United Airlines 2008 Annual Report Download - page 69

Download and view the complete annual report

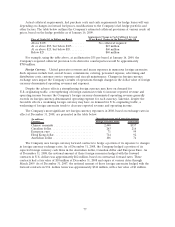

Please find page 69 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.indicated a potential impairment of value. This impairment analysis resulted in an additional fourth

quarter impairment charge of $107 million related to the Company’s B737 fleet. This additional

impairment charge was due to changes in market conditions and other conditions, including but not

limited to the cancellation of multiple letters of intent that the Company had to sell B737 aircraft, that

occurred since the impairment testing performed in the second quarter of 2008.

Due to the unfavorable economic and industry factors described above, the Company also

determined in the second quarter of 2008 that it was required to test its $91 million of pre-delivery

aircraft deposits for impairment. The Company determined that these aircraft deposits were completely

impaired and recorded an impairment charge to write-off their full carrying value and $14 million of

related capitalized interest. The Company believes that it is highly unlikely that it will take these future

aircraft deliveries and will therefore be required to forfeit the $91 million of deposits, which are not

transferable.

As a result of the impairment testing described above, the Company’s goodwill and certain of its

indefinite-lived intangible assets and tangible assets were recorded at fair value. In accordance with

FASB Staff Position No. 157-2, Effective Date of FASB Statement No. 157, the Company has not applied

Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“SFAS 157”) to the

determination of the fair value of these assets. However, the provisions of SFAS 157 were applied to the

determination of the fair value of financial assets and financial liabilities that were part of the SFAS 142

Step Two goodwill fair value determination.

Due to extreme fuel price volatility, tight credit markets, uncertain economic environment, as well

as other factors and uncertainties, the Company can provide no assurance that a material impairment

charge of aircraft or indefinite-lived intangible assets will not occur in a future period. The value of our

aircraft could be impacted in future periods by changes in the market for these aircraft. Such changes

could result in a greater supply and lower demand for certain aircraft types as other carriers announce

plans to retire similar aircraft. The Company will continue to monitor circumstances and events in future

periods to determine whether additional interim asset impairment testing is warranted.

Except for the adoption of fresh-start reporting at February 1, 2006, whereby the Company

remeasured long-lived assets at fair value, it is the Company’s policy to record assets acquired, including

aircraft, at acquisition cost. Depreciable life is determined through economic analysis, such as reviewing

existing fleet plans, obtaining appraisals and comparing estimated lives to other airlines that operate

similar fleets. Older generation aircraft are assigned lives that are generally consistent with the

experience of United and the practice of other airlines. As aircraft technology has improved, useful life

has increased and the Company has generally estimated the lives of those aircraft to be 30 years.

Residual values are estimated based on historical experience with regard to the sale of both aircraft and

spare parts and are established in conjunction with the estimated useful lives of the related fleets.

Residual values are based on current dollars when the aircraft are acquired and typically reflect asset

values that have not reached the end of their physical life. Both depreciable lives and residual values are

revised periodically to recognize changes in the Company’s fleet plan and other relevant information. A

one year increase in the average depreciable life of our flight equipment would reduce annual

depreciation expense on flight equipment by approximately $18 million.

Accounting for Goodwill and Intangible Assets. Upon the implementation of fresh-start reporting

(see Note 4, “Voluntary Reorganization Under Chapter 11—Fresh-Start Reporting,” in Combined Notes

to Consolidated Financial Statements) the Company’s assets, liabilities and equity were generally valued

at their respective fair values. The excess of reorganization value over the fair value of net tangible and

identifiable intangible assets and liabilities was recorded as goodwill in the accompanying Statements of

Consolidated Financial Position on the Effective Date. The entire goodwill amount of $2.3 billion at

December 31, 2007 was allocated to the mainline reporting segment. In addition, the adoption of

fresh-start reporting resulted in the recognition of $2.2 billion of indefinite-lived intangible assets.

In accordance with SFAS 142, the Company applies a fair value-based impairment test to the book

value of goodwill and indefinite-lived intangible assets on an annual basis and, if certain events or

69