United Airlines 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

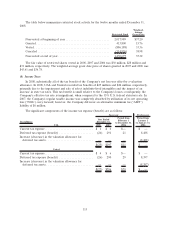

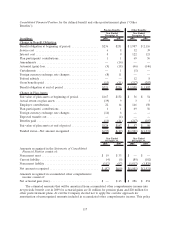

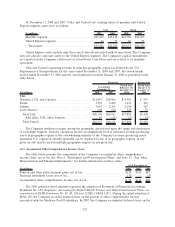

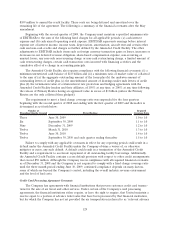

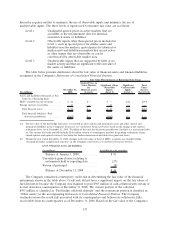

At December 31, 2008 and 2007, UAL’s and United’s net carrying values of mainline and United

Express segment assets were as follows:

(In millions) 2008 2007 2008 2007

UAL United

Mainline segment ............................ $19,415 $24,149 $19,586 $24,165

United Express segment ....................... 46 71 46 71

Total assets ............................... $19,461 $24,220 $19,632 $24,236

United Express assets include only those assets directly associated with its operations. The Company

does not allocate corporate assets to the United Express segment. The Company’s capital expenditures

are reported in the Company’s Statements of Consolidated Cash Flows and are related to its mainline

operations.

