United Airlines 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

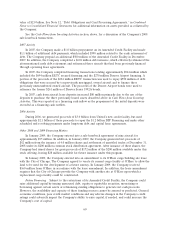

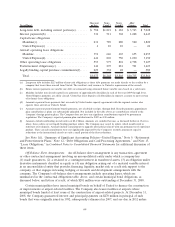

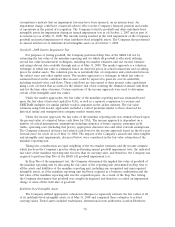

balance and net current exposure as of any calendar month-end measurement date, as summarized in

the following table:

Total Unrestricted Cash Balance(a)

Required % of

Net Current Exposure(b)

Less than $2.4 billion ......................................... 15%

Less than $2.0 billion ......................................... 25%

Less than $1.35 billion ........................................ 50%

Less than $1.2 billion ......................................... 100%

(a) Includes unrestricted cash, cash equivalents and short-term investments at month-end, including certain cash amounts

already held in reserve, as defined by the agreement.

(b) Net current exposure equals relevant advance ticket sales less certain exclusions, and as adjusted for specified amounts pay-

able between United and the processor, as further defined by the agreement.

The new agreement permits the Company to provide certain replacement collateral in lieu of cash

collateral, as long as the Company’s unrestricted cash is above $1.35 billion. Such replacement collateral

may be pledged for any amount of the required reserve up to the full amount thereof, with the stated

value of such collateral determined according to the agreement. Replacement collateral may be

comprised of aircraft, slots and routes, real estate or other collateral as agreed between the parties.

In the near term, the Company will not be required to post reserves under the new American

Express agreement as long as unrestricted cash as measured at each month-end, and as defined in the

agreement, is equal to or above $2.0 billion.

If the terms of the new agreement had been in place at December 31, 2008, and ignoring the near

term protection in the preceding sentence, the Company would have been required to provide collateral

of approximately $40 million.

An increase in the future reserve requirements as provided by the terms of either or both the

Company’s material card processing agreements could materially reduce the Company’s liquidity.

Capital Commitments and Off-Balance Sheet Arrangements. The Company’s business is very capital

intensive, requiring significant amounts of capital to fund the acquisition of assets, particularly aircraft.

In the past, the Company has funded the acquisition of aircraft through outright purchase, by issuing

debt, by entering into capital or operating leases, or through vendor financings. The Company also often

enters into long-term lease commitments with airports to ensure access to terminal, cargo, maintenance

and other required facilities.

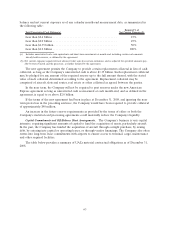

The table below provides a summary of UAL’s material contractual obligations as of December 31,

2008.

63