United Airlines 2008 Annual Report Download - page 58

Download and view the complete annual report

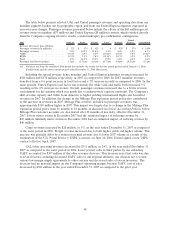

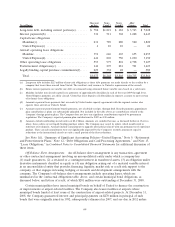

Please find page 58 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2007 to reduce debt and interest rates. The improvement in cash generated from operations that was

due to better operating performance was further enhanced by a decrease in operating cash used for

working capital. In 2007, the Company contributed approximately $236 million and $14 million to its

defined contribution plans and non-U.S. pension plans, respectively, as compared to contributions of

$270 million in 2006 for these plans.

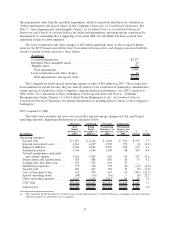

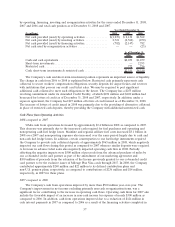

Cash Flows from Investing Activities.

2008 compared to 2007

Net sales of short-term investments provided cash of $2.3 billion for UAL in 2008 as compared to

cash used for net purchases of short-term investments of $2.0 billion in 2007. In 2008, the Company

invested most of its excess cash in money market funds, whereas in 2007, excess cash was largely invested

in short-term investments such as commercial paper. During 2008, the Company also received

$357 million of cash that was previously restricted cash held by the Company’s largest credit card

processor. The release of cash was part of an amendment to the Company’s co-branded credit card

agreement and largest credit card processor agreement. See Credit Card Processing Agreements, below,

for further discussion of the amended agreement and future cash reserve requirements.

In 2008, cash expenditures for property, equipment and software totaled approximately

$455 million. Additions to property in 2008 also included $20 million of capitalized interest. In 2007,

cash expenditures for property and equipment, software and capitalized interest were $639 million,

$65 million and $19 million, respectively. This year-over-year decrease is primarily due to the Company’s

efforts to optimize its available cash and a reduction in cash used to acquire aircraft as the 2007 capital

expenditures included cash used to acquire six aircraft that were previously financed as operating leases,

as discussed in 2007 compared to 2006, below.

During 2008, the Company generated $94 million from various asset sales including the sale of five

B737 aircraft, spare parts, engines and slots. Certain previously existing agreements in principle to sell

additional aircraft in 2008 have been terminated.

Investing cash of $274 million was generated from aircraft sold under sale-leaseback financing

agreements. In 2008, United entered into a $125 million sale-leaseback involving nine previously

unencumbered aircraft and a $149 million sale-leaseback involving 15 aircraft. See Note 15, “Lease

Obligations,” and Note 16, “Statement of Consolidated Cash Flows—Supplemental Disclosures,” in

Combined Notes to Consolidated Financial Statements for additional information related to these

transactions. In addition, the Company’s investing cash flows benefited from $41 million of cash proceeds

from a litigation settlement resulting in the recognition of a $29 million gain during 2008. The litigation

settlement related to pre-delivery advance aircraft deposits.

2007 compared to 2006

UAL’s cash released from restricted funds was $91 million in 2007 as compared to $357 million that

was provided by a decrease in the segregated and restricted funds for UAL in 2006. The significant cash

generated from restricted accounts in 2006 was due to our improved financial position upon our

emergence from bankruptcy. Net purchases of short-term investments used cash of $2.0 billion for UAL

in 2007 as compared to cash used for net purchases of short-term investments of $0.2 billion in 2006.

This change was due to investing additional excess cash in longer-term commercial paper in 2007 to

increase investment yields. Investing activities in 2007 also included the Company’s use of $96 million of

cash to acquire certain of the Company’s previously issued and outstanding debt instruments. The debt

instruments repurchased by the Company remain outstanding. See Note 12, “Debt Obligations and Card

Processing Agreements,” in Combined Notes to Consolidated Financial Statements for further information

related to the $96 million of purchased debt securities.

The Company’s capital expenditures were $658 million and $362 million in 2007 and 2006,

respectively, including the purchase of six aircraft during 2007. In the third quarter of 2007, the

58