United Airlines 2008 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

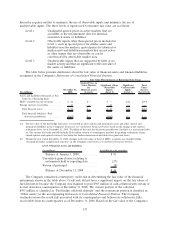

hierarchy requires entities to maximize the use of observable inputs and minimize the use of

unobservable inputs. The three levels of inputs used to measure fair value are as follows:

Level 1 Unadjusted quoted prices in active markets that are

accessible at the measurement date for identical,

unrestricted assets or liabilities.

Level 2 Observable inputs other than quoted prices included in

Level 1, such as quoted prices for similar assets and

liabilities in active markets; quoted prices for identical or

similar assets and liabilities in markets that are not active;

or other inputs that are observable or can be

corroborated by observable market data.

Level 3 Unobservable inputs that are supported by little or no

market activity and that are significant to the fair value of

the assets or liabilities.

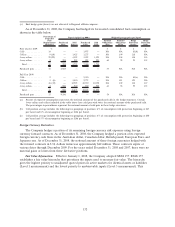

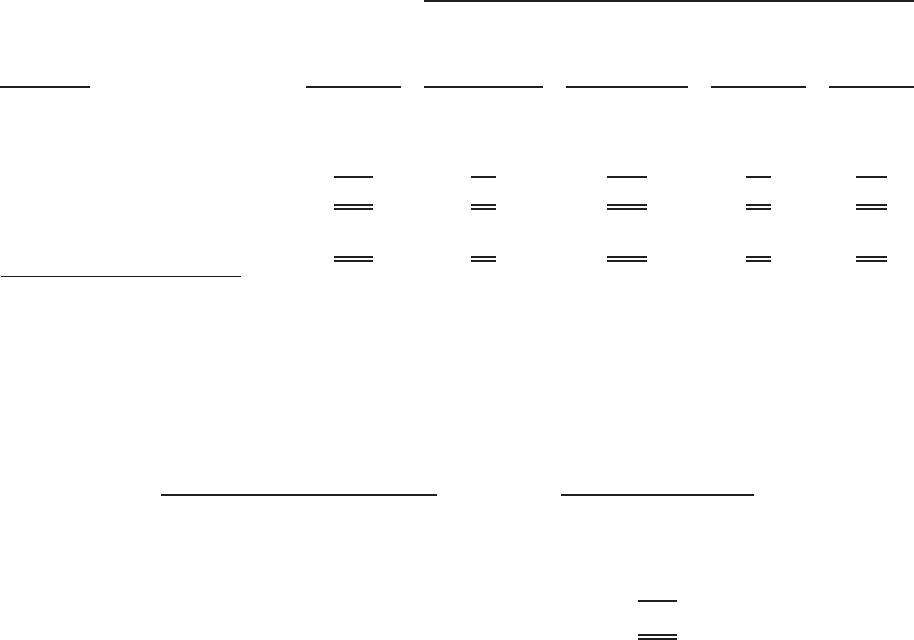

The table below presents disclosures about the fair value of financial assets and financial liabilities

recognized in the Company’s Statements of Consolidated Financial Position.

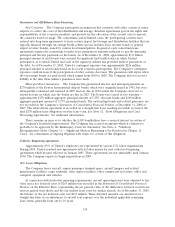

(In millions)

December 31,

2008

Quoted Prices in

Active Markets

for

Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Gains/

(Losses)

(Level 3)(b)

Fair Value Measurements at Reporting Date Using

Assets and Liabilities Measured at Fair

Value on a Recurring Basis:

EETC available-for-sale securities . . . . . $ 46 $— $ — $46 $(37)

Foreign currency receivables . ........ 10 — 10 — —

Total financial assets ............. $ 56 $— $ 10 $46 $(37)

Total financial liabilities—Fuel

derivative payables(a) . . . ........ $(867) $— $(867) $— $ —

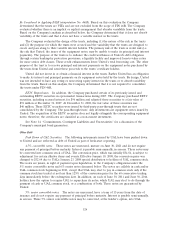

(a) The fair value of the fuel hedge derivatives is recorded in other current and noncurrent assets and other current and

noncurrent liabilities in the Company’s Statements of Consolidated Financial Position based on the timing of the contract

settlement dates. As of December 31, 2008, $9 million of the total fuel derivative payable was classified as a noncurrent liabil-

ity. The current fuel trade payable includes $140 million related to counterparty payables for pending settlements of pur-

chased options and expired contracts. See below for further discussion of fuel derivative gains and losses.

(b) During the year ended December 31, 2008, changes in the fair value of Level 3 EETC securities are classified within

“Accumulated other comprehensive income” in the Company’s Statements of Consolidated Financial Position.

Level 3 Financial Assets and Liabilities

(In millions) Available-for-sale securities

Balance at January 1, 2008............ $91

Unrealized gains (losses) relating to

instruments held at reporting date ...... (37)

Returnofprincipal ................... (8)

Balance at December 31, 2008 ......... $46

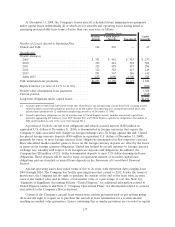

The Company considered counterparty credit risk in determining the fair value of the financial

instruments shown in the table above. Credit risk did not have a significant impact on the fair values of

fuel derivatives because the Company was required to post $965 million of cash collateral with certain of

its fuel derivative counterparties at December 31, 2008. The current portion of the collateral,

$953 million, is classified as “Fuel hedge collateral deposits” and the noncurrent portion is classified as

“Other assets” in the accompanying Statements of Consolidated Financial Position. The Company

routinely reviews the credit risk associated with its counterparties and believes its collateral is fully

recoverable from its counterparties as of December 31, 2008. Based on the fair value of the Company’s

133