United Airlines 2008 Annual Report Download - page 72

Download and view the complete annual report

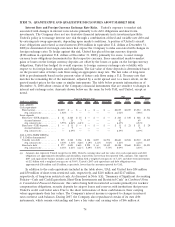

Please find page 72 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Valuation Allowance for Deferred Tax Assets. At December 31, 2008, the Company had valuation

allowances against its deferred tax assets of approximately $2.9 billion. In accordance with Statement of

Financial Accounting Standards No. 109, Accounting for Income Taxes, a valuation allowance is required

to be recorded when it is more likely than not that deferred tax assets will not be realized. Future

realization depends on the existence of sufficient taxable income within the carry forward period

available under the tax law. Sources of future taxable income include future reversals of taxable

temporary differences, future taxable income exclusive of reversing taxable differences, taxable income in

carry back years and tax planning strategies. These sources of positive evidence of realizability must be

weighed against negative evidence, such as cumulative losses in recent years. A recent history of losses

would make difficult a determination that a valuation allowance is not needed.

In forming a judgment about the future realization of our deferred tax assets, management

considered both the positive and negative evidence of realizability and gave significant weight to the

negative evidence from our cumulative losses for recent years. Management will continue to assess this

situation and make appropriate adjustments to the valuation allowance based on its evaluation of the

positive and negative evidence existing at that time. We are currently unable to forecast when there will

be sufficient positive evidence for us to reverse the remainder of the valuation allowances that we have

recorded. Through December 31, 2008, any reversals of valuation allowance would have reduced

goodwill, if any, then intangible assets. See Note 1(p), “Summary of Significant Accounting Policies—

New Accounting Pronouncements,” for information regarding the effect of changes to this method of

accounting for valuation allowance reversals, if any, on the Company’s results of operations and financial

condition after it adopts Statement of Financial Accounting Standards No. 141 (revised 2007), Business

Combinations, on January 1, 2009. See Note 8, “Income Taxes,” in Combined Notes to Consolidated

Financial Statements for additional information.

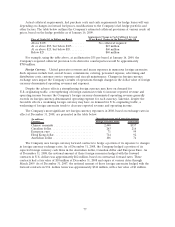

New Accounting Pronouncements. For detailed information, see Note 1(p), “Summary of Significant

Accounting Policies—New Accounting Pronouncements,” in Combined Notes to Consolidated Financial

Statements.

Forward-Looking Information

Certain statements throughout Item 7, Management’s Discussion and Analysis of Financial Condition

and Results of Operations and elsewhere in this report are forward-looking and thus reflect the

Company’s current expectations and beliefs with respect to certain current and future events and

financial performance. Such forward-looking statements are and will be subject to many risks and

uncertainties relating to United’s operations and business environment that may cause actual results to

differ materially from any future results expressed or implied in such forward-looking statements. Words

such as “expects,” “will,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook”

and similar expressions are intended to identify forward-looking statements.

Additionally, forward-looking statements include statements which do not relate solely to historical

facts, such as statements which identify uncertainties or trends, discuss the possible future effects of

current known trends or uncertainties, or which indicate that the future effects of known trends or

uncertainties cannot be predicted, guaranteed or assured. All forward-looking statements in this report

are based upon information available to the Company on the date of this report. The Company

undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result

of new information, future events, changed circumstances or otherwise.

The Company’s actual results could differ materially from these forward-looking statements due to

numerous factors including, without limitation, the following: its ability to comply with the terms of

financing arrangements; the costs and availability of financing; its ability to execute its business plan; its

ability to realize benefits from its resource optimization efforts and cost reduction initiatives; its ability to

utilize its net operating losses; its ability to attract, motivate and/or retain key employees; its ability to

attract and retain customers; demand for transportation in the markets in which it operates; general

economic conditions (including interest rates, foreign currency exchange rates, crude oil prices, costs of

72