United Airlines 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

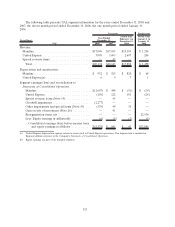

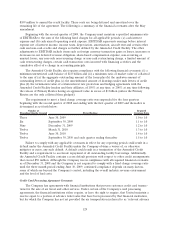

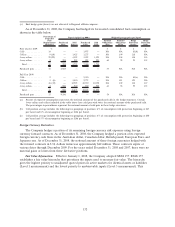

(b) Net current exposure equals relevant advance ticket sales less certain exclusions, and as adjusted for specified amounts pay-

able between United and the processor, as further defined by the agreement.

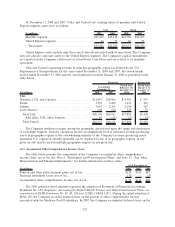

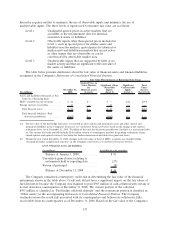

The new agreement permits the Company to provide certain replacement collateral in lieu of cash

collateral, as long as the Company’s unrestricted cash is above $1.35 billion. Such replacement collateral

may be pledged for any amount of the required reserve up to the full amount thereof, with the stated

value of such collateral determined according to the agreement. Replacement collateral may be

comprised of aircraft, slots and routes, real estate or other collateral as agreed between the parties.

In the near term, the Company will not be required to post reserves under the new American

Express agreement as long as unrestricted cash as measured at each month-end, and as defined in the

agreement, is equal to or above $2.0 billion.

If the terms of the new agreement had been in place at December 31, 2008, and ignoring the near

term protection in the preceding sentence, the Company would have been required to provide collateral

of approximately $40 million.

An increase in the future reserve requirements as provided by the terms of either or both the

Company’s material card processing agreements could materially reduce the Company’s liquidity.

(13) Fair Value Measurements and Derivative Instruments

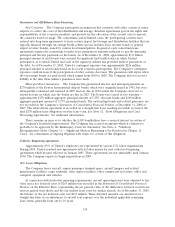

Instruments designated as cash flow hedges are accounted for under SFAS 133, as long as the hedge

is highly effective and the underlying transaction is probable. If both factors are present, the effective

portion of the changes in fair value of these contracts is recorded in accumulated other comprehensive

income (loss) until earnings are affected by the cash flows being hedged. To the extent that the

designated cash flow hedges are ineffective, gain or loss is recognized currently in earnings. The

Company offsets the fair value of derivative instruments executed with the same counterparty when

netting agreements exist.

Instruments classified as economic hedges do not qualify for hedge accounting under SFAS 133.

Under this classification all changes in the fair value of these contracts are recorded currently in income,

with the offset to either current assets or liabilities each reporting period. Economic fuel hedge gains

and losses are classified as part of aircraft fuel expense and fuel hedge gains and losses from instruments

that are not deemed economic hedges are classified as part of nonoperating income. Foreign currency

hedge gains and losses are classified as part of nonoperating income.

Aircraft Fuel Hedges.

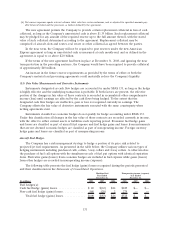

The Company has a risk management strategy to hedge a portion of its price risk related to

projected jet fuel requirements. As presented in the table below, the Company utilizes various types of

hedging instruments including purchased calls, collars, 3-way collars and 4-way collars. A collar involves

the purchase of fuel call options with the simultaneous sale of fuel put options with identical expiration

dates. Derivative gains (losses) from economic hedges are included in fuel expense while gains (losses)

from other hedges are recorded in nonoperating income (expense).

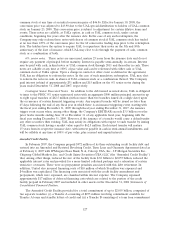

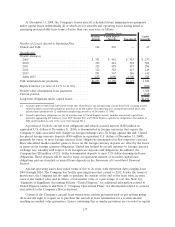

The following table presents the fuel hedge (gains) losses recognized during the periods presented

and their classification in the Statements of Consolidated Operations.

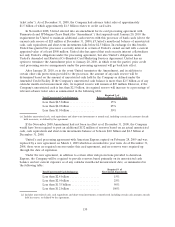

(In millions) 2008 2007 2006 2008 2007 2006

Mainline Fuel

Year Ended

December 31,

Nonoperating income (expense)

Year Ended

December 31,

Fuel hedges(a):

Cash fuel hedge (gains) losses.................. $ 40 $(63) $24 $249 $— $—

Non-cash fuel hedge (gains) losses .............. 568 (20) 2 279 — —

Total fuel hedge (gains) losses .............. $608 $(83) $26 $528 $— $—

131