United Airlines 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

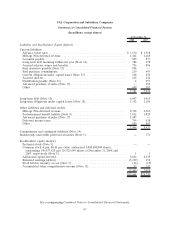

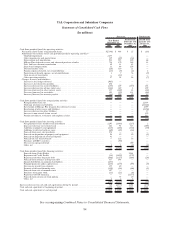

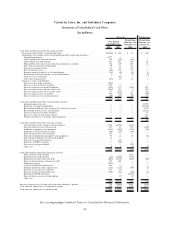

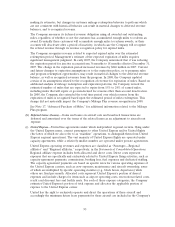

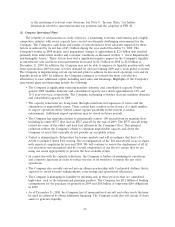

United Air Lines, Inc. and Subsidiary Companies

Statements of Consolidated Stockholder’s Equity (Deficit)

(In millions)

Receivable

from

Affiliates

Common

Stock

Additional

Capital

Invested

Retained

Earnings

(Deficit)

Accumulated

Other

Comprehensive

Income (Loss) Total

Predecessor Company

Balance at December 31, 2005 ........................ $(1,237) $— $ 4,213 $(28,809) $(36) $(25,869)

Net loss before reorganization items—January 2006 . . . ...... — — — (83) — (83)

Reorganization items—January 2006 . . . ............... — — — (1,392) — (1,392)

Subtotal ...................................... (1,237) — 4,213 (30,284) (36) (27,344)

Fresh start adjustments:

Unsecured claims and debt discharge . . . ............... — — — 24,389 — 24,389

Valuationadjustments,net......................... — — — (288) — (288)

Balance at January 31, 2006 ......................... (1,237) — 4,213 (6,183) (36) (3,243)

Fresh start adjustments:

Elimination of accumulated deficit and accumulated other

comprehensiveloss............................ — — — 6,183 36 6,219

Cancellation of receivable from affiliates and additional capital

invested . .................................. 1,237 — (4,213) — — (2,976)

Issuance of new equity interests in connection with emergence

fromChapter11.............................. — — 1,952 — — 1,952

Successor Company

Balance at February 1, 2006 ......................... — — 1,952 — — 1,952

Net income from February 1 to December 31, 2006 . . . ...... — — — 32 — 32

Other comprehensive income (loss), net:

Unrealized loss on derivatives, net . . ............... — — — — (5) (5)

Totalcomprehensiveincome,net ................... — — — 32 (5) 27

Adoption of SFAS 158, net $47 of tax . ............... — — — — 87 87

Preferred stock dividends (Note 5) . . . ............... — — — (9) — (9)

Asset contribution from parent . .................... — — 6 — — 6

Share-based compensation . . . .................... — — 159 — — 159

Proceeds from exercise of stock options ............... — — 10 — — 10

Balance at December 31, 2006 ........................ — — 2,127 23 82 2,232

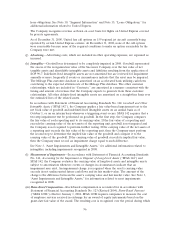

Netincome .................................. — — — 402 — 402

Other comprehensive income, net:

Unrealized gains on financial instruments, net.......... — — — — 5 5

Pension and other postretirement plans (Note 9)

Netgainarisingduringperiod,net$63oftax......... — — — — 102 102

Less: amortization of prior period gains, net . . . ...... — — — — (8) (8)

Total pension and other postretirement plans . . . ...... — — — — 94 94

Totalcomprehensiveincome,net ................... — — — 402 99 501

Preferred stock dividends (Note 5) .................... — — — (10) — (10)

Adoption of FIN 48 ............................. — — 2 — — 2

Tax adjustment on SFAS 158 adoption (Note 11) ........... — — — — (40) (40)

MPInoteforgiveness(Note18)...................... — — (213) — — (213)

Share-based compensation ......................... — — 49 — — 49

Proceeds from exercise of stock options . . ............... — — 35 — — 35

Balance at December 31, 2007 ........................ — — 2,000 415 141 2,556

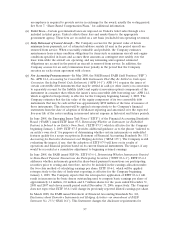

Netloss..................................... — — — (5,306) — (5,306)

Other comprehensive income (loss):

Unrealized losses on financial instruments . ........... — — — — (37) (37)

Pension and other postretirement plans (Note 9)

Netgainarisingduringperiod.................. — — — — 8 8

Less: amortization of prior period gains . ........... — — — — (19) (19)

Total pension and other postretirement plans .......... — — — — (11) (11)

Totalcomprehensiveloss,net...................... — — — (5,306) (48) (5,354)

Dividend to parent .............................. — — — (257) — (257)

Preferred stock dividends (Note 5) .................... — — — (3) — (3)

Conversion of preferred stock . . . .................... — — 374 — — 374

Capital contributions from parent (Note 18) . . . ........... — — 173 — — 173

Share-based compensation ......................... — — 31 — — 31

Balance at December 31, 2008 ........................ $ — $— $2,578 $(5,151) $ 93 $ (2,480)

See accompanying Combined Notes to Consolidated Financial Statements.

90