United Airlines 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

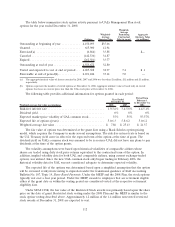

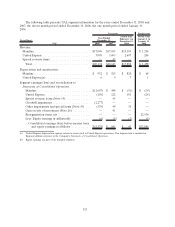

may result in more volatility in the amortization of these unrecognized amounts into net periodic

pension cost.

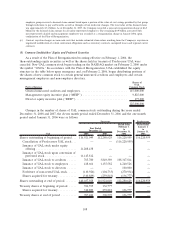

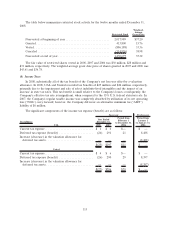

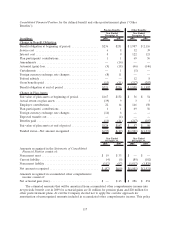

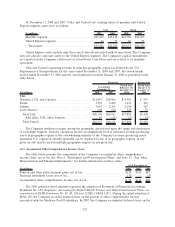

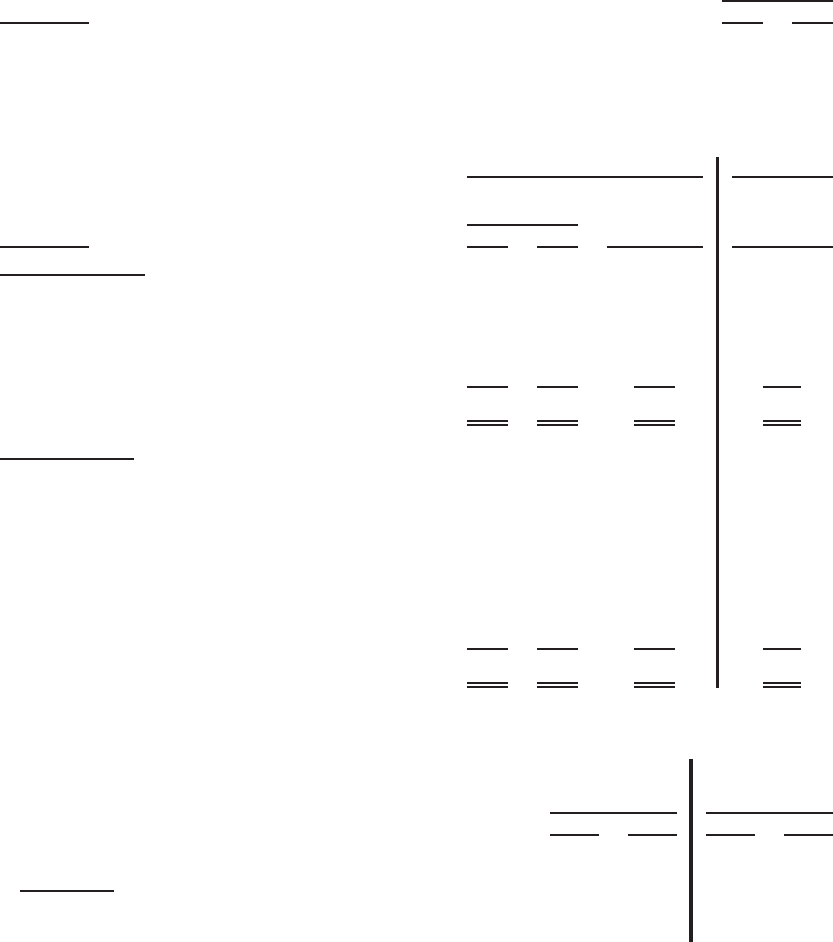

The following information relates to all pension plans with an accumulated benefit obligation and a

projected benefit obligation in excess of plan assets:

(In millions) 2008 2007

December 31,

Projected benefit obligation .......................................... $211 $208

Accumulated benefit obligation ....................................... 175 171

Fair value of plan assets ............................................. 94 106

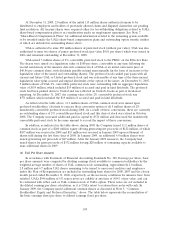

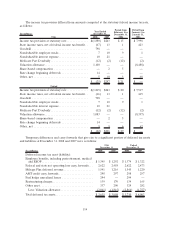

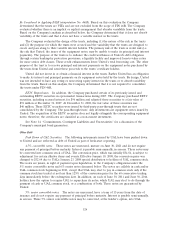

The net periodic benefit cost included the following components:

(In millions) 2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1

to January 31,

2006

Year Ended

December 31,

Successor Predecessor

Pension Benefits

Service cost ............................... $ 6 $ 8 $ 9 $ 1

Interest cost ............................... 8 9 8 1

Expected return on plan assets ................ (10) (9) (8) (1)

Recognized actuarial (gain) loss ............... (2) (1) — —

Net periodic benefit costs .................... $ 2 $ 7 $ 9 $ 1

Other Benefits,

Service cost ............................... $ 32 $ 39 $ 33 $ 3

Interest cost ............................... 122 121 116 11

Expected return on plan assets ................ (4) (3) (6) (1)

Amortization of prior service cost

including transition obligation ............... — — — (13)

Curtailment gain ........................... (1) — —

Recognized actuarial (gain) loss ............... (17) (11) — 8

Net periodic benefit costs .................... $132 $146 $143 $ 8

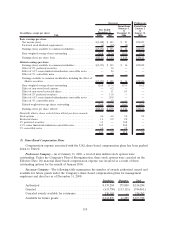

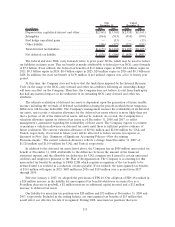

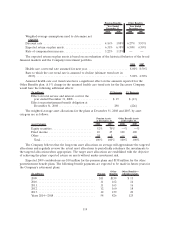

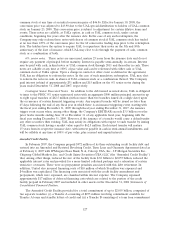

The assumptions below are based on country-specific bond yields and other economic data. The

weighted-average assumptions used for the benefit plans were as follows:

2008 2007 2008 2007

Pension Benefits

At

December 31,

Other Benefits

At

December 31,

Weighted-average assumptions used to determine benefit

obligations

Discount rate ..................................... 3.59% 4.16% 5.97% 6.27%

Rate of compensation increase ........................ 2.94% 3.22% — —

118