United Airlines 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Company elects not to extend its lease in which case the bonds are due in 2023. The outstanding

bonds and related guarantee are not recorded in the Company’s Statements of Consolidated Financial

Position in accordance with GAAP. The related lease agreement is accounted for as an operating lease

with the associated rent expense recorded on a straight-line basis. The annual lease payments through

2023 and the final payment for the principal amount of the bonds are included in the operating lease

payments in the contractual obligations table above. For further details, see Note 14, “Commitments,

Contingent Liabilities and Uncertainties—Guarantees and Off-Balance Sheet Financing,” in Combined

Notes to Consolidated Financial Statements.

Fuel Consortia. The Company participates in numerous fuel consortia with other carriers at major

airports to reduce the costs of fuel distribution and storage. Interline agreements govern the rights and

responsibilities of the consortia members and provide for the allocation of the overall costs to operate

the consortia based on usage. The consortia (and in limited cases, the participating carriers) have

entered into long-term agreements to lease certain airport fuel storage and distribution facilities that are

typically financed through tax-exempt bonds (either special facilities lease revenue bonds or general

airport revenue bonds), issued by various local municipalities. In general, each consortium lease

agreement requires the consortium to make lease payments in amounts sufficient to pay the maturing

principal and interest payments on the bonds. As of December 31, 2008, approximately $1.2 billion

principal amount of such bonds were secured by significant fuel facility leases in which United

participates, as to which United and each of the signatory airlines have provided indirect guarantees of

the debt. United’s exposure is approximately $226 million principal amount of such bonds based on its

recent consortia participation. The Company’s exposure could increase if the participation of other

carriers decreases. The guarantees will expire when the tax-exempt bonds are paid in full, which ranges

from 2010 to 2028. The Company did not record a liability at the time these indirect guarantees were

made.

Other Information

Foreign Operations. The Company’s Statements of Consolidated Financial Position reflect material

amounts of intangible assets related to the Company’s Pacific and Latin American route authorities and

its operations at London’s Heathrow Airport. Because operating authorities in international markets are

governed by bilateral aviation agreements between the U.S. and foreign countries, changes in U.S. or

foreign government aviation policies can lead to the alteration or termination of existing air service

agreements that could adversely impact, and significantly impair, the value of our international route

authorities and other assets. Significant changes in such policies could also have a material impact on

the Company’s operating revenues and expenses and results of operations. For further information, see

Note 3, “Asset Impairments and Intangible Assets” in Combined Notes to Consolidated Financial

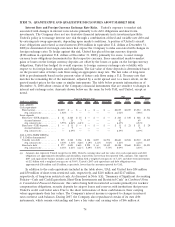

Statements, Item 1, Business—International Regulation and Item 7A, Quantitative and Qualitative

Disclosures above Market Risk for further information on the Company’s foreign currency risks associated

with its foreign operations.

Critical Accounting Policies

Critical accounting policies are defined as those that are affected by significant judgments and

uncertainties which potentially could result in materially different accounting under different

assumptions and conditions. The Company has prepared the accompanying financial statements in

conformity with GAAP, which requires management to make estimates and assumptions that affect the

reported amounts in the financial statements and accompanying notes. Actual results could differ from

those estimates under different assumptions or conditions. The Company has identified the following

critical accounting policies that impact the preparation of these financial statements.

Passenger Revenue Recognition. The value of unused passenger tickets and miscellaneous charge

orders (“MCOs”) is included in current liabilities as advance ticket sales. United records passenger ticket

sales and tickets sold by other airlines for use on United as operating revenues when the transportation

is provided or when the ticket expires. Tickets sold by other airlines are recorded at the estimated values

65