United Airlines 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

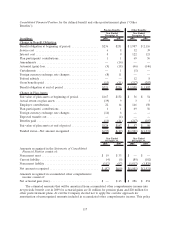

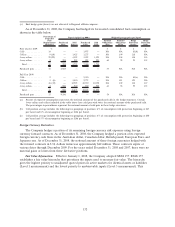

portion of the initial other comprehensive balance at the adoption date excluding the amount of

comprehensive income attributable to the Medicare Part D subsidiary. This adjustment of $40 million is

excluded from comprehensive income and is reported separately in the Company’s Statements of

Consolidated Stockholders’ Equity (Deficit).

(12) Debt Obligations and Card Processing Agreements

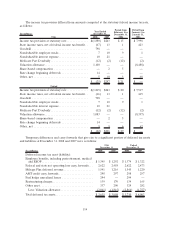

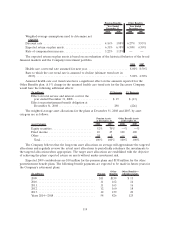

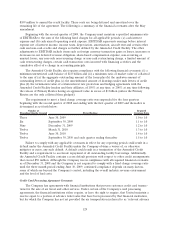

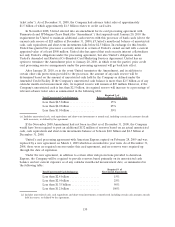

Long-term debt amounts outstanding at December 31, 2008 and 2007 are shown below:

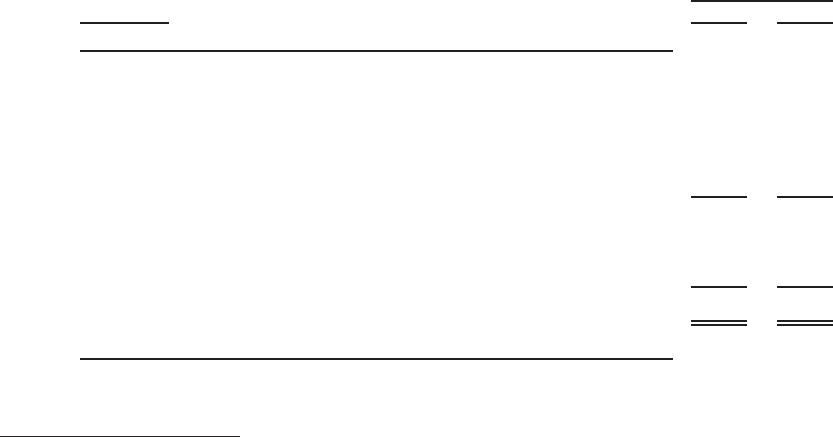

(In millions) 2008 2007

At December 31,

United

Secured notes, 1.64% to 9.52%, due 2009 to 2022 ............... $4,331 $4,659

Credit Facility, 3%, due 2014 ............................... 1,273 1,291

4.5% convertible notes, due 2021(a) ......................... 726 726

6% senior notes, due 2031(a)............................... 546 515

5% senior convertible notes, due 2021(a) ..................... 150 150

Total debt .............................................. 7,026 7,341

Less: unamortized debt discount .......................... (239) (251)

Less: current portion of long-term debt ..................... (780) (678)

Long-term debt, net ...................................... $6,007 $6,412

UAL(b)

Current portion of long-term debt ........................... $ 782 $ 678

Long-term debt, net ...................................... 6,007 6,415

(a) Instruments were issued by UAL and pushed down to United as discussed below.

(b) A direct subsidiary of UAL had additional debt of $2 million, which is classified as a current debt obligation

as of December 31, 2008, and $3 million which was classified as long-term debt obligation as of December 31,

2007.

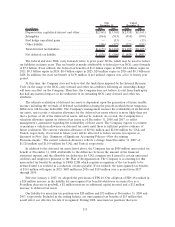

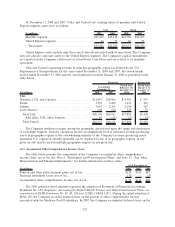

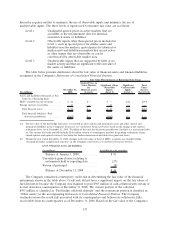

The Company has a $255 million revolving loan commitment available under Tranche A of its credit

facility. As of December 31, 2008 and 2007, the Company used $254 million and $102 million,

respectively, of the Tranche A commitment capacity for letters of credit. In addition, under a separate

agreement, the Company had $27 million of letters of credit issued as of December 31, 2008.

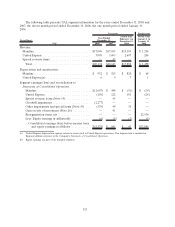

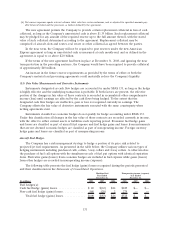

At December 31, 2008, UAL’s contractual principal payments under then-outstanding long-term

debt agreements in each of the next five calendar years are as follows: 2009—$782 million; 2010—

$952 million; 2011—$869 million; 2012—$414 million; 2013—$268 million and thereafter—

$3,743 million.

As of December 31, 2008, assets with a net carrying value of $7.9 billion, principally aircraft, route

authorities and Mileage Plus intangible assets were pledged under various loan and other agreements.

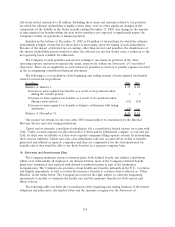

Aircraft-related Transactions

In June 2008, United entered into an $84 million credit agreement secured by three aircraft,

including two Airbus A320s and one Boeing B777. Borrowings under the agreement are at a variable

interest rate based on LIBOR plus a margin. The loan has a final maturity in June 2015.

In July 2008, United completed a $241 million credit agreement secured by 26 of the Company’s

owned A319 and A320 aircraft. Borrowings under the agreement were at a variable interest rate based

on LIBOR plus a margin. Periodic principal and interest payments are required until the final maturity

in June 2019. The Company may not prepay the loan prior to July 2012. This agreement did not change

124