United Airlines 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

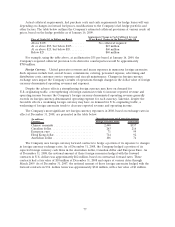

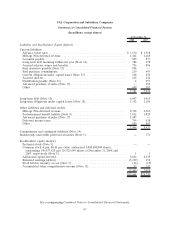

December 31, 2008. The Company recognizes changes in fair value of these securities through other

comprehensive income; however, on a net basis, the Company is not exposed to market risk due to the

existence of offsetting changes in the fair value of the Company’s related debt obligations.

The material changes in the amounts reported in the table above for 2008 as compared to 2007

include the following: (1) cash and short-term investments decreased by approximately $1.5 billion

primarily due to cash used for operating activities as discussed in Liquidity above; (2) lease deposits

decreased by $190 million due to scheduled payments and aircraft acquisitions under lease agreement

terms; and (3) debt obligations decreased by $316 million primarily due to scheduled debt repayments in

2008, which were partially offset by new debt issuances in 2008. The interest rate on the Company’s cash

and variable rate debt decreased in 2008, as compared to 2007, primarily due to a decrease in market

interest rates.

Commodity Price Risk (Jet Fuel). Our results of operations and liquidity have been, and may

continue to be, materially impacted by changes in the price of aircraft fuel and other oil-related

commodities and related derivative instruments. When market conditions indicate risk reduction is

achievable, United may use commodity option contracts or other derivative instruments to reduce its

price risk exposure to jet fuel. The Company’s derivative positions are typically comprised of crude oil,

heating oil and jet fuel derivatives. The derivative instruments are designed to provide protection against

increases in the price of aircraft fuel. Some derivative instruments may result in hedging losses if the

underlying commodity prices drop below specified floors; however, the negative impact of these losses

may be offset by the benefit of lower jet fuel acquisition cost since the Company typically does not hedge

all of its fuel consumption. United may adjust its hedging program based on changes in market

conditions. At December 31, 2008, the fair value of United’s fuel-related derivatives was a payable of

$867 million, as compared to a receivable of $20 million at December 31, 2007. The primary reason for

this change was due to the dramatic spike in fuel prices through July 2008 and the subsequent fuel price

decreases in the latter part of 2008. At December 31, 2008, the fuel derivative payables includes

$140 million related to pending settlements for purchased options and expired contracts.

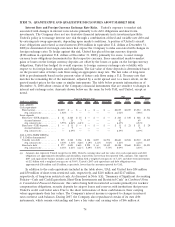

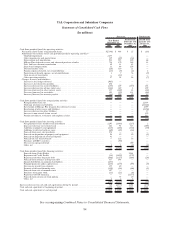

As of December 31, 2008, the Company had hedged its forecasted consolidated fuel consumption as

shown in the table below.

Percentage of

Projected

Fuel

Requirements

Hedged(a)

Purchased

Puts

Sold

Puts(a)

Purchased

Calls

Sold

Calls

Payment

Obligations

Stop

Payment

Obligations

Begin

Hedge

Protection

Begins

Hedge

Protection

Ends

Barrels hedged (in 000s) Weighted-average price per barrel

First Quarter 2009: . . . % $ $ $ $

Calls ............ 14 — — 1,975 — NA NA 83(b) NA

Collars ........... 9(10) — 1,425 1,275 — NA 109 118 NA

3-way collars ....... 25(29) — 4,125 3,525 3,525 NA 104 118 143

4-way collars ....... 2 225 225 225 225 63 78 95 135

Total........... 50 225 5,775 7,000 3,750

Purchasedputs ..... 35 4,925 — — — 57 NA NA NA

Full Year 2009:

Calls ............ 9 — — 5,350 — NA NA 81(c) NA

Collars ........... 5 (6) — 3,450 2,775 — NA 111 123 NA

3-way collars ....... 18(22) — 12,525 10,350 10,350 NA 102 118 147

4-way collars ....... 2 900 900 900 900 63 78 95 135

Total........... 34 900 16,875 19,375 11,250

Purchasedputs ..... 17 9,500 — — — 54 NA NA NA

Calls purchased from

January 1, 2009 to

January 16, 2009:

First Quarter 2009 . . . 4 — — 525 — NA NA 54 NA

Full Year 2009 ...... 2 — — 1,350 — NA NA 59 NA

75