAL securities. Accordingly, UAL and

United recognized a non-cash reorganization gain of $24.6 billion and $24.4 billion, respectively.

(b) The Company revalued its Mileage Plus Frequent Flyer Program (“Mileage Plus”) obligations at fair value as a result of

fresh-start reporting, which resulted in a $2.4 billion non-cash reorganization charge.

(c) In accordance with fresh-start reporting, the Company revalued its assets at their estimated fair value and liabilities at

estimated fair value or the present value of amounts to be paid. This resulted in a non-cash reorganization gain of $2.1 billion,

primarily as a result of newly recognized intangible assets, offset partly by reductions in the fair value of tangible property

and equipment.

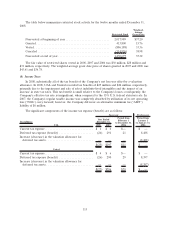

(d) In exchange for employees’ contributions to the successful reorganization of the Company, including agreeing to reductions

in pay and benefits, the Company agreed in the Plan of Reorganization to provide each employee group a deemed claim

which was used to provide a distribution of a portion of the equity of the reorganized entity to those employees. Each

107