United Airlines 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.decreased in 2008 primarily due to an amendment to our largest credit card processing agreement and

posting of letters of credit, as further discussed below.

The increase in net cash used by investing activities was primarily due to a reallocation of excess

cash from short-term investments to cash and cash equivalents. Investing cash flows benefited from a

reduction in restricted cash of $484 million. This benefit was primarily due to the amendment of the

credit card processing agreement in association with the co-branded amendment described above, which

decreased restricted cash by $357 million, and the substitution of letters of credit for cash deposits

related to workers’ compensation obligations. In addition, UAL financing outflows included

approximately $253 million to pay a $2.15 per common share special distribution in January 2008.

The Company expects its cash flows from operations and its available capital to be sufficient to meet

its future operating expenses, lease obligations and debt service requirements in the next twelve months;

however, the Company’s future liquidity could be impacted by increases or decreases in fuel prices, fuel

hedge collateral requirements, inability to adequately increase revenues to offset high fuel prices,

softening revenues resulting from reduced demand, failure to meet future debt covenants and other

factors. See the Liquidity and Capital Resources and Item 7A, Quantitative and Qualitative Disclosures

about Market Risk, below, for a discussion of these factors and the Company’s significant operating,

investing and financing cash flows.

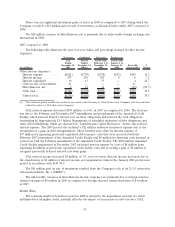

Capital Commitments. At December 31, 2008, the Company’s future commitments for the purchase

of property and equipment include approximately $2.4 billion of nonbinding aircraft commitments and

$0.6 billion of binding commitments. The nonbinding commitments of $2.4 billion are related to 42 A319

and A320 aircraft. These orders may be cancelled which would result in the forfeiture of $91 million of

advance payments provided to the manufacturer. United believes it is highly unlikely that it will take

delivery of the remaining aircraft in the future and therefore believes it will be required to forfeit its

$91 million of advance delivery deposits. Based on this determination, the Company recorded an

impairment charge in 2008 to decrease the value of the deposits and related capitalized interest of

$14 million to zero in the Company’s Statements of Consolidated Financial Position. In addition, the

Company’s capital commitments include commitments related to its international premium cabin

enhancement program. During 2008, the Company reduced the scope of this project by six aircraft, from

the originally disclosed number of 97 aircraft. As of December 31, 2008, the Company had completed

upgrades on 25 aircraft and had remaining capital commitments to complete enhancements on an

additional 66 aircraft. For further details, see Note 14, “Commitments, Contingent Liabilities and

Uncertainties,” in Combined Notes to Consolidated Financial Statements.

Contingencies. During the course of its Chapter 11 proceedings, the Company successfully reached

settlements with most of its creditors and resolved most pending claims against the Debtors. We are a

party to numerous long-term agreements to lease certain airport and maintenance facilities that are

financed through tax-exempt municipal bonds issued by various local municipalities to build or improve

airport and maintenance facilities. United was advised during its restructuring that these municipal

bonds may have been unsecured (or in certain instances, partially secured) pre-petition debt. In 2006,

certain of United’s LAX municipal bond obligations were conclusively adjudicated through the

Bankruptcy Court as financings and not true leases; however, there remains pending litigation to

determine the value of the security interests, if any, that the bondholders have in our underlying

leaseholds. See Note 4, “Voluntary Reorganization Under Chapter 11,” in Combined Notes to Consoli-

dated Financial Statements for further information on this matter and the resolution of the separate SFO

municipal bond matter in 2008.

United has guaranteed $270 million of the City and County of Denver, Colorado Special Facilities

Airport Revenue Bonds (United Air Lines Project) Series 2007A (the “Denver Bonds”). This guarantee

replaces our prior guarantee of $261 million of bonds issued by the City and County of Denver,

Colorado in 1992. These bonds are callable by United. The outstanding bonds and related guarantee are

not recorded in the Company’s Statements of Consolidated Financial Position. However, the related lease

44