United Airlines 2008 Annual Report Download - page 127

Download and view the complete annual report

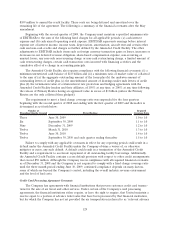

Please find page 127 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.common stock at any time at an initial conversion price of $46.86. Effective January 10, 2008, the

conversion price was adjusted to $43.90 due to the UAL special distribution to holders of UAL common

stock on January 23, 2008. This conversion price is subject to adjustment for certain dilutive items and

events. These notes are callable, at UAL’s option, in cash or UAL common stock, under certain

conditions, beginning five years after the issuance date. In the case of any such redemption, the

Company may only redeem these notes with shares of common stock if UAL common stock has traded

at no less than 125% of the conversion price for the 60 consecutive trading days prior to the redemption

date. The holders have the option to require UAL to repurchase their notes on the 5th and 10th

anniversary of the date of issuance, which UAL may elect to do through the payment of cash, common

stock or a combination of both.

6% senior notes. These notes are unsecured, mature 25 years from the issuance date and do not

require any payment of principal before maturity. Interest is payable semi-annually, in arrears. Interest

may be paid with cash, in kind notes or UAL common stock through 2011 and thereafter in cash. These

notes are callable at any time at 100% of par value and can be redeemed with either cash or UAL

common stock at UAL’s option. Upon a change in control or other event as defined in the agreement,

UAL has an obligation to redeem the notes. In the case of such mandatory redemption, UAL may elect

to redeem the notes in cash, in shares of UAL common stock or a combination thereof. The Company

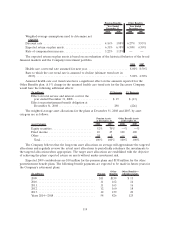

paid interest in-kind of approximately $31 million and $15 million on the 6% senior notes during the

years ended December 31, 2008 and 2007, respectively.

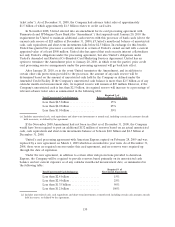

Contingent Senior Unsecured Notes. In addition to the debt issued as noted above, UAL is obligated

to issue to the PBGC 8% senior unsecured notes with an aggregate $500 million principal amount in up

to eight equal tranches of $62.5 million (with no more than two tranches issued on a single date) upon

the occurrence of certain financial triggering events. Any required tranche will be issued no later than

45 days following the end of any fiscal year in which there is an issuance-triggering event,starting with

the fiscal year ending December 31, 2009 through fiscal year ending December 31, 2017. An issuance

trigger event occurs when, among other things, the Company’s EBITDAR exceeds $3.5 billion over the

prior twelve months ending June 30 or December 31 of any applicable fiscal year, beginning with the

fiscal year ending December 31, 2009. However, if the issuance of a tranche would cause a default under

any other securities then existing, UAL may satisfy its obligations with respect to such tranche by issuing

UAL common stock having a market value equal to $62.5 million. Each issued tranche will mature

15 years from its respective issuance date, with interest payable in cash in semi-annual installments, and

will be callable at any time at 100% of par value, plus accrued and unpaid interest.

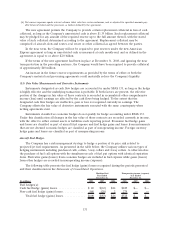

Amended Credit Facility

In February 2007, the Company prepaid $972 million of its then outstanding credit facility debt and

entered into an Amended and Restated Revolving Credit, Term Loan and Guaranty Agreement dated as

of February 2, 2007 with JPMorgan Chase Bank, N.A, Citicorp USA, Inc., J.P. Morgan Securities Inc.,

Citigroup Global Markets, Inc. and Credit Suisse Securities (USA) LLC (the “Amended Credit Facility”)

that, among other things, reduced the size of the facility from $3.0 billion to $2.055 billion, reduced the

applicable interest rates and provided for a more limited collateral package and a relaxation of certain

restrictive covenants. There were no prepayment penalties associated with this debt retirement. In

addition, United also incurred financing costs of $10 million of which $6 million was expensed and

$4 million was capitalized. The financing costs associated with the credit facility amendment and

prepayment, which were expensed, are classified within interest expense. The Company expensed

approximately $17 million of deferred financing costs which are related to the portion of the credit

facility prepaid in February 2007 and included in other assets on the December 31, 2006 Statements of

Consolidated Financial Position.

The Amended Credit Facility provided for a total commitment of up to $2.055 billion, comprised of

two separate tranches: (i) a Tranche A consisting of $255 million revolving commitment available for

Tranche A loans and standby letters of credit and (ii) a Tranche B consisting of a term loan commitment

127