Nokia 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

Corporate governance

NOKIA IN 2014

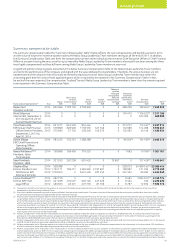

Proposal by the Corporate Governance and Nomination Committee

for compensation to the Board of Directors in 2015

On January 29, 2015, the Corporate Governance and Nomination

Committee of the Board announced its proposal to the Annual General

Meeting convening on May 5, 2015 regarding the remuneration to

the Board in 2015. The Committee will propose that the annual fee

payable to the Board members elected at the same meeting for a term

until the close of the Annual General Meeting in 2016 remains at the

same level as it has been for the past seven years and be as follows:

EUR 440 000 for the Chairman, EUR 150 000 for the Vice Chairman

and EUR 130 000 for each member; for the Chairman of the Audit

Committee and the Chairman of the Personnel Committee an

additional annual fee of EUR 25 000, and for each member of the

Audit Committee an additional annual fee of EUR 10 000.

The guiding principle of the Corporate Governance and Nomination

Committee’s remuneration proposal is to align the interests of the

directors with those of the shareholders by remunerating directors

primarily with Nokia shares that according to the current policy shall

be retained for the duration of the Board membership. Therefore,

the Committee will propose that, as in the past, approximately 40% of

the Board remuneration be paid in Nokia shares purchased from the

market or alternatively by using treasury shares held by the company.

The shares shall be retained until the end of a director’s Board

membership in line with the current Nokia policy (except for those

shares needed to oset any costs relating to the acquisition of the

shares, including taxes). The rest of the remuneration would be

payable in cash, most of which is typically used to cover taxes arising

from the remuneration.

The Committee’s aim is to ensure that Nokia has an ecient Board

of international professionals representing a diverse mix of skills and

experience. A competitive Board remuneration contributes to the

achievement of this target.

In determining the proposed remuneration, it is the Committee’s

policy to review and compare the total remuneration levels and their

criteria paid in other global companies with net sales and complexity

ofbusiness comparable to that of Nokia’s. It is the company’s policy

that the remuneration consists of an annual fee only, and that no fees

for meeting attendance are paid. It is also the company’s policy that a

signicant portion of director compensation will be paid in the form of

company shares purchased from the market or by using shares held by

the company and that each Board member shall retain, in accordance

with the current policy, all Nokia shares received as director

compensation until the end of his or her Board membership (except

for those shares needed to oset any costs relating to the acquisition

of the shares, including taxes). In addition, it is Nokia’s policy that

non-executive members of the Board do not participate in any of

its equity programs and do not receive stock options, performance

shares, restricted shares or any other equity-based or otherwise

variable compensation for their duties as Board members.

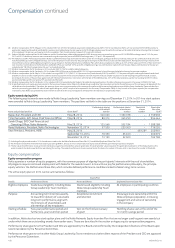

Executive compensation

Introduction

The year 2014 was one of fundamental change for Nokia.

Following the Sale of the D&S Business, Nokia emerged with three

businesses—Nokia Networks, HERE and Nokia Technologies.

As a result of these changes and the new Nokia strategy we have

introduced new corporate values and reviewed and refreshed

our executive pay practices and policies for the Nokia Group

Leadership Team.

Key updates made to our executive compensation practices are

as follows:

Drive performance

■ We have updated the mix of various compensation elements to

reflect market practice for companies of similar size and complexity.

■Performance shares are now used as the primary vehicle for

long-term incentives.

Attract and retain the right talent

■ We have updated our peer group for assessment of the

competitiveness of our compensation packages and structure given

our renewed business and strategy.

Align with shareholder interests

■ Our share ownership and clawback policies have been strengthened

as part of the review of our compensation approach in order to

ensure appropriate alignment with shareholders and accountability

for sustainable long-term company success.