Nokia 2014 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205NOKIA IN 2014

Financial statements

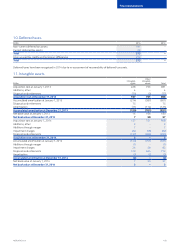

Auditor fees and services

Auditor fees and services

PricewaterhouseCoopers Oy has served as our independent auditor

for each of the scal years in the three-year period ended

December 31, 2014. The independent auditor is elected annually by

our shareholders at the Annual General Meeting for the scal year in

question. The Audit Committee of the Board of Directors makes a

proposal to the shareholders in respect of the appointment of the

auditor based upon its evaluation of the qualications and

independence of the auditor to be proposed for election or

re-election on an annual basis.

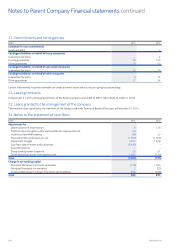

The following table presents fees by type paid to

PricewaterhouseCoopers for the years ended December 31:

EURm 2014 2013

Audit fees(1) 14.8 16.8

Audit-related fees(2) 0.6 10.0

Tax fees(3) 0.8 1.7

Other fees(4) 2.9 1.1

Total 19.1 29.6

(1) Audit fees consist of fees billed for the annual audit of the Group’s consolidated nancial

statements and the statutory nancial statements of the Group’s subsidiaries.

(2) Audit-related fees consist of fees billed for assurance and related services that are reasonably

related to the performance of the audit or review of the Group’s nancial statements or that

are traditionally performed by the independent auditor, and include consultations concerning

nancial accounting and reporting standards; advice on tax accounting matters; advice and

assistance in connection with local statutory accounting requirements; due diligence related to

acquisitions or divestitures; nancial due diligence in connection with provision of funding to

customers, reports in relation to covenants in loan agreements; employee benet plan audits

and reviews; and audit procedures in connection with investigations and compliance programs.

They also include fees billed for other audit services, which are those services that only the

independent auditor reasonably can provide, and include the provision of comfort letters and

consents in connection with statutory and regulatory lings and the review of documents led

with the SEC and other capital markets or local nancial reporting regulatory bodies.

(3) Tax fees include fees billed for: (i) corporate and indirect compliance including preparation and/or

review of tax returns, preparation, review and/or ling of various certicates and forms and

consultation regarding tax returns and assistance with revenue authority queries; (ii) transfer

pricing advice and assistance with tax clearances; (iii) customs duties reviews and advice;

(iv) consultations and tax audits (assistance with technical tax queries and tax audits and appeals

and advice on mergers, acquisitions and restructurings); (v) personal compliance (preparation of

individual tax returns and registrations for employees (non-executives), assistance with applying

visa, residency, work permits and tax status for expatriates); and (vi) consultation and planning

(advice on stock-based remuneration, local employer tax laws, social security laws, employment

laws and compensation programs and tax implications on short-term international transfers).

(4) Other fees include fees billed for company establishment, forensic accounting, data security,

investigations and reviews of licensing arrangements with customers, other consulting services

and occasional training or reference materials and services.

Audit Committee pre-approval policies

andprocedures

The Audit Committee of our Board of Directors is responsible, among

other matters, for the oversight of the external auditor subject to the

requirements of Finnish law. The Audit Committee has adopted a

policy regarding pre-approval of audit and permissible non-audit

services provided by our independent external auditor (the “Policy”).

Under the Policy, proposed services either: (i) may be pre-approved

by the Audit Committee in accordance with certain service categories

described in appendices to the Policy (“general pre-approval”);

or (ii) require the specic pre-approval of the Audit Committee

(“specic pre-approval”). The Audit Committee may delegate either

type of pre-approval authority to one or more of its members. The

appendices to the Policy set out the audit, audit-related, tax and other

services that have received the general pre-approval of the Audit

Committee. All other audit, audit-related (including services related to

internal controls and signicant M&A projects), tax and other services

are subject to a specic pre-approval from the Audit Committee. All

service requests concerning generally pre-approved services will be

submitted to the Corporate Controller, who will determine whether the

services are within the services generally pre-approved. The Policy and

its appendices are subject to annual review by the Audit Committee.

The Audit Committee establishes budgeted fee levels annually for

each of the four categories of audit and non-audit services that are

pre-approved under the Policy, namely, audit, audit-related, tax and

other services. Requests or applications to provide services that

require specic approval by the Audit Committee are submitted to

the Audit Committee by both the external auditor and the Corporate

Controller. At each regular meeting of the Audit Committee, the

external auditor provides a report in order for the Audit Committee

to review the services that the auditor is providing, as well as the

status and cost of those services.