United Airlines 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

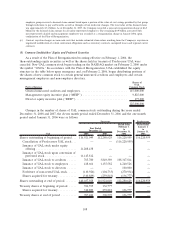

(b) During 2008, the Company sold 24 aircraft and leased them back. See Note 15, “Lease Obligations,” for additional

information related to these sale-leaseback transactions.

(c) During 2008, the Company acquired certain aircraft under existing lease terms.

(d) At December 31, 2008, United’s operating fleet was the same as UAL’s fleet and included 62 unencumbered aircraft. The

unencumbered aircraft at December 31, 2008 exclude nine aircraft which became encumbered with the December 2008

signing of a binding sale-leaseback agreement that closed in January 2009. See Note 12, “Debt Obligations and Card

Processing Agreements,” and Note 23, “Subsequent Events,” for additional information.

(e) As of December 31, 2008, the owned nonoperating aircraft and engines are classified as Other non-current assets in the

Company’s Statements of Consolidated Financial Position. These aircraft are not classified as assets held for sale because the

assets may not be sold within one year. As a result of the impairment testing discussed in Note 3, “Asset Impairments and

Intangible Assets,” these assets have been recorded at their net realizable value of $198 million at December 31, 2008.

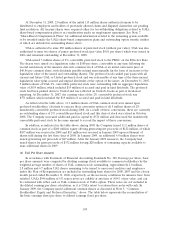

During 2008, the Company expensed $24 million related to the retirement of leased aircraft, of

which $16 million remained accrued and unpaid at December 31, 2008. These amounts consist of the

present value of future lease payments for aircraft that have been removed from service in advance of

their lease termination dates as of December 31, 2008, estimated payments for lease return maintenance

conditions related to B737 aircraft and the write-off of fresh-start lease fair value adjustments. Periodic

lease payments will be made over the lease terms of these aircraft unless early return agreements are

reached with the lessors; and, lease return maintenance condition payments, if any, will be made upon

return of the aircraft to the lessors. The total expected payments for leased aircraft that were grounded

at December 31, 2008 and that are expected to be grounded in 2009 are $132 million, payable through

2013. These estimated payments are future lease payments and estimated lease maintenance return

condition payments. Actual lease payments may be less if the Company is able to negotiate early

termination of any of its leases.

Other costs. As the Company continues to implement the operational plans discussed above, it may

incur additional costs related to its conversion of the Company’s fleet of Ted aircraft, costs to exit

additional facilities such as airports no longer served, lease termination costs, additional severance costs

and asset impairment charges, among others. Such future costs and charges may be material.

(3) Asset Impairments and Intangible Assets

Asset Impairments

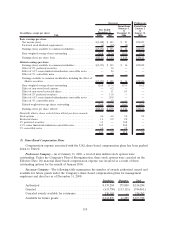

In accordance with SFAS 142 and SFAS 144, as of May 31, 2008 the Company performed an interim

impairment test of its goodwill, all intangible assets and certain of its long-lived assets (principally

aircraft and related spare engines and spare parts) due to events and changes in circumstances that

indicated an impairment might have occurred. In addition, the Company also performed an interim

impairment test on certain of its aircraft fleet types as of December 31, 2008 due to management’s

determination that unfavorable market conditions indicated potential impairment of value. Factors

deemed by management to have collectively constituted an impairment triggering event included record

high fuel prices, significant losses in the first and second quarters of 2008, a softening U.S. economy,

analyst downgrade of UAL common stock, rating agency changes in outlook for the Company’s debt

instruments from stable to negative, the announcement of the planned removal from UAL’s fleet of 100

aircraft in 2008 and 2009 and a significant decrease in the fair value of UAL’s outstanding equity and

debt securities during the first five months of 2008, including a decline in UAL’s market capitalization to

significantly below book value. The Company’s consolidated fuel expense increased by more than 50%

during this period.

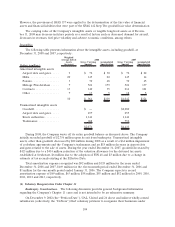

As a result of this impairment testing, for which certain estimates made in the second quarter of

2008 were adjusted to final values in the third quarter of 2008, the Company recorded impairment

charges during the year ended December 31, 2008, as presented in the table below. All of these

impairment charges are within the mainline segment. All of the impairments other than the goodwill

impairment, which is separately identified, are classified within “Other impairments and special items” in

the Company’s Statements of Consolidated Operations.

101