United Airlines 2008 Annual Report Download - page 126

Download and view the complete annual report

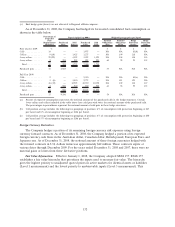

Please find page 126 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Be Considered in Applying FASB interpretation No. 46(R). Based on this evaluation the Company

determined that the trusts are VIEs and are not excluded from the scope of FIN 46R. The Company

evaluated whether there is an implicit or explicit arrangement that absorbs variability from the trusts.

Based on the Company’s analysis as described below, the Company determined that it does not absorb

variability of the trusts and that it does not have a variable interest in the trusts.

The Company evaluated the design of the trusts, including (1) the nature of the risk in the trusts

and (2) the purpose for which the trusts were created and the variability that the trusts are designed to

create and pass along to their variable interest holders. The primary risk of the trusts is credit risk (i.e.

the risk that United, the issuer of the equipment notes, may be unable to make its principal and interest

payments). The purpose of the trusts is to enhance the credit worthiness of United’s debt obligation

through certain bankruptcy protection provisions, a liquidity facility and improved loan-to-value ratios

for more senior debt classes. These credit enhancements lower United’s total borrowing cost. The other

purpose of the trust is to receive principal and interest payments on the equipment notes purchased by

the trusts from United and remit these proceeds to the trusts’ certificate holders.

United did not invest in or obtain a financial interest in the trusts. Rather United has an obligation

to make its interest and principal payments on its equipment notes held by the trusts. By design, United

was not intended to have any voting or non-voting equity interest in the trusts or to absorb variability

from the trusts. Based on this analysis, the Company determined that it is not required to consolidate

the trusts under FIN 46R.

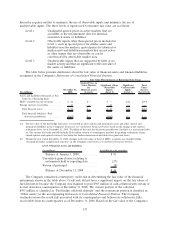

EETC Repurchases. In addition, the Company purchased certain of its previously issued and

outstanding EETC securities in open market transactions during 2007. The Company purchased EETC

securities, including accrued interest, for $96 million and adjusted these securities to a fair value of

$91 million at December 31, 2007. At December 31, 2008, the fair value of these securities was

$46 million. These EETC securities were issued by third-party pass-through trusts that are not

consolidated by the Company. The pass-through trusts’ only investments are equipment notes issued by

United. The acquisition of the EETC securities does not legally extinguish the corresponding equipment

notes; therefore, the certificates are classified as a non-current investment.

See Note 14, “Commitments, Contingent Liabilities and Uncertainties” for a discussion of the

Company’s municipal bond guarantees.

Other Debt

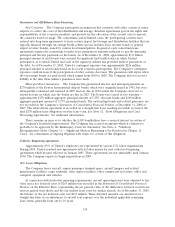

Push Down of UAL Securities. The following instruments issued by UAL have been pushed down

to United and are reflected as debt of United as part of fresh-start reporting.

4.5% convertible notes. These notes are unsecured, mature on June 30, 2021 and do not require

any payment of principal before maturity. Interest is payable semi-annually, in arrears. These notes may

be converted into common stock of UAL. The conversion price, which was initially $34.84, is subject to

adjustment for certain dilutive items and events. Effective January 10, 2008, the conversion price was

changed to $32.64 due to UAL’s January 23, 2008 special distribution to holders of UAL common stock.

The notes are junior, in right of payment upon liquidation, to the Company’s obligations under the

5% senior convertible notes and 6% senior notes discussed below. The notes are callable in cash and/or

UAL common stock beginning in 2011, except that UAL may elect to pay in common stock only if the

common stock has traded at not less than 125% of the conversion price for the 60 consecutive trading

days immediately before the redemption date. In addition, on each of June 30, 2011 and June 30, 2016,

holders have the option to require UAL to repurchase its notes, which UAL may elect to do through the

payment of cash or UAL common stock, or a combination of both. These notes are guaranteed by

United.

5% senior convertible notes. The notes are unsecured, have a term of 15 years from the date of

issuance and do not require any payment of principal before maturity. Interest is payable semi-annually,

in arrears. These 5% senior convertible notes may be converted, at the holder’s option, into UAL

126