United Airlines 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

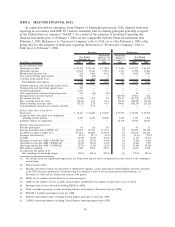

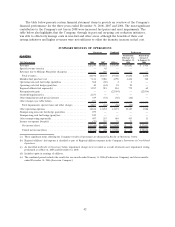

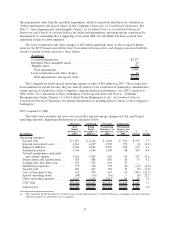

Additional details of significant variances in 2008 as compared to 2007 results, as presented in the

table above, include the following:

• UAL recorded the following impairment and other charges, as further discussed below, during

the year ended December 31, 2008:

(In millions)

Year Ended

December 31,

2008 Income statement classification

Goodwill impairment................. $2,277 Goodwill impairment

Intangible asset impairments ........... 64

Aircraft and related deposit

impairments ...................... 250

Total other impairments ............. 314

Lease termination and other charges .... 25

Total other impairments and special

items.......................... 339 Otherimpairments and special items

Severance.......................... 106 Salariesandrelatedcosts

Employee benefit obligation adjustment . . 57 Salaries and related costs

Litigation-related settlement gain ....... (29) Other operating expenses

Charges related to terminated/deferred

projects ......................... 26 Purchased services

Net gain on asset sales ............... (3) Depreciation and amortization

Accelerated depreciation .............. 34 Depreciation and amortization

Total other charges................. 191

Operating non-cash fuel hedge loss...... 568 Aircraft fuel

Nonoperating non-cash fuel hedge loss . . . 279 Miscellaneous, net

Tax benefit on intangible asset

impairments and asset sales .......... (31) Income tax benefit

Total impairments and other charges . . . $3,623

• The relatively small income tax benefit in 2008 is related to the impairment and sale of certain

indefinite-lived intangible assets, partially offset by the impact of an increase in state tax rates. In

2007, UAL recognized income tax expense of $297 million.

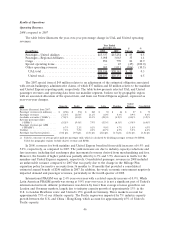

Liquidity. The following table provides a summary of the Company’s cash, restricted cash and

short-term investments at December 31, 2008 and 2007.

(In millions) 2008 2007

As of December 31,

Cash and cash equivalents ................................. $2,039 $1,259

Short-term investments ................................... — 2,295

Restricted cash .......................................... 272 756

Cash, short-term investments & restricted cash ............... $2,311 $4,310

The decrease in the Company’s cash, restricted cash and short-term investments balances was

primarily due to a $3.4 billion unfavorable reduction in cash flows from operations in 2008 as compared

to 2007. The operating cash decrease was primarily due to increased cash expenses, mainly fuel and fuel

hedge cash settlements, as discussed below under Results of Operations. Fuel hedge collateral

requirements also used operating cash of approximately $965 million in the year ended December 31,

2008. This unfavorable variance was partly offset by approximately $600 million of proceeds received

from the amendment of the co-brand credit card agreement, as discussed above. Restricted cash

43