United Airlines 2008 Annual Report Download - page 98

Download and view the complete annual report

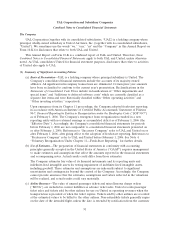

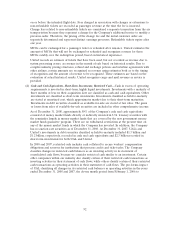

Please find page 98 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.derivative instruments and hedging activities. Entities are required to provide enhanced

disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative

instruments and related hedged items are accounted for under SFAS 133 and its related

interpretations and (c) how derivative instruments and related hedged items affect an entity’s

financial position, financial performance and cash flows. SFAS 161 is effective for the Company

for periods beginning January 1, 2009. The Company will incorporate the additional disclosures

required under SFAS 161 into its future consolidated financial statements.

In February 2008, the FASB issued FSP No. 157-2, Effective Date of FASB Statement No. 157

(“FSP 157-2”). This FSP delayed the effective date of Statement of Financial Accounting

Standards No. 157, Fair Value Measurements (“SFAS 157”) for all nonfinancial assets and

nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial

statements on a recurring basis, until periods beginning January 1, 2009. The Company is

currently evaluating the impact of SFAS 157 on the reporting and disclosure of its nonfinancial

assets and nonfinancial liabilities.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141

(revised 2007), Business Combinations (“SFAS 141R”). This statement replaces Statement of

Financial Accounting Standards No. 141, Business Combinations (“SFAS 141”). SFAS 141R

retains the fundamental requirements in Statement No. 141 that the acquisition method of

accounting be used for all business combinations and for an acquirer to be identified for each

business combination. In addition, SFAS 141R provides new guidance intended to improve

reporting by creating greater consistency in the accounting and financial reporting of business

combinations, resulting in more complete, comparable and relevant information for users of

financial statements. SFAS 141R is effective for the Company for any business combinations

with an acquisition date on or after January 1, 2009. In accordance with the provisions of

SFAS 141R that amended Statement of Financial Accounting Standards No. 109, Accounting for

Income Taxes (“SFAS 109”), beginning January 1, 2009, the Company will be required to

recognize any changes in the valuation allowance for deferred tax assets, which was established

as part of fresh-start reporting, to be recognized as an adjustment to income tax expense. This

reflects a change from current practice which requires changes in the valuation allowance to first

reduce goodwill to zero and then to reduce intangible assets to zero.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160,

Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB No. 51

(“SFAS 160”). This statement amends Accounting Research Bulletin 51, Consolidated Financial

Statements, to establish accounting and reporting standards for the noncontrolling interest (also

known as minority interest) in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160

is effective for the Company for periods beginning January 1, 2009. The Company does not

expect the adoption of SFAS 160 to have a significant impact on its consolidated financial

statements.

(q) Income Tax Contingencies—The Company has recorded reserves for income taxes and associated

interest that may become payable in future years. Certain of these reserves are for uncertain

income tax positions which are accounted for in accordance with FASB Interpretation No. 48,

Accounting for Uncertainty in Income Taxes (“FIN 48”), effective January 1, 2007. Although

management believes that its positions taken on income tax matters are reasonable, the

Company nevertheless has established tax and interest reserves in recognition that various

taxing authorities may challenge certain of the positions taken by the Company, potentially

resulting in additional liabilities for taxes and interest. The Company’s tax contingency reserves

are reviewed periodically and are adjusted as events occur that affect its estimates, such as the

availability of new information, the lapsing of applicable statutes of limitations, the conclusion

of tax audits, the measurement of additional estimated liability, the identification of new tax

contingencies, the release of administrative tax guidance affecting its estimates of tax liabilities,

98