United Airlines 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

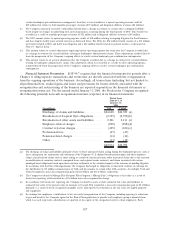

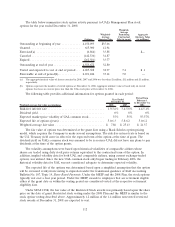

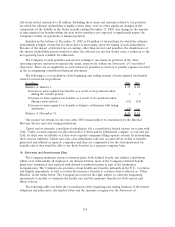

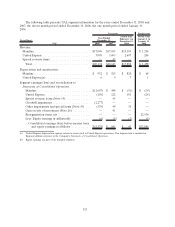

Consolidated Financial Position for the defined benefit and other postretirement plans (“Other

Benefits”):

(In millions) 2008 2007 2008 2007

Year Ended

December 31,

Year Ended

December 31,

Pension Benefits Other Benefits

Change in Benefit Obligation

Benefit obligation at beginning of period ................. $236 $251 $ 1,987 $ 2,116

Service cost ........................................ 6 8 32 39

Interest cost ........................................ 8 9 122 121

Plan participants’ contributions ......................... 1 1 69 56

Amendments ....................................... — (16) — —

Actuarial (gain) loss .................................. (9) (18) (46) (146)

Curtailments ....................................... — 1 (1) —

Foreign currency exchange rate changes .................. (8) 11 — —

Federal subsidy ..................................... — — 12 8

Gross benefits paid .................................. (13) (11) (217) (207)

Benefit obligation at end of period ...................... $221 $236 $ 1,958 $ 1,987

Change in Plan Assets

Fair value of plan assets at beginning of period............. $167 $152 $ 56 $ 54

Actual return on plan assets ........................... (39) 9 3 3

Employer contributions ............................... 22 14 146 150

Plan participants’ contributions ......................... 1 1 69 56

Foreign currency exchange rate changes .................. (14) 6 — —

Expected transfer out................................. — (4) — —

Benefits paid ....................................... (13) (11) (217) (207)

Fair value of plan assets at end of period ................. $124 $167 $ 57 $ 56

Funded status—Net amount recognized .................. $(97) $(69) $(1,901) $(1,931)

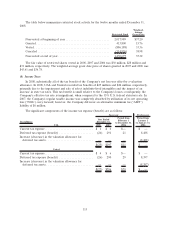

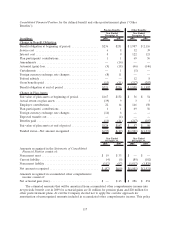

2008 2007 2008 2007

Year Ended

December 31,

Year Ended

December 31,

Amounts recognized in the Statements of Consolidated

Financial Position consist of:

Noncurrent asset .................................... $ 19 $33 $ — $ —

Current liability ..................................... (4) (5) (89) (102)

Noncurrent liability .................................. (112) (97) (1,812) (1,829)

Net amount recognized ............................... $ (97) $(69) $(1,901) $(1,931)

Amounts recognized in accumulated other comprehensive

income consist of:

Net actuarial gain (loss) ............................... $ — $43 $ 286 $ 254

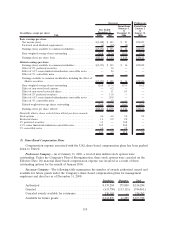

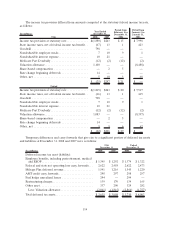

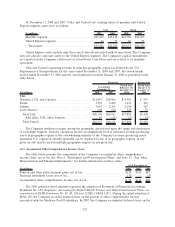

The estimated amounts that will be amortized from accumulated other comprehensive income into

net periodic benefit cost in 2009 for actuarial gains are $1 million for pension plans and $20 million for

other postretirement plans. At exit the Company elected not to apply the corridor approach for

amortization of unrecognized amounts included in accumulated other comprehensive income. This policy

117