United Airlines 2008 Annual Report Download - page 109

Download and view the complete annual report

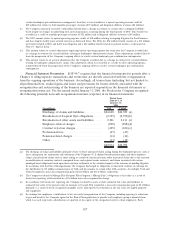

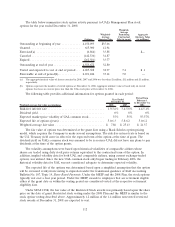

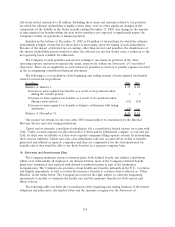

Please find page 109 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2008, 2.0 million of the initial 115 million shares authorized remain to be

distributed to employees and holders of previously allowed claims and disputed claims that are pending

final resolution. All treasury shares were acquired either for tax withholding obligations related to UAL’s

share-based compensation plan or as consideration under an employment agreement. See Note 7,

“Share-Based Compensation Plans” for additional information related to the remaining grants available

to be awarded under the UAL’s share-based compensation plans and outstanding option awards, neither

of which are included in outstanding shares above.

UAL is authorized to issue 250 million shares of preferred stock (without par value). UAL was also

authorized to issue two shares of junior preferred stock (par value $0.01 per share) which were issued in

2006 and remained outstanding at December 31, 2008.

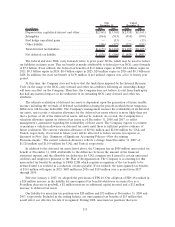

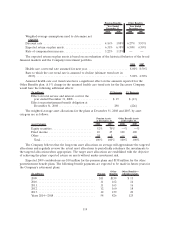

UAL issued 5 million shares of 2% convertible preferred stock to the PBGC on the Effective Date.

The shares were issued at a liquidation value of $100 per share, convertible at any time following the

second anniversary of the issuance date into common stock of UAL at an initial conversion price of

$46.86 per common share; with dividends payable in kind semi-annually (in the form of increases to the

liquidation value of the issued and outstanding shares). The preferred stock ranked pari passu with all

current and future UAL or United preferred stock and was redeemable at any time at the then-current

liquidation value (plus accrued and unpaid dividends) at the option of the issuer. At December 31, 2007,

5 million shares of UAL 2% convertible preferred stock were outstanding with an aggregate liquidation

value of $519 million, which included $19 million of accrued and paid in kind dividends. The preferred

stock had been pushed down to United and was reflected on United’s books as part of fresh-start

reporting. At December 31, 2007, the carrying value of the 2% convertible preferred stock was

$371 million, which included the $19 million of accrued and paid in kind dividends.

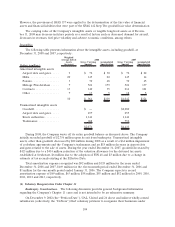

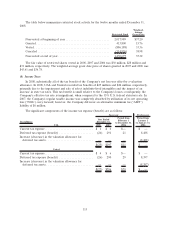

As reflected in the table above, 11.1 million shares of UAL common stock were issued upon

preferred stockholders’ elections to exercise their conversion option of all 5 million shares of 2%

mandatorily convertible preferred stock during 2008. As a result of these conversions, there are currently

no outstanding shares of 2% convertible preferred stock and this class of stock was retired in October

2008. The Company increased additional paid in capital by $374 million and decreased the mandatorily

convertible preferred stock by the same amount to record the impact of these conversions.

In addition, as indicated in the table above, during 2008 the Company issued 11.2 million shares of

common stock as part of a $200 million equity offering generating net proceeds of $122 million, of which

$107 million was received in 2008 and $15 million was received in January 2009 upon settlement of

shares sold during the last three days of 2008. In January 2009, an additional 4.0 million shares were

issued generating net proceeds of $47 million. After the January 2009 issuances, the Company had

issued shares for gross proceeds of $172 million leaving $28 million of remaining capacity available to

issue additional shares in 2009.

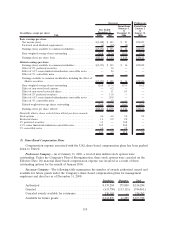

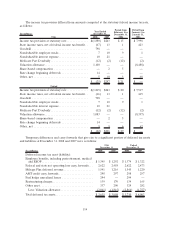

(6) UAL Per Share Amounts

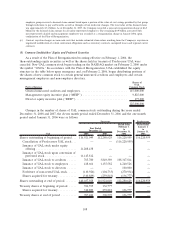

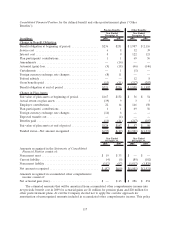

In accordance with Statement of Financial Accounting Standards No. 128, Earnings per Share, basic

per share amounts were computed by dividing earnings (loss) available to common stockholders by the

weighted-average number of shares of UAL common stock outstanding. Approximately 2.0 million,

2.8 million and 6.7 million UAL shares remaining to be issued to unsecured creditors and employees

under the Plan of Reorganization are included in outstanding basic shares for 2008, 2007 and the eleven

month period ended December 31, 2006, respectively, as the necessary conditions for issuance have been

satisfied. UAL’s $546 million of 6% senior notes are callable at any time at 100% of par value, and can

be redeemed with either cash or UAL common stock at UAL’s option. These notes are not included in

the diluted earnings per share calculation, as it is UAL’s intent to redeem these notes with cash. In

January 2009, the Company issued additional common shares as discussed in Note 5, “Common

Stockholders’ Equity and Preferred Securities,” above. The table below represents the reconciliation of

the basic earnings (loss) per share to diluted earnings (loss) per share.

109