Nokia 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.164 NOKIA IN 2014

Notes to consolidated nancial statements continued

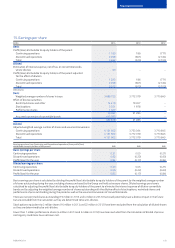

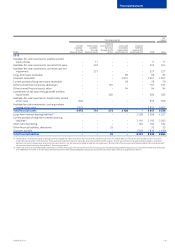

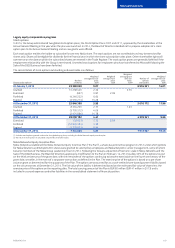

24. Shares of the Parent Company

Shares and shareholders

Shares and share capital

Nokia Corporation (“Parent Company”) has one class of shares. Each share entitles the holder to one vote at General Meetings. At December 31,

2014 the share capital of Nokia Corporation is EUR 245 896 461.96 and the total number of shares issued is 3 745 044 246. At December 31,

2014 the total number of shares includes 96 900 800 shares owned by Group companies representing 2.6% of share capital and total voting

rights. Under the Nokia Articles of Association, Nokia Corporation does not have minimum or maximum share capital or share par value.

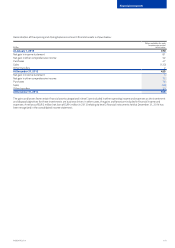

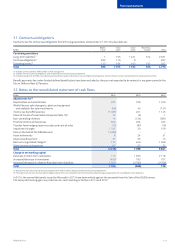

Authorizations

Authorization to issue shares and special rights entitling to shares

At the Annual General Meeting held on May 7, 2013 the shareholders authorized the Board of Directors to issue a maximum of 740 million

shares through one or more issues of shares or special rights entitling to shares. The Board of Directors may issue either new shares or shares

held by the Parent Company. The authorization includes the right for the Board of Directors to decide on all the terms and conditions of such

share and special rights issuances, including to whom the shares and special rights may be issued. The authorization may be used to develop

the Parent Company’s capital structure, diversify the shareholder base, nance or carry out acquisitions or other arrangements, settle the

Parent Company’s equity-based incentive plans, or for other purposes resolved by the Board of Directors. The authorization that would have

been eective until June 30, 2016 was terminated by the resolution of the Annual General Meeting on June 17, 2014.

At the Annual General Meeting held on June 17, 2014 the shareholders authorized the Board of Directors to issue a maximum of 740 million

shares through one or more issues of shares or special rights entitling to shares, including stock options. The Board of Directors may issue

either new shares or shares held by the Parent Company. The authorization includes the right for the Board of Directors to resolve on all the

terms and conditions of such share and special rights issuances, including issuance in deviation from the shareholders’ pre-emptive rights. The

authorization may be used to develop the Parent Company’s capital structure, diversify the shareholder base, nance or carry out acquisitions

or other arrangements, settle the Parent Company’s equity-based incentive plans, or for other purposes resolved by the Board of Directors.

The authorization is eective until December 17, 2015.

In 2014, Nokia Corporation issued 49 904 new shares following the holders of stock options issued in 2011 exercising their options.

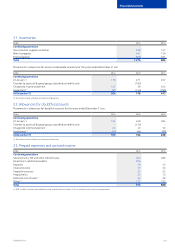

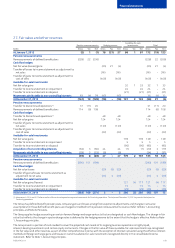

On October 26, 2012 the Group issued a EUR 750 million convertible bond based on an authorization to issue shares and special rights entitling

to shares, granted by the Annual General Meeting on May 6, 2010 and terminated by a resolution in the Annual General Meeting on May 7, 2013.

The bonds had a ve-year maturity and a 5.0% per annum coupon payable semi-annually. The initial conversion price was EUR 2.6116, which

was adjusted to EUR 2.44 per share on June 18, 2014 due to the distribution of ordinary and special dividends as resolved by the Annual

General Meeting on June 17, 2014. Bond terms and conditions require conversion price adjustments following dividend distributions.

Consequently, the Board of Directors decided to issue 20 192 323 new shares on the conversion of the bonds into Nokia shares based on

the authorization by the Annual General Meeting and in deviation from the pre-emptive subscription right of the shareholders. Based on the

adjusted conversion price of EUR 2.44, the maximum number of new shares which may be issued by the Group on the conversion of the bonds

is 307.3 million shares, representing 8.4% of the Group’s total number of shares at December 31, 2014, excluding the shares owned by the

Group. The right to convert the bonds into shares commenced on December 6, 2012 and ends on October 18, 2017. On March 15, 2013 EUR

0.1 million of the bond was converted into shares resulting in the issuance of 38 290 shares.

On September 23, 2013 the Group issued three EUR 500 million tranches of convertible bonds to Microsoft based on an authorization to issue

shares and special rights entitling to shares granted by the Annual General Meeting on May 7, 2013 and terminated by a resolution in the Annual

General Meeting on June 17, 2014. The maximum number of shares which might have been issued by the Group on conversion of these bonds,

based on the initial conversion price of each tranche, was approximately 367.5 million. At the closing of the Sale of the D&S Business, these

bonds were redeemed and the principal amount and accrued interest netted against the proceeds from the transaction.

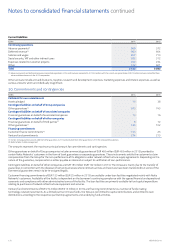

At December 31, 2014 the Board of Directors had no other authorizations to issue shares, convertible bonds, warrants or stock options.

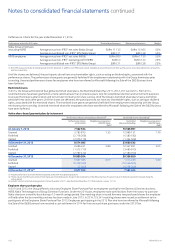

Other authorizations

At the Annual General Meeting held on May 7, 2013, the shareholders authorized the Board of Directors to repurchase a maximum of

370 million Nokia shares using funds in the unrestricted equity. The Group did not repurchase any shares on the basis of this authorization.

The authorization that would have been eective until June 30, 2014 was terminated by the resolution of the Annual General Meeting on

June 17, 2014.

At the Annual General Meeting held on June 17, 2014 the shareholders authorized the Board of Directors to repurchase a maximum of

370 million Nokia shares. The amount corresponds to less than 10% of the total number of Nokia shares. The shares may be repurchased in

order to develop the capital structure of the Parent Company and are expected to be cancelled. In addition, the shares may be repurchased

in order to nance or carry out acquisitions or other arrangements, to settle the Parent Company’s equity-based incentive plans, or to be

transferred for other purposes. The authorization is eective until December 17, 2015. The Board of Directors decided on June 18, 2014 under

the authorization granted by the Annual General Meeting to commence share repurchases. The Board of Directors decided to repurchase a

maximum of 370 million shares, up to an equivalent of EUR 1.25 billion. At December 31, 2014 the Group had repurchased 66 903 682 shares.

On January 29, 2015 the Group announced that the Board of Directors had decided to cancel these treasury shares. The cancellation of the

shares does not have an impact on the Parent Company’s share capital.