United Airlines 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

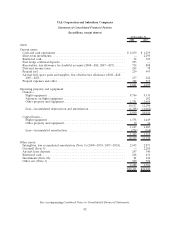

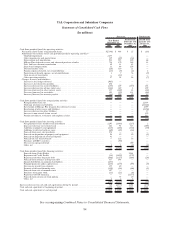

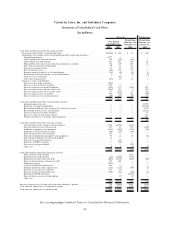

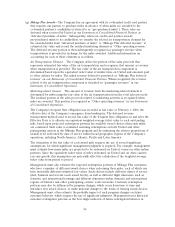

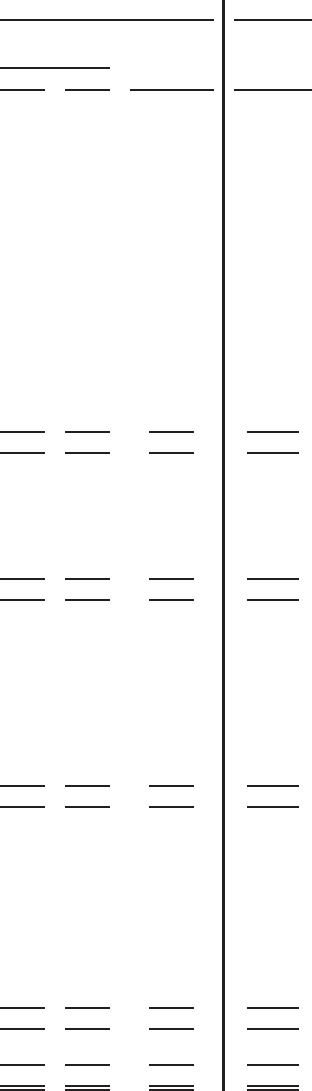

United Air Lines, Inc. and Subsidiary Companies

Statements of Consolidated Cash Flows

(In millions)

2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

Successor Predecessor

Cash flows provided (used) by operating activities:

Net income (loss) before reorganization items . . . ............................ $(5,306) $ 402 $ 32 $ (83)

Adjustments to reconcile to net cash provided (used) by operating activities—

Goodwill impairment . . . .......................................... 2,277 — — —

Otherimpairmentsandspecialitems ................................... 339 (89) (36) —

Depreciation and amortization . . ..................................... 932 925 820 68

Mileage Plus deferred revenue and advanced purchase of miles .................. 738 170 269 14

Debt and lease discount amortization . . . ................................ 49 41 83 —

Share-based compensation .......................................... 31 49 159 —

Deferred income taxes . . .......................................... (26) 318 29 —

Pensionexpense(benefit),netofcontributions............................. (13) (5) (4) 8

Postretirement benefit expense, net of contributions . . . ....................... 1 7 76 (9)

Gain on sale of investment .......................................... — (41) — —

Other operating activities . .......................................... (27) 46 62 3

Changes in assets and liabilities—

Increase in fuel hedge collateral . ..................................... (965) — — —

Increase in fuel derivative payables..................................... 858 — — —

Increase (decrease) in accrued liabilities . ................................ (128) 172 (263) 152

Increase (decrease) in advance ticket sales ................................ (388) 249 4 109

Decrease (increase) in other current assets................................ 257 (269) 13 (26)

Decrease (increase) in receivables ..................................... 197 (58) 131 (98)

Increase (decrease) in accounts payable. . ................................ (49) 210 50 25

(1,223) 2,127 1,425 163

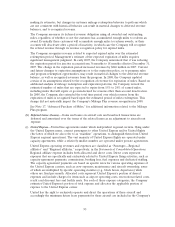

Cash flows provided (used) by reorganization activities:

Reorganization items, net. .......................................... — — — 22,709

Discharge of claims and liabilities ..................................... — — — (24,389)

Revaluation of Mileage Plus frequent flyer deferred revenue . . .................. — — — 2,399

Revaluation of other assets and liabilities . ................................ — — — (2,111)

Increase (decrease) in other liabilities . . . ................................ — — — 38

Increase in non-aircraft claims accrual. . . ................................ — — — 421

Pension curtailment, settlement and termination ............................ — — — 912

— — — (21)

Cash flows provided (used) by investing activities:

Net (purchases) sales of short-term investments ............................ 2,259 (1,951) (233) 2

(Increase) decrease in restricted cash . . . ................................ 455 87 322 (203)

Additions to property and equipment . . . ................................ (415) (658) (332) (30)

Additions to deferred software costs .................................... (60) (65) (46) —

Proceeds from asset sale-leasebacks .................................... 274 — — —

Proceeds on disposition of property and equipment . . . ....................... 93 18 40 (1)

Proceeds from litigation on advanced deposits . ............................ 41 — — —

Proceeds on sale of investments . . ..................................... — 128 — —

Purchases of EETC securities . . . ..................................... — (96) — —

Decrease in segregated funds . . . ..................................... — — 200 —

Other,net .................................................... 9 4 (6) (6)

2,656 (2,533) (55) (238)

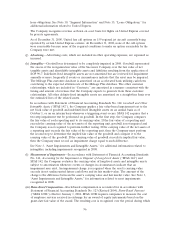

Cash flows provided (used) by financing activities:

Proceeds from Credit Facility . . . ..................................... — — 2,961 —

Repayment of Credit Facility . . . ..................................... (18) (1,495) (175) —

Repayment of other long-term debt .................................... (664) (1,255) (663) (24)

Proceeds from issuance of long-term debt ................................ 337 694 — —

Dividend to parent ............................................... (257) — — —

Capital contributions from parent ..................................... 163 — — —

Principal payments under capital leases . . ................................ (235) (177) (99) (5)

Decrease in aircraft lease deposits ..................................... 155 80 — —

Payment of deferred financing costs .................................... (120) (18) (66) (1)

RepaymentofDIPfinancing......................................... — — (1,157) —

Proceeds from exercise of stock options . . ................................ — 35 10 —

Other,net .................................................... — 2 2 —

(639) (2,134) 813 (30)

Increase (decrease) in cash and cash equivalents during the period . .................. 794 (2,540) 2,183 (126)

Cash and cash equivalents at beginning of period . . ............................ 1,239 3,779 1,596 1,722

Cash and cash equivalents at end of period . . ................................ $2,033 $1,239 $3,779 $ 1,596

See accompanying Combined Notes to Consolidated Financial Statements.

89