United Airlines 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In Step Two of the impairment test, the Company determined the implied fair value of goodwill of

the mainline reporting unit by allocating the fair value of the reporting unit determined in Step One to

all the assets and liabilities of the mainline reporting unit, including any recognized and unrecognized

intangible assets, as if the mainline reporting unit had been acquired in a business combination and the

fair value of the mainline reporting unit was the acquisition price. As a result of the Step Two testing,

the Company determined that goodwill was completely impaired and therefore recorded an impairment

charge during the second quarter of 2008 to write-off the full value of goodwill.

Indefinite-lived intangible assets

2008 Interim Impairment Test

The Company utilized appropriate valuation techniques to separately estimate the fair values of all

of its indefinite-lived intangible assets as of May 31, 2008 and compared those estimates to related

carrying values. Tested assets included tradenames, international route authorities, London Heathrow

slots and codesharing agreements. The Company used a market or income valuation approach, as

described above, to estimate fair values. Based on the results of this testing, the Company recorded a

$64 million impairment charge to indefinite-lived intangible assets for the year ended December 31,

2008.

Annual Impairment Tests

United performed annual impairment reviews of its indefinite-lived intangible assets as of October 1,

2008 and 2007 and of its goodwill as of October 1, 2007 and determined that no impairment was

indicated.

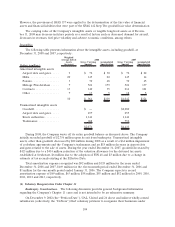

Long-lived assets

For purposes of testing impairment of long-lived assets at May 31, 2008, the Company determined

whether the carrying amount of its long-lived assets was recoverable by comparing the carrying amount

to the sum of the undiscounted cash flows expected to result from the use and eventual disposition of

the assets. If the carrying value of the assets exceeded the expected cash flows, the Company estimated

the fair value of these assets to determine whether an impairment existed. The Company grouped its

aircraft by fleet type to perform this evaluation and used data and assumptions through May 31, 2008.

The estimated undiscounted cash flows were dependent on a number of critical management

assumptions including estimates of future capacity, passenger yield, traffic, operating costs (including fuel

prices) and other relevant assumptions. If estimates of fair value were required, fair value was estimated

using the market approach. Asset appraisals, published aircraft pricing guides and recent transactions for

similar aircraft were considered by the Company in its market value determination. Based on the results

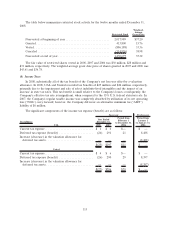

of these tests, the Company determined that an impairment of $38 million existed which was attributable

to the Company’s fleet of owned B737 aircraft and related spare parts. In addition, as of December 31,

2008, the Company performed an impairment test of its B737 aircraft. Based on this analysis, the

Company recorded an additional charge of $107 million to reduce the carrying value of the B737

aircraft. As described in Note 2, “Company Operational Plans,” the Company is retiring its entire B737

fleet earlier than originally planned.

Due to the unfavorable economic and industry factors described above, the Company also

determined in the second quarter of 2008 that it was required to perform an impairment test of its

$105 million of pre-delivery aircraft deposits and related capitalized interest. The Company determined

that these aircraft deposits were completely impaired and wrote off their full carrying value. The

Company believes that it is highly unlikely that it will take these future aircraft deliveries and, therefore,

the Company will be required to forfeit the deposits, which are also not transferable.

As a result of the impairment testing described above, the Company’s goodwill and certain of its

indefinite-lived intangible assets and tangible assets were recorded at fair value. In accordance with

FSP 157-2,the Company has not applied SFAS 157 to the determination of the fair value of these assets.

103