United Airlines 2008 Annual Report Download - page 140

Download and view the complete annual report

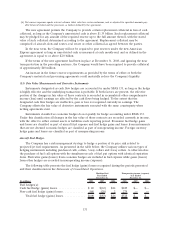

Please find page 140 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Amendment requires that our co-branded credit card partner make annual guaranteed

payments to United between 2008 and 2017. Between 2008 and 2012, our co-branded credit card

partner’s annual guaranteed payment is satisfied through the purchase of a specified minimum amount

of miles. Afterwards, our co-branded credit card partner’s annual guaranteed payment is satisfied

through awarding pre-purchased miles, purchasing miles and through other contractual payments.

Between 2008 and 2012, our co-branded credit card partner is allowed to carry forward those miles

purchased subject to the annual guarantee that have not been awarded to its cardholders. Any miles

carried forward subject to this provision will result in a net increase to our “Advance purchase of miles”

obligation in our Statements of Consolidated Financial Position.

In connection with the Amendment, the Company received a payment of $100 million in exchange

for the extension of the license previously granted to its co-branded credit card partner to be the

exclusive issuer of Mileage Plus Visa cards through 2017. This amount is reflected as Mileage Plus

deferred revenue in our Statements of Consolidated Financial Position and is being recognized as revenue

over the period the fees are earned.

As part of the Amendment, the Company granted its co-branded credit card partner a first lien in

specified Mileage Plus assets and a second lien on those assets that are provided as collateral under our

credit facility. See Note 12, “Debt Obligations and Card Processing Agreements,” for additional

information regarding these assets. The Amendment may be terminated by either party upon the

occurrence of certain events as defined, including but not limited to a change in law that has a material

adverse impact, insolvency of one of the parties, or failure of the parties to perform their obligations.

The security interest is released if the Company repurchases the full balance of the pre-purchased miles

or the Company achieves a certain fixed charge coverage ratio.

In November 2008, the Company further amended its largest credit card processing agreement to

allow for the temporary substitution of aircraft collateral in lieu of cash collateral. United also agreed

that such security interest collateralizes not only United’s obligations under this processing agreement,

but also United’s obligations under United’s Amended and Restated Co-Branded Card Marketing

Services Agreement. See Note 12, “Debt Obligations and Card Processing Agreements,”—Credit Card

Processing Agreement Covenants,” for further discussion of the substitution agreement.

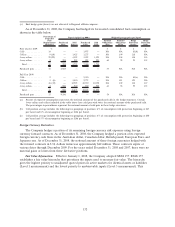

(18) Related Party Transactions

In 2008, United contributed cash of $257 million to UAL for use in UAL’s payment of its January

2008 special distribution to its common shareholders. In addition, UAL made capital contributions of

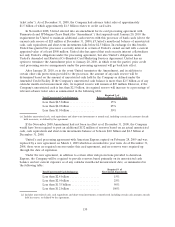

$173 million to United during 2008 consisting of the following:

• In December 2008, UAL contributed 100% of the capital stock United BizJet Holdings, Inc.

(“Bizjet”) to United, which had a book value of $10 million. In accordance with SFAS 141,

United’s results of operations reflect the results of operations of Bizjet as though the contribution

from UAL occurred on January 1, 2006, the earliest period presented. Subsequently, United and

Bizjet entered into a merger agreement under which Bizjet was merged with and into United,

with United being the surviving company. This merger was effective December 31, 2008. The only

impact that this contribution will have on United’s previously reported results of operations in

2008 is an increase to income of $29 million in the three and six month periods ended June 30,

2008 and the nine month period ended September 30, 2008.

• In addition, UAL contributed cash of $163 million to United. This contribution included

$107 million of proceeds that UAL generated from the issuance and sale of UAL common stock.

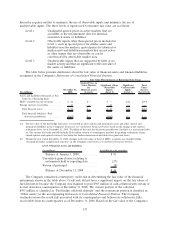

At December 31, 2006, United, through one of its wholly-owned subsidiaries, Mileage Plus, Inc.

(“MPI”), had a $200 million note receivable from UAL. During 2007, UAL, United and MPI executed a

note payment agreement to pay and thereby cancel this note payable (plus accrued interest). This

transaction had no effect in the UAL consolidated financial statements and was treated as a forgiveness

140