Nokia 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Board review

NOKIA IN 2014

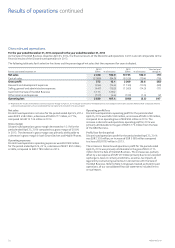

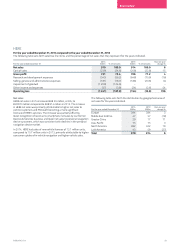

For the year ended December 31, 2013 compared to the year ended December 31, 2012

The following table sets forth selective line items and the percentage of net sales that they represent for years indicated.

For the year ended December 31

2013

EURm % of net sales

2012

EURm % of net sales

Year-on-year

change %

Net sales 10 735 100.0 15 152 100.0 (29)

Cost of sales (8 526) (79.4) (12 320) (81.3) (31)

Gross prot 2 209 20.6 2 832 18.7 (22)

Research and development expenses (1 130) (10.5) (1 658) (10.9) (32)

Selling and marketing expenses (1 345) (12.5) (1 857) (12.3) (28)

Administrative and general expenses (215) (2.0) (286) (1.9) (25)

Other income and expenses (109) (1.0) (510) (3.4) (79)

Operating loss (590) (5.5) (1 479) (9.8) (60)

Net sales

Discontinued operations net sales decreased by 29% to

EUR 10 735 million compared to EUR 15 152 million in 2012. The

decline in discontinued operations net sales in 2013 was primarily due

to lower Mobile Phones net sales and, to a lesser extent, lower Smart

Devices net sales. The decline in Mobile Phones net sales was due to

lower volumes and average selling prices, aected by competitive

industry dynamics, including intense smartphone competition at

increasingly lower price points and intense competition at the low end

of our product portfolio. The decline in Smart Devices net sales was

primarily due to lower volumes, aected by competitive industry

dynamics, including the strong momentum of competing smartphone

platforms, as well as our portfolio transition from Symbian products

to Lumia products.

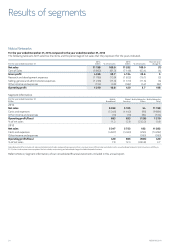

The following table sets forth the distribution by geographical area

of our net sales for the scal years 2013 and 2012.

For the year ended December 31

2013

EURm

2012

EURm

Year-on-year

change %

Europe 3 266 4 498 (27)

Middle East & Africa 1 689 2 712 (38)

Greater China 816 1 519 (46)

Asia-Pacic 2 691 3 655 (26)

North America 623 532 17

Latin America 1 650 2 236 (26)

Total 10 735 15 152 (29)

Gross margin

Discontinued operations gross margin improved to 20.6% in 2013

compared to 18.7% in 2012. The increase in gross margin in 2013 was

primarily due to a higher Smart Devices gross margin, partially oset

by slightly lower Mobile Phones gross margin. The increase in Smart

Devices gross margin was primarily due to lower inventory related

allowances, which adversely aected Smart Devices gross margin

in2012.

Operating expenses

Discontinued operations operating expenses were EUR 2 799 million

in 2013, compared to EUR 4 311 million in 2012. The 35% decrease

in 2013 was due to lower Mobile Phones and Smart Devices operating

expenses, primarily due to structural cost savings, as well as overall

cost controls.

Operating prot/loss

Discontinued operations operating margin improved to negative 5.5%

in 2013 compared to negative 9.8% in 2012. The improvement was

primarily due to structural cost savings, as well as overall cost controls,

and a higher gross margin.