Nokia 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Financial statements

NOKIA IN 2014

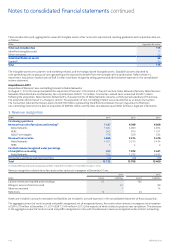

Amendments to IAS 19, Dened Benet Plans: Employee

Contributions, require an entity to consider contributions from

employees or third parties when accounting for dened benet

plans. Where the contributions are linked to service, they should

be attributed to periods of service as a negative benet. These

amendments clarify that if the amount of the contributions is

independent of the number of years of service, an entity is permitted

to recognize such contributions as a reduction in the service cost in

the period in which the service is rendered, instead of allocating the

contributions to the periods of service.

Improvement to IFRS 2, Share-based Payment, claries various issues

relating to the denitions of performance and service conditions

which are vesting conditions, including: a performance condition must

contain a service condition, a performance target must be met while

the counterparty is rendering service, a performance target may relate

to the operations or activities of an entity, or to those of another

entity in the same group, a performance condition may be a market

or non-market condition, and if the counterparty, regardless of the

reason, ceases to provide service during the vesting period, the

service condition is not satised.

Amendment to IFRS 3, Business Combinations, claries that all

contingent consideration arrangements classied as liabilities (or

assets) arising from a business combination should be subsequently

measured at fair value through prot or loss whether or not they fall

within the scope of IFRS 9 (or IAS 39, as applicable).

Amendment to IFRS 8, Operating Segments, claries that an entity

must disclose the judgments made by management in applying the

aggregation criteria in paragraph 12 of IFRS 8 used to assess whether

the segments are ‘similar’, and that the reconciliation of segment

assets to total assets is only required to be disclosed if the

reconciliation is reported to the chief operating decision maker,

similar to the required disclosure for segment liabilities.

Amendment to IAS 24, Related Party Disclosures, claries that a

management entity (an entity that provides key management

personnel services) is a related party subject to the related party

disclosures. In addition, an entity that uses a management entity is

required to disclose the expenses incurred for management services.

Amendment to IFRS 13, Fair Value Measurement, claries that the

portfolio exception in IFRS 13 can be applied not only to nancial

assets and nancial liabilities, but also to other contracts within the

scope of IFRS 9 (or IAS 39, as applicable).

Amendments to IAS 16 and IAS 38: Clarication of Acceptable Methods

of Depreciation and Amortization, clarify the principle in IAS 16 and

IAS 38 that revenue reects a pattern of economic benets that are

generated from operating a business (of which the asset is part)

rather than the economic benets that are consumed through use

of the asset. As a result, a revenue-based method cannot be used

to depreciate property, plant and equipment and may only be used

in very limited circumstances to amortize intangible assets. The

amendments are eective prospectively for annual periods beginning

on or after January 1, 2016.