United Airlines 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements

The Company

UAL Corporation (together with its consolidated subsidiaries, “UAL”) is a holding company whose

principal, wholly-owned subsidiary is United Air Lines, Inc. (together with its consolidated subsidiaries,

“United”). We sometimes use the words “we,” “our,” “us” and the “Company” in this Annual Report on

Form 10-K for disclosures that relate to both UAL and United.

This Annual Report on Form 10-K is a combined report of UAL and United. Therefore, these

Combined Notes to Consolidated Financial Statements apply to both UAL and United, unless otherwise

noted. As UAL consolidates United for financial statement purposes, disclosures that relate to activities

of United also apply to UAL.

(1) Summary of Significant Accounting Policies

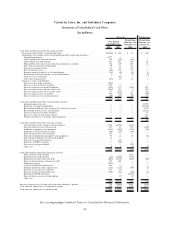

(a) Basis of Presentation—UAL is a holding company whose principal subsidiary is United. The

Company’s consolidated financial statements include the accounts of its majority-owned

affiliates. All significant intercompany transactions are eliminated. Certain prior year amounts

have been reclassified to conform to the current year’s presentation. Reclassifications in the

Statements of Consolidated Cash Flows include reclassifications of “Other impairments and

special items” and “Additions to deferred software costs” which are currently classified as a

separate line items and were historically classified within “Other operating activities” and

“Other investing activities,” respectively.

Upon emergence from its Chapter 11 proceedings, the Company adopted fresh-start reporting

in accordance with American Institute of Certified Public Accountants’ Statement of Position

90-7, Financial Reporting by Entities in Reorganization under the Bankruptcy Code (“SOP 90-7”)

as of February 1, 2006. The Company’s emergence from reorganization resulted in a new

reporting entity with no retained earnings or accumulated deficit as of February 1, 2006 (the

“Effective Date”). Accordingly, the Company’s consolidated financial statements for periods

before February 1, 2006 are not comparable to consolidated financial statements presented on

or after February 1, 2006. References to “Successor Company” refer to UAL and United on or

after February 1, 2006, after giving effect to the adoption of fresh-start reporting. References to

“Predecessor Company” refer to UAL and United before February 1, 2006. See Note 4,

“Voluntary Reorganization Under Chapter 11—Fresh-Start Reporting,” for further details.

(b) Use of Estimates—The preparation of financial statements in conformity with accounting

principles generally accepted in the United States of America (“GAAP”) requires management

to make estimates and assumptions that affect the amounts reported in the financial statements

and accompanying notes. Actual results could differ from those estimates.

The Company estimates fair value of its financial instruments and its reporting units and

indefinite-lived intangible assets for testing impairment of indefinite-lived intangible assets,

including goodwill. These estimates and assumptions are inherently subject to significant

uncertainties and contingencies beyond the control of the Company. Accordingly, the Company

cannot provide assurance that the estimates, assumptions and values reflected in the valuations

will be realized, and actual results could vary materially.

(c) Airline Revenues—The value of unused passenger tickets and miscellaneous charge orders

(“MCOs”) are included in current liabilities as advance ticket sales. United records passenger

ticket sales and tickets sold by other airlines for use on United as operating revenues when the

transportation is provided or when the ticket expires. Tickets sold by other airlines are recorded

at the estimated values to be billed to the other airlines. Non-refundable tickets generally expire

on the date of the intended flight, unless the date is extended by notification from the customer

91