United Airlines 2008 Annual Report Download - page 92

Download and view the complete annual report

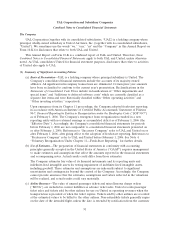

Please find page 92 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on or before the intended flight date. Fees charged in association with changes or extensions to

non-refundable tickets are recorded as passenger revenue at the time the fee is incurred.

Change fees related to non-refundable tickets are considered a separate transaction from the air

transportation because they represent a charge for the Company’s additional service to modify a

previous order. Therefore, the pricing of the change fee and the initial customer order are

separately determined and represent distinct earnings processes. Refundable tickets expire after

one year.

MCOs can be exchanged for a passenger ticket or refunded after issuance. United estimates the

amount of MCOs that will not be exchanged or refunded and recognizes revenue for these

MCOs ratably over the redemption period, based on historical experience.

United records an estimate of tickets that have been used, but not recorded as revenue due to

system processing errors, as revenue in the month of sale based on historical results. Due to

complex industry pricing structures, refund and exchange policies and interline agreements with

other airlines, certain amounts are recognized as revenue using estimates both as to the timing

of recognition and the amount of revenue to be recognized. These estimates are based on the

evaluation of actual historical results. United recognizes cargo and mail revenue as service is

provided.

(d) Cash and Cash Equivalents, Short-Term Investments, Restricted Cash—Cash in excess of operating

requirements is invested in short-term, highly liquid investments. Investments with a maturity of

three months or less on their acquisition date are classified as cash and cash equivalents. Other

investments are classified as short-term investments. Investments classified as held-to-maturity

are stated at amortized cost, which approximates market due to their short-term maturities.

Investments in debt securities classified as available-for-sale are stated at fair value. The gains

or losses from sales of available-for-sale securities are included in other comprehensive income.

As of December 31, 2008, approximately 50% of the Company’s cash and cash equivalents

consisted of money market funds directly or indirectly invested in U.S. treasury securities with

the remainder largely in money market funds that are covered by the new government money

market funds guarantee program. There are no withdrawal restrictions at the present time on

any of the money market funds in which the Company has invested. In addition, the Company

has no auction rate securities as of December 31, 2008. At December 31, 2007, UAL’s and

United’s investments in debt securities classified as held-to-maturity included $1.3 billion and

$1.2 billion, respectively, recorded in cash and cash equivalents and $2.3 billion recorded in

short-term investments for both UAL and United.

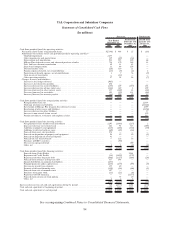

In 2008 and 2007, restricted cash includes cash collateral to secure workers’ compensation

obligations and reserves for institutions that process credit card ticket sales. The Company

classifies changes in restricted cash balances as an investing activity in its statement of

consolidated cash flows, because we consider restricted cash similar to an investment. Certain

other companies within our industry also classify certain of their restricted cash transactions as

investing activities in their statement of cash flows, while others classify certain of their restricted

cash transactions as operating activities in their statement of cash flows. The pro-forma impact

of UAL classifying all changes in its restricted cash balances as operating activities in the years

ended December 31, 2008 and 2007, the eleven month period from February 1, 2006 to

92