United Airlines 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fuel derivative instruments, our counterparties may require the Company to post additional amounts of

collateral when the price of the underlying commodity decreases and lesser amounts when the price of

the underlying commodity increases.

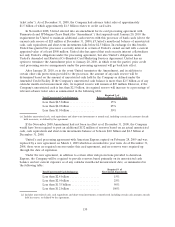

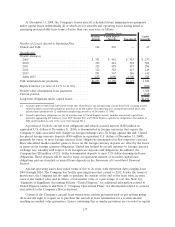

Derivative instruments and investments presented in the table above have the same fair value as

their carrying value. The table below presents the carrying values and estimated fair values of the

Company’s financial instruments not presented in the table above:

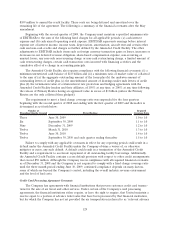

(In millions)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

2008 2007

Long-tem debt (including current portion) .................. $6,789 $4,192 $7,093 $6,796

Preferred stock........................................ — — 371 401

Lease deposits ........................................ 326 351 516 531

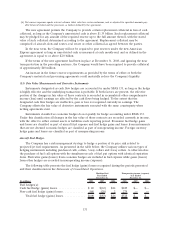

Fair value of the above financial instruments was determined as follows:

Description Fair Value Methodology

Cash and Cash Equivalents,

Short-term Investments and

Restricted Cash

The carrying amounts approximate fair value because of the

short-term maturity of these investments.

Enhanced Equipment

Trust Certificates (“EETCs”)

The EETCs are not actively traded on an exchange. Fair value is

based on the trading prices of similar EETC instruments issued by

other airlines. The Company uses internal models and observable

and unobservable inputs to corroborate third party quotes. Because

certain inputs are unobservable, the Company categorized the

EETCs as Level 3.

Fuel Derivative Instruments Derivative contracts are privately negotiated contracts and are not

exchange traded. Fair value measurements are estimated with

option pricing models that employ observable and unobservable

inputs.

Foreign Currency Derivative

Instruments

Fair value is determined with a formula utilizing observable inputs.

Preferred Stock and Long-Term

Debt

The fair value is based on the quoted market prices for the same or

similar issues, discounted cash flow models using appropriate

market rates and the Black-Scholes model to value conversion rights

in UAL’s convertible preferred stock and debt instruments. The

Company’s credit risk was considered in estimating fair value.

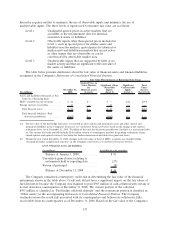

(14) Commitments, Contingent Liabilities and Uncertainties

General Guarantees and Indemnifications. In the normal course of business, the Company enters

into numerous real estate leasing and aircraft financing arrangements that have various guarantees

included in the contracts. These guarantees are primarily in the form of indemnities. In both leasing and

financing transactions, the Company typically indemnifies the lessors and any tax/financing parties,

against tort liabilities that arise out of the use, occupancy, operation or maintenance of the leased

premises or financed aircraft. Currently, the Company believes that any future payments required under

these guarantees or indemnities would be immaterial, as most tort liabilities and related indemnities are

covered by insurance (subject to deductibles). Additionally, certain leased premises such as fueling

stations or storage facilities include indemnities of such parties for any environmental liability that may

arise out of or relate to the use of the leased premises.

134