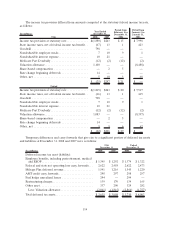

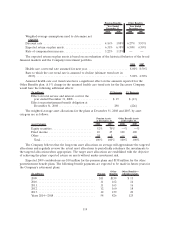

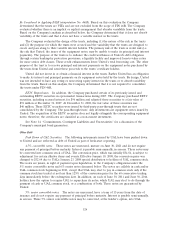

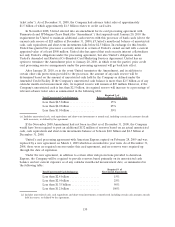

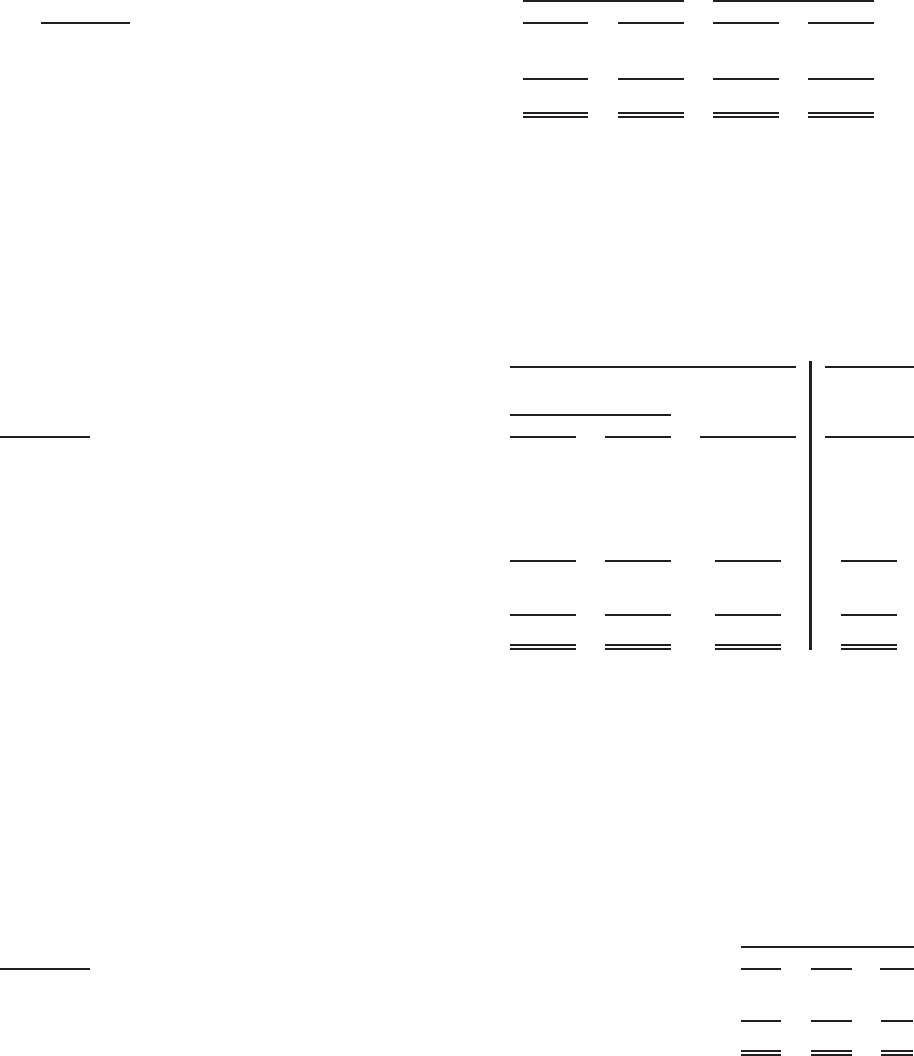

UAL and United’s operating revenue by principal geographic region (as defined by the U.S.

Department of Transportation) for the years ended December 31, 2008 and 2007, the eleven month

period ended December 31, 2006 and the one month period ended January 31, 2006 is presented in the

table below.

(In millions) 2008 2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

Successor Predecessor

UAL

Domestic (U.S. and Canada)...................... $12,819 $14,006 $11,981 $ 953

Pacific ....................................... 3,712 3,262 3,214 283

Atlantic ...................................... 3,055 2,365 2,158 167

Latin America ................................. 608 510 529 55

TotalUAL .................................. $20,194 $20,143 $17,882 $1,458

Add (less): UAL other domestic ............... 43 (12) (2) (4)

TotalUnited................................. $20,237 $20,131 $17,880 $1,454

The Company attributes revenue among the geographic areas based upon the origin and destination

of each flight segment. United’s operations involve an insignificant level of dedicated revenue-producing

assets in geographic regions as the overwhelming majority of the Company’s revenue producing assets

(primarily U.S. registered aircraft) generally can be deployed in any of its geographic regions, as any

given aircraft may be used in multiple geographic regions on any given day.

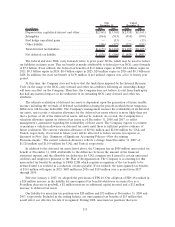

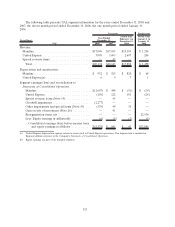

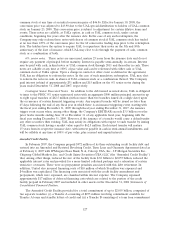

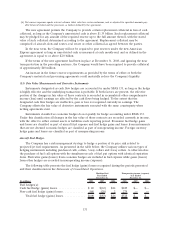

(11) Accumulated Other Comprehensive Income (Loss)

The table below presents the components of the Company’s accumulated other comprehensive

income (loss), net of tax. See Note 9, “Retirement and Postretirement Plans” and Note 13, “Fair Value

Measurements and Financial Instruments,” for further information on these items.

(In millions) 2008 2007 2006

As of December 31,

Pension and other postretirement gains, net of tax .......................... $130 $141 $87

Financial instrument losses, net of tax. . . ................................. (37) — (5)

Accumulated other comprehensive income, net of tax ....................... $ 93 $141 $82

The 2006 pension-related amounts represent the adoption of Statement of Financial Accounting

Standards No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—an

amendment of FASB Statements No. 87, 88, 106 and 132(R) (“SFAS 158”). During the initial adoption of

SFAS 158, the Company recorded deferred taxes on the portion of other comprehensive income

associated with the Medicare Part D subsidiary. In 2007, the Company recomputed deferred taxes on the

123