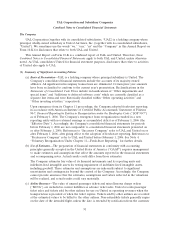

United Airlines 2008 Annual Report Download - page 97

Download and view the complete annual report

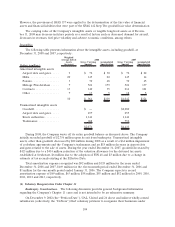

Please find page 97 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.an employee is required to provide service in exchange for the award, usually the vesting period.

See Note 7, “Share-Based Compensation Plans,” for additional information.

(n) Ticket Taxes—Certain governmental taxes are imposed on United’s ticket sales through a fee

included in ticket prices. United collects these fees and remits them to the appropriate

government agency. These fees are recorded on a net basis (excluded from operating revenues).

(o) Early Retirement of Leased Aircraft—The Company accrues for the present value of future

minimum lease payments, net of estimated sublease rentals (if any) in the period aircraft are

removed from service. When reasonably estimable and probable, the Company estimates

maintenance lease return condition obligations for items such as minimum aircraft and engine

conditions specified in leases and accrues these amounts as contingent rent ratably over the

lease term while the aircraft are operating, and any remaining unrecognized estimated

obligations are accrued in the period an aircraft is removed from service. In addition, the

Company accrues for an early termination lease penalty in the period that the Company

executes an early return agreement with a lessor.

(p) New Accounting Pronouncements—In May 2008, the FASB issued FASB Staff Position (“FSP”)

No. APB 14-1, Accounting for Convertible Debt Instruments That May Be Settled in Cash upon

Conversion (Including Partial Cash Settlement) (“APB 14-1”). APB 14-1 requires the issuer of

certain convertible debt instruments that may be settled in cash (or other assets) on conversion

to separately account for the liability (debt) and equity (conversion option) components of the

instrument in a manner that reflects the issuer’s non-convertible debt borrowing rate. APB 14-1,

which is applied retrospectively, is effective for the Company beginning January 1, 2009. The

Company estimates that the fair value of the equity component of its two convertible debt

instruments that may be cash settled was approximately $250 million at the time of issuance of

these instruments. This discount will be applied retrospectively to the Company’s financial

statements from the date of adoption of fresh-start reporting and amortized over the expected

five-year life of the notes resulting in increased interest expense in historical and future periods.

In June 2008, the Emerging Issues Task Force (“EITF”) of the Financial Accounting Standards

Board (“FASB”) issued EITF Issue 07-5, Determining Whether an Instrument (or Embedded

Feature) is Indexed to an Entity’s Own Stock, (“EITF 07-5”) which is effective for the Company

beginning January 1, 2009. EITF 07-5 provides additional guidance as to the phrase “indexed to

an entity’s own stock” for purposes of determining whether certain instruments or embedded

features qualify for a scope exception in Statement of Financial Accounting Standards No. 133,

Accounting for Derivative Instruments and Hedging Activities (“SFAS 133”). The Company is still

evaluating the impact, if any, that the adoption of EITF 07-5 will have on its results of

operations and financial position based on its current financial instruments. The impact, if any,

would be recorded as a cumulative adjustment to beginning retained earnings.

In June 2008, the FASB issued FSP No. EITF 03-6-1, Determining Whether Instruments Granted

in Share-Based Payment Transactions Are Participating Securities (“EITF 03-6-1”). EITF 03-6-1

addresses whether instruments granted in share-based payment transactions are participating

securities prior to vesting and, therefore, need to be included in the earnings allocation under

the two-class method of calculating earnings per share. EITF 03-6-1, which will be applied

retrospectively to the date of fresh-start reporting, is effective for the Company beginning

January 1, 2009. The Company expects that the retrospective application of EITF 03-6-1 will

result in increases in the basic shares outstanding used to compute basic earnings per share of

approximately 1.4 million, 2.0 million and 2.7 million shares for the years ended December 31,

2008 and 2007 and eleven month period ended December 31, 2006, respectively. The Company

does not expect that EITF 03-6-1 will change its previously reported diluted earnings per share.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161,

Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB

Statement No. 133 (“SFAS 161”). This Statement changes the disclosure requirements for

97