United Airlines 2008 Annual Report Download - page 95

Download and view the complete annual report

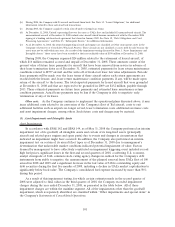

Please find page 95 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.making its estimates, but changes in customer mileage redemption behavior to patterns which

are not consistent with historical behavior can result in material changes to deferred revenue

balances, and to recognized revenue.

The Company measures its deferred revenue obligation using all awarded and outstanding

miles, regardless of whether or not the customer has accumulated enough miles to redeem an

award. Eventually these customers will accumulate enough miles to redeem awards, or their

accounts will deactivate after a period of inactivity, in which case the Company will recognize

the related revenue through its revenue recognition policy for expired miles.

The Company recognizes revenue related to expected expired miles over the estimated

redemption period. Management’s estimate of the expected expiration of miles requires

significant management judgment. In early 2007, the Company announced that it was reducing

the expiration period for inactive accounts from 36 months to 18 months effective December 31,

2007. The change in the expiration period increased revenues by $246 million in 2007. Current

and future changes to expiration assumptions or to the expiration policy, or to program rules

and program redemption opportunities, may result in material changes to the deferred revenue

balance, as well as recognized revenues from the program. In 2008, the Company updated

certain of its assumptions related to the recognition of revenue for expiration of miles. Based on

additional analysis of mileage redemption and expiration patterns, the Company revised the

estimated number of miles that are expected to expire from 15% to 24% of earned miles,

including miles that will expire or go unredeemed for reasons other than account deactivation.

In 2008, the Company also extended the total time period over which revenue from the

expiration of miles is recognized based upon the estimated period of miles redemption. This

change did not materially impact the Company’s Mileage Plus revenue recognition in 2008.

See Note 17, “Advanced Purchase of Miles,” for additional information related to the Mileage

Plus program.

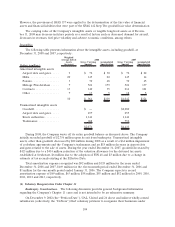

(h) Deferred Gains (Losses)—Gains and losses on aircraft sale and leaseback transactions are

deferred and amortized over the terms of the related leases as an adjustment to aircraft rent

expense.

(i) United Express—United has agreements under which independent regional carriers, flying under

the United Express name, connect passengers to other United Express and/or United flights

(the latter of which we also refer to as “mainline” operations, to distinguish them from United

Express regional operations). The vast majority of United Express flights are operated under

capacity agreements, while a relatively smaller number are operated under prorate agreements.

United Express operating revenues and expenses are classified as “Passenger—Regional

affiliates” and “Regional affiliates,” respectively, in the Statements of Consolidated Operations.

Regional affiliate expense includes both allocated and direct costs. Direct costs represent

expenses that are specifically and exclusively related to United Express flying activities, such as

capacity agreement payments, commissions, booking fees, fuel expenses and dedicated staffing.

The capacity agreement payments are based on specific rates for various operating expenses of

the United Express carriers, such as crew expenses, maintenance and aircraft ownership, some

of which are multiplied by specific operating statistics (e.g., block hours, departures) while

others are fixed per month. Allocated costs represent United Express’s portion of shared

expenses and include charges for items such as airport operating costs, reservation-related costs,

credit card discount fees and facility rents. For each of these expense categories, the Company

estimates United Express’s portion of total expense and allocates the applicable portion of

expense to the United Express carrier.

United has the right to exclusively operate and direct the operations of these aircraft and

accordingly the minimum future lease payments for these aircraft are included in the Company’s

95