United Airlines 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

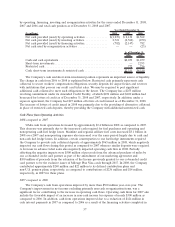

Credit Ratings. In 2008, both Standard & Poor’s and Moody’s Investors Services lowered the

Company’s credit ratings. Standard & Poor’s lowered its ratings from a corporate credit rating of B

(outlook stable) to B- (outlook negative) reflecting expected losses and reduced operating cash flow due

to volatile fuel prices. Meanwhile, Moody’s Investor Services lowered UAL’s corporate family from “B2”

to “Caa1” with a negative outlook and its secured bank rating from “B1” to “B3,” citing record-high fuel

prices and the weak U.S. economy. These credit ratings are below investment grade levels. Downgrades

from these rating levels, among other things, could restrict the availability and/or increase the cost of

future financing for the Company.

Amended Credit Facility Covenants. The Company’s Amended Credit Facility requires compliance

with certain covenants. The Company was in compliance with all of its Amended Credit Facility

covenants as of December 31, 2008 and 2007. In May 2008, the Company amended the terms of certain

financial covenants of the Amended Credit Facility. A summary of financial covenants, after the May

amendment, is included below.

Beginning with the second quarter of 2009, the Company must maintain a specified minimum ratio

of EBITDAR to the sum of the following fixed charges for all applicable periods: (a) cash interest

expense and (b) cash aircraft operating rental expense. EBITDAR represents earnings before interest

expense net of interest income, income taxes, depreciation, amortization, aircraft rent and certain other

cash and non-cash credits and charges as further defined by the Amended Credit Facility. The other

adjustments to EBITDAR include items such as foreign currency transaction gains or losses, increases or

decreases in our deferred revenue obligation, share-based compensation expense, non-recurring or

unusual losses, any non-cash non-recurring charge or non-cash restructuring charge, a limited amount of

cash restructuring charges, certain cash transaction costs incurred with financing activities and the

cumulative effect of a change in accounting principle.

The Amended Credit Facility also requires compliance with the following financial covenants: (i) a

minimum unrestricted cash balance of $1.0 billion, and (ii) a minimum ratio of market value of collateral

to the sum of (a) the aggregate outstanding amount of the loans plus (b) the undrawn amount of

outstanding letters of credit, plus (c) the unreimbursed amount of drawings under such letters of credit

and (d) the termination value of certain interest rate protection and hedging agreements with the

Amended Credit Facility lenders and their affiliates, of 150% at any time, or 200% at any time following

the release of Primary Routes having an appraised value in excess of $1 billion (unless the Primary

Routes are the only collateral then pledged).

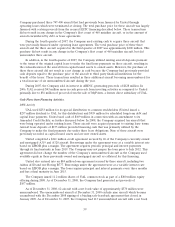

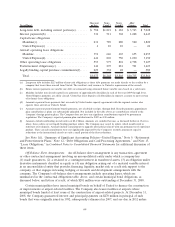

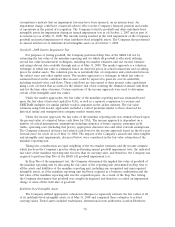

The requirement to meet a fixed charge coverage ratio was suspended for the four quarters

beginning with the second quarter of 2008 and ending with the first quarter of 2009 and thereafter is

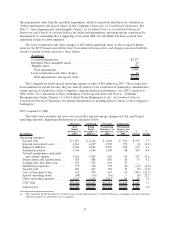

determined as set forth below:

Number of

Preceding Months Covered Period Ending

Required

Coverage Ratio

Three ............ June 30, 2009 1.0 to 1.0

Six............... September 30, 2009 1.1 to 1.0

Nine ............. December 31, 2009 1.2 to 1.0

Twelve............ March 31, 2010 1.3 to 1.0

Twelve............ June 30, 2010 1.4 to 1.0

Twelve............ September 30, 2010 and each quarter ending thereafter 1.5 to 1.0

The Amended Credit Facility contains a cross default provision with respect to other credit

arrangements that exceed $50 million. Although the Company was in compliance with all required

financial covenants as of December 31, 2008, and the Company is not required to comply with a fixed

charge coverage ratio until the three month period ending June 30, 2009, continued compliance depends

on many factors, some of which are beyond the Company’s control, including the overall industry

revenue environment and the level of fuel costs. There are no assurances that the Company will continue

to comply with its debt covenants. Failure to comply with applicable covenants in any reporting period

would result in a default under the Amended Credit Facility, which could have a material adverse impact

61