United Airlines 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

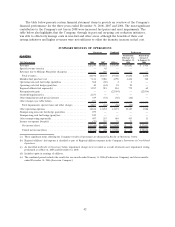

Results of Operations

Operating Revenues.

2008 compared to 2007

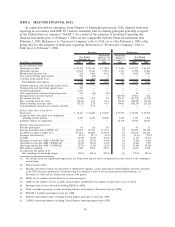

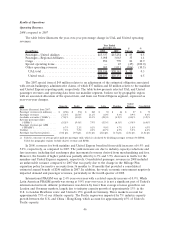

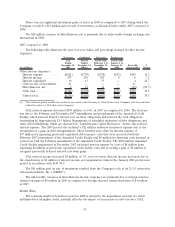

The table below illustrates the year-over-year percentage change in UAL and United operating

revenues.

(In millions) 2008 2007

$

Change

%

Change

Year Ended

December 31,

Passenger—United Airlines ...................... $15,337 $15,254 $ 83 0.5

Passenger—Regional Affiliates .................... 3,098 3,063 35 1.1

Cargo ....................................... 854 770 84 10.9

Special operating items .......................... — 45 (45) (100.0)

Other operating revenues ........................ 905 1,011 (106) (10.5)

UAL total .................................. $20,194 $20,143 $ 51 0.3

United total ................................. $20,237 $20,131 $ 106 0.5

The 2007 special item of $45 million relates to an adjustment of the estimated obligation associated

with certain bankruptcy administrative claims, of which $37 million and $8 million relates to the mainline

and United Express reporting units, respectively. The table below presents selected UAL and United

passenger revenues and operating data from our mainline segment, broken out by geographic region

with an associated allocation of the special item, and from our United Express segment, expressed as

year-over-year changes.

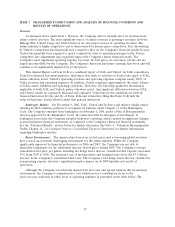

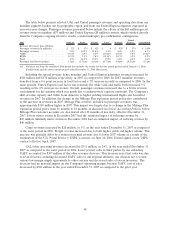

2008 Domestic Pacific Atlantic Latin Mainline

United

Express Consolidated

Increase (decrease) from 2007:

Passenger revenues (in millions) . . . $ (156) $ (91) $ 263 $ 30 $ 46 $ 27 $ 73

Passenger revenues . ........... (1.7)% (2.8)% 11.1% 6.0% 0.3% 0.9% 0.4%

Availableseatmiles(“ASMs”)..... (7.8)% (4.8)% 11.0% (2.8)% (4.2)% (0.8)% (3.9)%

Revenue passenger miles

(“RPMs”)................. (8.5)% (9.4)% 7.9% (5.5)% (6.3)% (3.9)% (6.0)%

Passenger revenues per ASM

(“PRASM”) . . . . . . . . . . . . . . . . 6.7% 2.1% 0.1% 9.0% 4.7% 1.8% 4.5%

Yield(a).................... 7.4% 7.2% 2.2% 12.7% 6.9% 5.0% 6.8%

Passenger load factor (points) ..... (0.6)pts. (3.9)pts. (2.3)pts. (2.2)pts. (1.7)pts. (2.4)pts. (1.8)pts.

a) Yield is a measure of average price paid per passenger mile, which is calculated by dividing passenger revenues by RPMs.

Yields for geographic regions exclude charter revenue and RPMs.

In 2008, revenues for both mainline and United Express benefited from yield increases of 6.9% and

5.0%, respectively, as compared to 2007. The yield increases are due to industry capacity reductions and

fare increases, including fuel surcharges plus incremental revenues derived from merchandising and fees.

However, the benefit of higher yields was partially offset by 6.3% and 3.9% decreases in traffic for the

mainline and United Express segments, respectively. Consolidated passenger revenues in 2008 included

an unfavorable variance compared to 2007 that was partly due to the change in the Mileage Plus

expiration policy for inactive accounts from 36 months to 18 months that provided a consolidated

estimated annual benefit of $246 million in 2007. In addition, the weak economic environment negatively

impacted demand and passenger revenues, particularly in the fourth quarter of 2008.

International PRASM was up 2.4% year-over-year with a related capacity increase of 0.9%. While

Latin American PRASM growth was strong at 9.0% year-over-year, it is not a significant part of United’s

international network. Atlantic performance was driven by lower than average revenue growth in our

London and Germany markets, largely due to industry capacity growth of approximately 13% in the

U.S. to London Heathrow route and United’s 15% growth in Germany. These markets account for

approximately 75% of our Atlantic capacity. The Pacific region was impacted by 7% industry capacity

growth between the U.S. and China / Hong Kong, which account for approximately 45% of United’s

Pacific capacity.

46