United Airlines 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

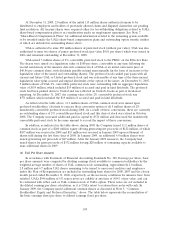

• As discussed in Note 23, “Subsequent Events,” in January 2009, the Company completed several

financing-related transactions which generated approximately $315 million of proceeds.

The following is a discussion of expenses associated with implementing the Company’s plans. In

addition, see Note 3, “Asset Impairments and Intangible Assets,” for a discussion of the impairment

charges recorded during the year ended December 31, 2008.

Severance. During 2008, the Company reduced its workforce in operations and corporate functions

through attrition and both voluntary and involuntary furloughs. The Company is streamlining its

workforce to match the reduced capacity of its operations. The Company reduced its workforce in 2008

and plans to further reduce its workforce in 2009. Workforce reductions include salaried and

management positions and certain of the Company’s unionized workforce. The Company’s standard

severance policies provide the affected employees with salary continuation as well as certain insurance

benefits for a specified period of time. The Company recognizes its severance obligations in accordance

with Statement of Financial Accounting Standards No. 112 (As Amended), Employers’ Accounting for

Postemployment Benefits—an amendment of FASB Statements No. 5 and 43, except for voluntary

programs which are accounted for under Statement of Financial Accounting Standards No. 88,

Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for

Termination Benefits.

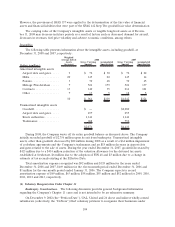

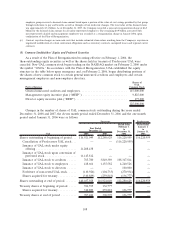

The following is a reconciliation of the Company’s severance accrual activity:

(In millions)

Balance at January 1, 2008 ........................... $ —

Accruals ........................................ 106

Payments . . . .................................... (25)

Balance at December 31, 2008 ........................ $ 81

In addition to involuntary furloughs, the Company is currently offering furlough-mitigation

programs, such as voluntary early-out options, primarily to certain union groups. Termination benefits

expected to be paid under such voluntary programs are not recognized until the employees accept the

termination benefit offer. Therefore, as the Company continues to implement its reductions in force

during 2009, additional severance costs may be incurred. Severance expense is classified within salaries

and related costs in the Company’s Statements of Consolidated Operations. Severance charges are

expected to be primarily within the mainline segment where the fleet reductions will occur.

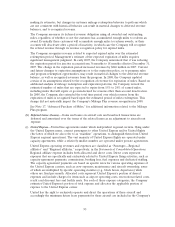

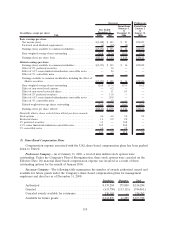

Aircraft. The following table provides additional information regarding UAL and United aircraft

including the impacts of the fleet reductions discussed above.

Owned Leased Total Owned Leased Total

Total

Mainline

Regional

Affiliates Total

B737s (Mainline) All Other Mainline

Operating:

Aircraft at December 31, 2007 (a) .......... 47 47 94 208 158 366 460 279 739

Added (removed) from operating fleet ..... (29) (19) (48) (3) — (3) (51) 1 (50)

Converted from owned to leased (b). . ..... — — — (24) 24 — — — —

Converted from leased to owned (c) . . ..... — — — 10 (10) — — — —

Aircraft at December 31, 2008 (d) .......... 18 28 46 191 172 363 409 280 689

Removed from operating fleet in 2008 (e) . . . 29 19 48 3 — 3 51 — 51

Sold/returned to lessor during 2008 . . ..... (5) (7) (12) — — — (12) — (12)

Nonoperating at December 31, 2008 (a) (e) . . . 24 12 36 3 — 3 39 — 39

(a) At December 31, 2007, the Company had 113 unencumbered aircraft. In 2007, United leased one operating aircraft from

UAL and therefore had one less owned B737 aircraft and one more leased aircraft as compared to UAL’s fleet. This

particular aircraft became nonoperational in 2008; therefore, United has one less nonoperating owned B737 aircraft and one

more leased aircraft as compared to UAL’s fleet at December 31, 2008.

100