United Airlines 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

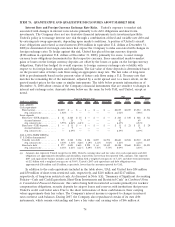

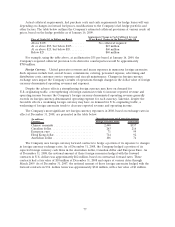

Actual collateral requirements, fuel purchase costs and cash requirements for hedge losses will vary

depending on changes in forward fuel prices, modifications to the Company’s fuel hedge portfolio and

other factors. The table below outlines the Company’s estimated collateral provisions at various crude oil

prices, based on the hedge portfolio as of January 16, 2009.

Price of Crude Oil, in Dollars per Barrel

Approximate Change in Cash Collateral for each

$5 per Barrel Change in the Price of Crude Oil

Above $105 ........................ Nocollateral required

At or above $85, but below $105 ........ $45million

At or above $25, but below $85......... $60million

Below$25......................... $40million

For example, using the table above, at an illustrative $35 per barrel at January 16, 2009, the

Company’s required collateral provision to its derivative counterparties would be approximately

$780 million.

Foreign Currency. United generates revenues and incurs expenses in numerous foreign currencies.

Such expenses include fuel, aircraft leases, commissions, catering, personnel expense, advertising and

distribution costs, customer service expenses and aircraft maintenance. Changes in foreign currency

exchange rates impact the Company’s results of operations through changes in the dollar value of foreign

currency-denominated operating revenues and expenses.

Despite the adverse effects a strengthening foreign currency may have on demand for

U.S.-originating traffic, a strengthening of foreign currencies tends to increase reported revenue and

operating income because the Company’s foreign currency-denominated operating revenue generally

exceeds its foreign currency-denominated operating expense for each currency. Likewise, despite the

favorable effects a weakening foreign currency may have on demand for U.S.-originating traffic, a

weakening of foreign currencies tends to decrease reported revenue and operating income.

The Company’s most significant net foreign currency exposures in 2008, based on exchange rates in

effect at December 31, 2008, are presented in the table below:

(In millions)

Currency Foreign Currency Value USD Value

Operating revenue net of operating expense

Chinese renminbi ......................... 2,440 $357

Canadian dollar........................... 263 216

European euro ........................... 71 99

Hong Kong dollar ......................... 714 92

Australian dollar .......................... 106 74

The Company uses foreign currency forward contracts to hedge a portion of its exposure to changes

in foreign currency exchange rates. As of December 31, 2008, the Company hedged a portion of its

expected foreign currency cash flows in the Australian dollar, Canadian dollar and European Euro. As

of December 31, 2008, the notional amount of these foreign currencies hedged with the forward

contracts in U.S. dollars was approximately $62 million, based on contractual forward rates. These

contracts had a fair value of $10 million at December 31, 2008 and expire at various dates through

March 2009. As of December 31, 2007, the notional amount of these foreign currencies hedged with the

forward contracts in U.S. dollars terms was approximately $346 million, with a fair value of $1 million.

77