Nokia 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

Financial statements

NOKIA IN 2014

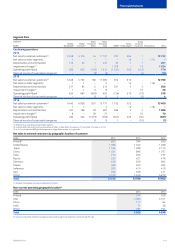

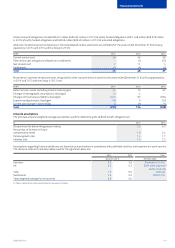

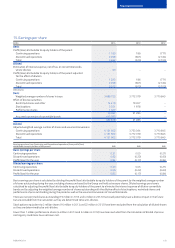

Future cash ows

Employer contributions expected to be made to the post-employment dened benet plans in 2015 are EUR 28 million and the weighted

average duration of the dened benet obligations is 16 years at December 31, 2014.

The expected maturity analysis of undiscounted benets paid from the dened benet plans of the Continuing operations is shown here:

EURm 2015 2016 2017 2018 2019 2020-2024

Pension benets 42 43 45 48 50 316

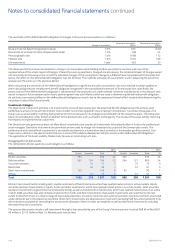

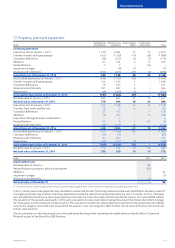

9. Depreciation and amortization by function

EURm 2014 2013 2012

Continuing operations

Cost of sales 61 88 119

Research and development expenses(1) 129 293 525

Selling, general and administrative expenses(2) 107 179 444

Total 297 560 1 088

(1) Includes amortization of acquired intangible assets of EUR 36 million (EUR 188 million in 2013 and EUR 375 million in 2012).

(2) Includes amortization of acquired intangible assets of EUR 40 million (EUR 93 million in 2013 and EUR 313 million in 2012).

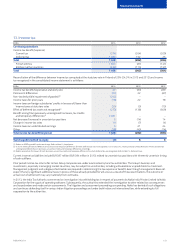

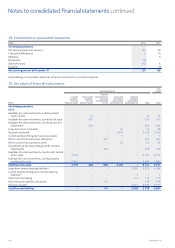

10. Impairment

Impairment charges by asset category are:

EURm 2014 2013 2012

Continuing operations

Goodwill 1 209 – –

Other intangible assets –– 8

Property, plant and equipment –12 23

Investments in associated companies –– 8

Available-for-sale investments 15 831

Total 1 224 20 70

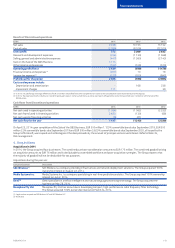

Goodwill

Goodwill impairment assessment for the HERE CGU was carried out at September 30, 2014. The previous assessment date was October 1,

2013. The assessment date was brought forward to September 30, 2014 due to an adjustment to the HERE strategy and the related new

long-range plan, which incorporates the slower than expected increase in net sales directly to consumers, and the Group’s plans to curtail its

investment in certain higher-risk and longer-term growth opportunities. This represented a triggering event resulting in an interim impairment

test to assess if events or changes in circumstances indicate that the carrying amount of HERE goodwill may not be recoverable. The goodwill

impairment assessment for the HERE CGU was rolled forward to October 1, 2014 to align with the annual assessment date. The goodwill

impairment assessment for the Nokia Networks Radio Access Networks group of CGUs in Mobile Broadband and Global Services group of CGUs

was carried out at November 30, 2014 (November 30 in 2013).

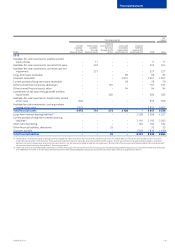

The carrying value of goodwill allocated to each of the Group’s CGUs at each of the respective years’ impairment testing dates is:

EURm 2014 2013

HERE(1) 2 273 3 219

Global Services 106 91

Radio Access Networks in Mobile Broadband 96 88

Devices & Services (Discontinued operations) –1 417

(1) The carrying value of goodwill after the 2014 impairment charge.

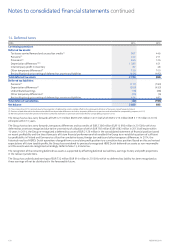

The recoverable amounts of the Group’s CGUs were determined using the fair value less costs of disposal method. In the absence of observable

market prices, the recoverable amounts were estimated based on an income approach, specically a discounted cash ow model. The valuation

method is in line with previous years, with the exception that the cash ow forecast period is ve years in comparison with ten years previously.

The cash ow projections used in calculating the recoverable amounts are based on nancial plans approved by management covering an

explicit forecast period of ve years and reect the price that would be received to sell the CGU in an orderly transaction between market

participants at the measurement date. The level of fair value hierarchy within which the fair value measurement is categorized is level 3.

Refer to Note 19, Fair value of nancial instruments for the fair value hierarchy.