United Airlines 2008 Annual Report Download - page 55

Download and view the complete annual report

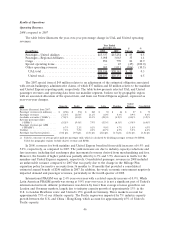

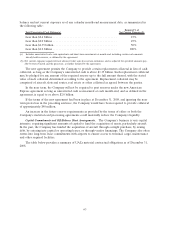

Please find page 55 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recorded income tax expense of $297 million for the year ended December 31, 2007 based an estimated

effective tax rate of 43%. See Note 8, “Income Taxes,” in Combined Notes to Consolidated Financial

Statements for additional information.

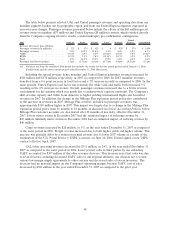

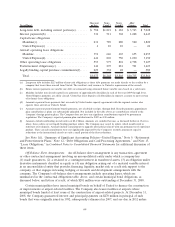

Liquidity and Capital Resources

As of the date of this Form 10-K, the Company believes it has sufficient liquidity to fund its

operations for the next twelve months, including funding for scheduled repayments of debt and capital

lease obligations, capital expenditures, cash deposits required under fuel hedge contracts and other

contractual obligations. We expect to meet our liquidity needs in 2009 from cash flows from operations,

cash and cash equivalents on hand, proceeds from new financing arrangements using unencumbered

assets and proceeds from aircraft sales and sales of other assets, among other sources. While the

Company expects to meet its future cash requirements in 2009, our ability to do so could be impacted by

many factors including, but not limited to, the following:

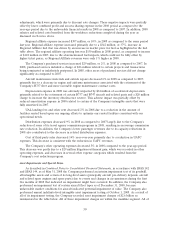

• Volatile fuel prices and the cost and effectiveness of hedging fuel prices, as described above in

the Overview and Results of Operations sections, may require the use of significant liquidity in

future periods. Crude oil prices have been extremely volatile and unpredictable in recent years

and may become more volatile in future periods due to the current severe dislocations in world

financial markets.

• In late 2008, the price of crude oil dramatically fell from its record high in July 2008. Earlier in

2008, the Company entered into derivative contracts (including collar strategies) to hedge the risk

of future price increases. As fuel prices have fallen below the floor of the collars, the Company

has had, and could continue to have, significant future payment obligations at the settlement

dates of these contracts. In addition, the Company has been and may in the future be further

required to provide counterparties with additional cash collateral prior to such settlement dates.

While the Company’s results of operations should benefit significantly from lower fuel prices on

its unhedged fuel consumption, in the near term lower fuel prices could also significantly and

negatively impact liquidity based on the amount of cash settlements and collateral that may be

required. However, at December 31, 2008 the Company partially mitigated its exposure to further

price declines by purchasing put options to effectively cover approximately 55% of its short put

positions. In addition, over the longer term, lower crude oil prices will further benefit the

Company as the unfavorable hedge contracts terminate and the Company realizes the benefit of

lower jet fuel costs on a larger percentage of its fuel consumption. See Note 13, “Fair Value

Measurements and Derivative Instruments” in Combined Notes to Consolidated Financial

Statements, as well as Item 7A, Quantitative and Qualitative Disclosures Above Market Risk, for

further information regarding the Company’s fuel derivative instruments.

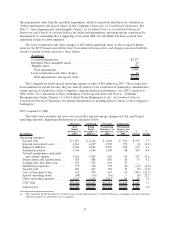

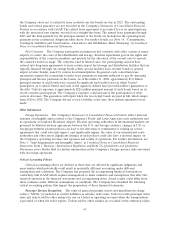

• The Company’s current operational plans to address the severe condition of the global economy

may not be successful in improving its results of operations and liquidity:

• The Company may not achieve expected increases in unit revenue from the capacity reductions

announced by the Company and certain of its competitors. Further, certain of the Company’s

competitors may not reduce capacity or may increase capacity; thereby diminishing our

expected benefit from capacity reductions. The Company may also not achieve expected

revenue improvements from merchandising and fee enhancement initiatives.

• Poor general economic conditions have had, and may in the future continue to have, a

significant adverse impact on travel demand, which may result in a negative impact to

revenues.

• The Company is using cash to implement its operational plans for such items as severance

payments, lease termination payments, conversion of Ted aircraft and facility closure costs,

among others. These cash requirements will reduce the Company’s cash available for its

ongoing operations and commitments.

55