United Airlines 2008 Annual Report Download - page 138

Download and view the complete annual report

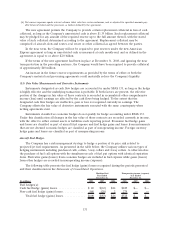

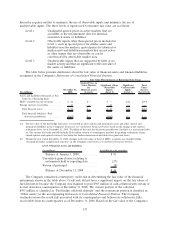

Please find page 138 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.leases on the balance sheet and, accordingly, all residual value guarantee amounts contained in the

Company’s aircraft leases are fully reflected as capital lease obligations in the Statements of Consolidated

Financial Position.

The Company has various operating leases for 119 aircraft in which the lessors are trusts established

specifically to purchase, finance and lease aircraft to United. These leasing entities related to 108 of

these aircraft meet the criteria for VIEs; however, the Company does not hold a significant variable

interest in and is not considered the primary beneficiary of the leasing entities since the lease terms are

consistent with market terms at the inception of the lease and do not include a residual value guarantee,

fixed-price purchase option or similar feature that obligates us to absorb decreases in value, or entitles

the Company to participate in increases in the value of the financed aircraft. In addition, of the

Company’s total aircraft operating leases only 11 of these aircraft leases have leasing entities that meet

the criteria for VIEs and allow the Company to purchase the aircraft at other than fair market value.

These leases have fixed price purchase options specified in the lease agreements which at the inception

of the lease approximated the aircraft’s expected fair market value at the option date.

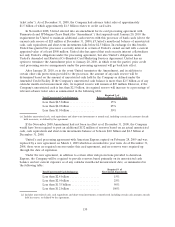

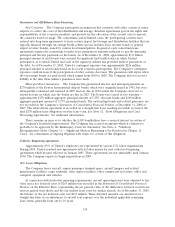

In October 2008, United entered into a $125 million sale-leaseback involving nine previously

unencumbered aircraft. This financing agreement terminates in 2010; however, United has the option to

extend the financing agreement for one year provided it meets the minimum loan to asset value

requirement. Interest payments are based on LIBOR plus a margin. The lease is considered a capital

lease resulting in non-cash increases to capital lease assets and capital lease obligations.

In December 2008, United entered into a $149 million sale-leaseback involving 15 previously

unencumbered aircraft. The final maturities of the leases under this agreement vary and have an average

term of seven years. Two of the leased aircraft are being accounted for as operating leases, with the

remaining 13 accounted for as capital leases.

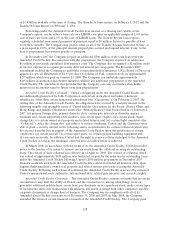

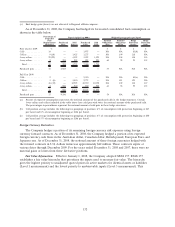

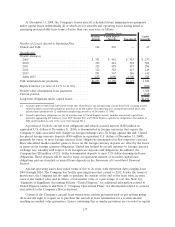

Amounts charged to rent expense, net of minor amounts of sublease rentals, were $926 million and

$928 million and $934 million and $936 million for UAL and United, respectively, for the years ended

December 31, 2008 and 2007, respectively; $833 million and $834 million for UAL and United,

respectively, for the eleven months ended December 31, 2006; $76 million for both UAL and United for

the month ended January 31, 2006. Included in Regional affiliates expense in the Statements of

Consolidated Operations were operating rents for United Express aircraft of $413 million, $425 million

and $403 million for the Successor Company for the years ended December 31, 2008 and 2007 and the

eleven months ended December 31, 2006, respectively; and $35 million for the month ended January 31,

2006 for the Predecessor Company.

138