United Airlines 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.However, we have already taken actions to capitalize on opportunities under the new agreement.

Upon the effective date of the transatlantic aviation agreement, the DOT’s approval of United’s

application for antitrust immunity with bmi also became effective, allowing the two airlines to

deepen their commercial relationship and adding bmi to the multilateral group of Star Alliance

carriers that had already been granted antitrust immunity by the DOT.

• United and Continental Airlines announced their plan to form a new partnership that will link

the airlines’ networks and services worldwide to the benefit of customers, employees and

shareholders, creating new revenue opportunities, cost savings and other efficiencies.

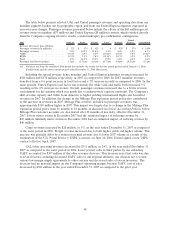

The Company also took certain actions to maintain adequate liquidity and minimize its financing

costs during this challenging economic environment. During 2008, the Company generated unrestricted

cash of approximately $1.9 billion through new financing agreements, amendments to our Mileage Plus

co-branded credit card agreement and our largest credit card processing agreement and other means.

Some of these agreements are summarized below. See Liquidity and Capital Resources—Financing

Activities, below, for additional information related to these agreements.

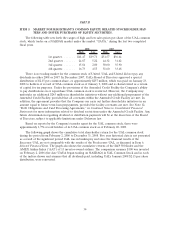

• During the fourth quarter of 2008, UAL began a public offering of up to $200 million of UAL

common stock, generating gross proceeds of $172 million in 2008 and January 2009. UAL may

issue additional shares during 2009 until it reaches $200 million in proceeds.

• United completed a $241 million credit agreement secured by 26 of the Company’s currently

owned and mortgaged A319 and A320 aircraft. Borrowings under the agreement were at a

variable interest rate based on LIBOR plus a margin. The credit agreement requires periodic

principal and interest payments through its final maturity in June 2019. The Company may not

prepay the loan prior to July 2012. This agreement did not change the number of the Company’s

unencumbered aircraft as the Company used available equity in these previously owned and

mortgaged aircraft as collateral for this financing.

• United entered into an $84 million loan agreement secured by three aircraft, including two

Airbus A320 and one Boeing B777 aircraft. Borrowings under the agreement were at a variable

interest rate based on LIBOR plus a margin. The loan requires principal and interest payments

every three months and has a final maturity in June 2015.

• During 2008 and January 2009, United also entered into three aircraft sale-leaseback agreements.

The Company sold these aircraft for approximately $370 million and has leased them back.

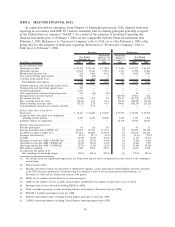

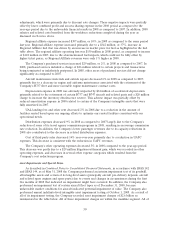

• The Company completed an amendment of its marketing services agreement with its Mileage

Plus co-branded bankcard partner and its largest credit card processor to amend the terms of

their existing agreements to, among other things, extend the terms of the agreements. These

amendments resulted in an immediate increase in the Company’s cash position by approximately

$1.0 billion, which included a total of $600 million for the advanced purchase of miles and the

licensing extension payment, as well as the release of approximately $357 million in previously

restricted cash for reserves required under the credit card processing agreement. Approximately

$100 million of additional cash receipts are expected over the next two years based on the

amended terms of the co-brand agreement as compared to cash that would have been generated

under the terms of the previous co-brand agreement. This amount is less than the Company’s

initial estimate primarily due to the severe weakening of the global economy. As part of the

transaction, United granted a first lien of specified intangible Mileage Plus assets and a second

lien on certain other assets. The term of the amended co-branded agreement is through

December 31, 2017. See the discussion below in Liquidity for additional terms of this agreement.

The Company also made the following significant changes to its international route network:

• United commenced daily, non-stop service between Washington Dulles and Dubai in October

2008.

40