United Airlines 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ARINC is a provider of transportation communications and systems engineering. The transaction

generated proceeds of $128 million and resulted in a pre-tax gain of $41 million.

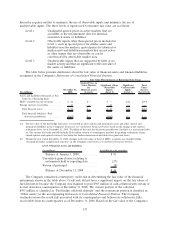

Investments at December 31, 2008 and 2007 include $46 million and $91 million of the Company’s

previously issued EETC debt securities that the Company repurchased in 2007. These securities remain

outstanding and are classified as available-for-sale. An unrealized loss of $37 million and $5 million to

record these securities at fair value has been recognized in other comprehensive income during 2008 and

2007, respectively. See Note 12, “Debt Obligations and Card Processing Agreements,” for additional

information.

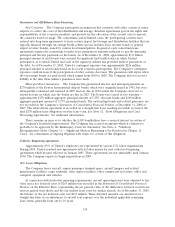

(21) Distribution Payable

In December 2007, the UAL Corporation Board of Directors approved a special distribution of

$2.15 per share to holders of UAL common stock. The distribution, of approximately $257 million, was

paid on January 23, 2008 to the holders of record of UAL common stock on January 9, 2008. The

distribution, which is characterized as a return of capital for income tax purposes, was accrued at

December 31, 2007 in UAL’s Statements of Consolidated Financial Position.

In January 2008, United’s Board of Directors approved a dividend of up to $260 million to UAL to

fund the January 23, 2008 special distribution to UAL common stockholders. As such, United did not

accrue the distribution at December 31, 2007 in its Statements of Consolidated Financial Position.

(22) UAL Selected Quarterly Financial Data (Unaudited)

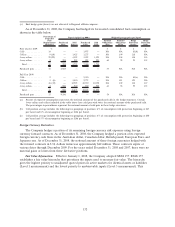

(In millions, except per share amounts) March 31 June 30 September 30 December 31

Quarter Ended

2008:

Operating revenues ............................. $4,711 $5,371 $5,565 $4,547

Loss from operations ........................... (441) (2,694) (491) (812)

Netloss...................................... (537) (2,729) (779) (1,303)

Basic and diluted loss per share ................... $(4.45) $(21.47) $(6.13) $ (9.91)

2007:

Operating revenues ............................. $4,373 $5,213 $5,527 $5,030

Earnings (loss) from operations ................... (92) 537 656 (64)

Net income (loss) .............................. (152) 274 334 (53)

Basic earnings (loss) per share .................... $(1.32) $ 2.31 $ 2.82 $ (0.47)

Diluted earnings (loss) per share .................. $(1.32) $ 1.83 $ 2.21 $ (0.47)

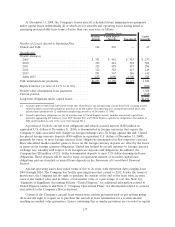

UAL’s quarterly financial data is subject to seasonal fluctuations and historically, its results in the

second and third quarters are better as compared to the first and fourth quarters of each year since the

latter quarters normally reflect weaker demand. UAL’s quarterly results were impacted by the following

significant items:

2008

• The second quarter was negatively impacted by impairment charges of $2.5 billion related to the

Company’s interim impairment testing of its intangible assets. In addition, the Company incurred

$110 million of severance and employee benefit charges, as well as $26 million of purchased

services charges. Offsetting these impacts was a $29 million gain from a litigation-related

settlement gain.

• The third quarter included reversals of $16 million of intangible asset impairments recorded

during the second quarter. The Company also recorded an additional $6 million of severance

142