United Airlines 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

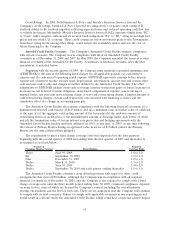

the impairments other than the goodwill impairment, which is separately identified, are classified as

“Other impairments and special items” in the Company’s Statements of Consolidated Operations. See

Note 3, “Asset Impairments and Intangible Assets,” in Combined Notes to Consolidated Financial

Statements and Critical Accounting Policies for additional information, including factors considered by

management in concluding that a triggering event under SFS 142 and SFAS 144 had occurred and

additional details of assets impaired.

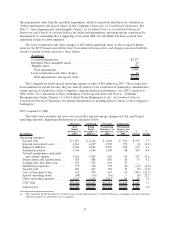

The lease termination and other charges of $25 million primarily relate to the accrual of future

rents for the B737 leased aircraft that have been removed from service and charges associated with the

return of certain of these aircraft to their lessors.

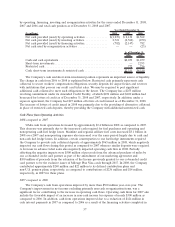

(In millions)

Goodwill impairment ............................................. $2,277

Indefinite-lived intangible assets .................................... 64

Tangible assets .................................................. 250

Total impairments ............................................. 2,591

Lease termination and other charges................................. 25

Total impairments and special items ............................... $2,616

The Company recorded special operating expense credits of $44 million in 2007. These items have

been classified as special because they are directly related to the resolution of bankruptcy administrative

claims and are not indicative of the Company’s ongoing financial performance. See 2007 compared to

2006, below, for a discussion of these bankruptcy-related special items and Note 4, “Voluntary

Reorganization Under Chapter 11 of the United States Bankruptcy Code,” in Combined Notes to

Consolidated Financial Statements for further information on pending matters related to the Company’s

bankruptcy.

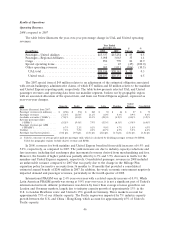

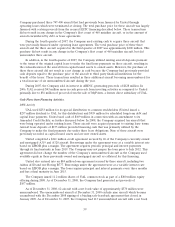

2007 compared to 2006

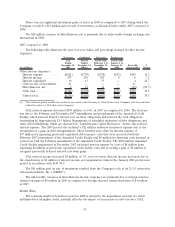

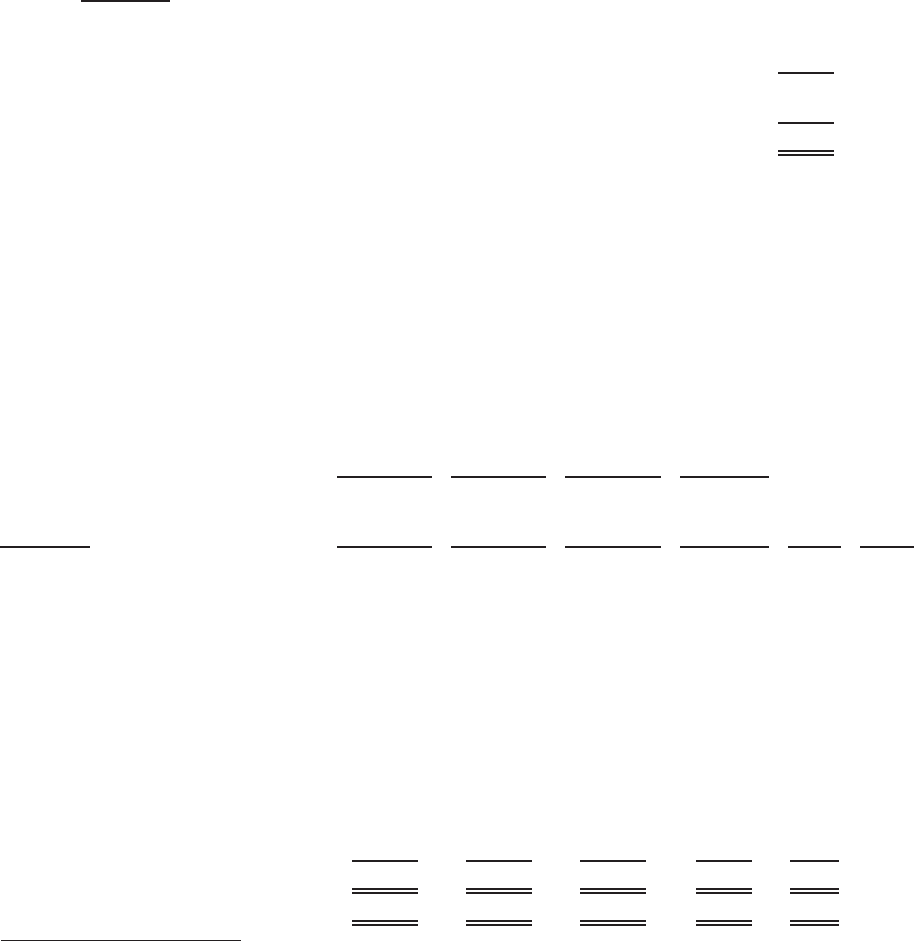

The table below includes the year-over-year dollar and percentage changes in UAL and United

operating expenses. Significant fluctuations are discussed below.

(In millions)

Year

Ended

December 31,

2007

Period

Ended

December 31,

2006(a)

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

$

Change

%

Change

Successor Combined Successor Predecessor

Operating expenses:

Aircraft fuel ................. $ 5,003 $ 4,824 $ 4,462 $ 362 $179 3.7

Salaries and related costs ....... 4,261 4,267 3,909 358 (6) (0.1)

Regional affiliates ............. 2,941 2,824 2,596 228 117 4.1

Purchased services ............ 1,346 1,246 1,148 98 100 8.0

Aircraft maintenance materials

and outside repairs .......... 1,166 1,009 929 80 157 15.6

Depreciation and amortization . . . 925 888 820 68 37 4.2

Landing fees and other rent ..... 876 876 801 75 — —

Distribution expenses .......... 779 798 738 60 (19) (2.4)

Aircraft rent ................. 406 415 385 30 (9) (2.2)

Cost of third party sales ........ 316 679 614 65 (363) (53.5)

Special operating items......... (44) (36) (36) — (8) 22.2

Other operating expenses ....... 1,131 1,103 1,017 86 28 2.5

UAL total . . ................. $19,106 $18,893 $17,383 $1,510 $ 213 1.1

United total ................. $19,099 $18,875 $17,369 $1,506 $ 224 1.2

(a) The combined period includes the results for one month ended January 31, 2006 (Predecessor Company) and eleven months

ended December 31, 2006 (Successor Company).

51