United Airlines 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Guarantees and Off-Balance Sheet Financing.

Fuel Consortia. The Company participates in numerous fuel consortia with other carriers at major

airports to reduce the costs of fuel distribution and storage. Interline agreements govern the rights and

responsibilities of the consortia members and provide for the allocation of the overall costs to operate

the consortia based on usage. The consortium (and in limited cases, the participating carriers) have

entered into long-term agreements to lease certain airport fuel storage and distribution facilities that are

typically financed through tax-exempt bonds (either special facilities lease revenue bonds or general

airport revenue bonds), issued by various local municipalities. In general, each consortium lease

agreement requires the consortium to make lease payments in amounts sufficient to pay the maturing

principal and interest payments on the bonds. As of December 31, 2008, approximately $1.2 billion

principal amount of such bonds were secured by significant fuel facility leases in which United

participates, as to which United and each of the signatory airlines has provided indirect guarantees of

the debt. As of December 31, 2008, United’s contingent exposure was approximately $226 million

principal amount of such bonds based on its recent consortia participation. The Company’s contingent

exposure could increase if the participation of other carriers decreases. The guarantees will expire when

the tax-exempt bonds are paid in full, which ranges from 2010 to 2028. The Company did not record a

liability at the time these indirect guarantees were made.

Municipal Bond Guarantees. The Company has guaranteed interest and principal payments on

$270 million of the Denver International Airport bonds, which were originally issued in 1992, but were

subsequently redeemed and reissued in 2007 and are due in 2032 unless the Company elects not to

extend its lease in which case the bonds are due in 2023. The bonds were issued in two tranches —

approximately $170 million aggregate principal amount of 5.25% discount bonds and $100 million

aggregate principal amount of 5.75% premium bonds. The outstanding bonds and related guarantee are

not recorded in the Company’s Statements of Consolidated Financial Position at December 31, 2008 or

2007. The related lease agreement is recorded on a straight-line basis resulting in ratable accrual of the

final $270 million lease obligation over the lease term. See Note 12, “Debt Obligations and Card

Processing Agreements,” for additional information.

There remains an issue as to whether the LAX bondholders have a secured interest in certain of

the Company’s leasehold improvements. The Company has accrued an amount which it estimates is

probable to be approved by the Bankruptcy Court for this matter. See Note 4, “Voluntary

Reorganization Under Chapter 11 — Significant Matters Remaining to be Resolved in Chapter 11

Cases,” for a discussion of ongoing litigation with respect to certain of this obligation.

Collective Bargaining Agreements.

Approximately 83% of United’s employees are represented by various U.S. labor organizations.

During 2005, United reached new agreements with its labor unions for new collective bargaining

agreements which became effective in January 2005. These agreements are not amendable until January

2010. The Company expects to begin negotiations in 2009.

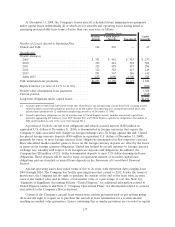

(15) Lease Obligations

The Company leases aircraft, airport passenger terminal space, aircraft hangars and related

maintenance facilities, cargo terminals, other airport facilities, other commercial real estate, office and

computer equipment and vehicles.

In connection with fresh-start reporting requirements, aircraft operating leases were adjusted to fair

value and a net deferred asset of $263 million was recorded in the Statement of Consolidated Financial

Position on the Effective Date, representing the net present value of the differences between stated lease

rates in agreed term sheets and the fair market lease rates for similar aircraft. As of December 31, 2008,

the balance of the net deferred asset was $153 million. These deferred amounts are amortized on a

straight-line basis as an adjustment to aircraft rent expense over the individual applicable remaining

lease terms, generally from one to 16 years.

136