Nokia 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76 NOKIA IN 2014

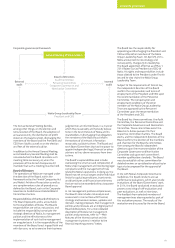

Risk factors

Set forth below is a description

ofrisk factors that could aect

Nokia. There may be, however,

additional risks unknown to

Nokiaand other risks currently

believed to be immaterial that

could turn out to be material.

These risks, either individually or together,

could adversely aect our business, sales,

protability, results of operations, nancial

condition, costs, expenses, liquidity, market

share, brand, reputation and share price from

time to time. Unless otherwise indicated or

the context otherwise provides, references in

these risk factors to “Nokia”, “we”, “us” and

“our” mean Nokia’s consolidated operating

segments and refer to Continuing operations.

We describe the risks that aect the Nokia

Group or are relevant to all Nokia businesses

at the beginning of this section and provide

information on additional risks that are

primarily related to the individual Nokia

business: Nokia Networks, HERE and Nokia

Technologies, and are detailed separately

under their respective headings below.

This annual report also contains

forward-looking statements that involve

risksand uncertainties presented in

“Forward-looking statements” below.

Risks relating to Nokia

■Nokia’s strategy to be a leader in

technologies of the Programmable World,

which is subject to various risks and

uncertainties, including that Nokia may

notbe able to sustain or improve the

operational and financial performance

ofitsbusinesses or that Nokia may not be

able to correctly identify or successfully

pursue business opportunities.

■We may be adversely affected by general

economic and market conditions.

■We are a company with global operations

and with sales derived from various

countries, exposing us to risks related to

regulatory, political or other developments

in various counties or regions.

■Our products, services and business

models depend on IPR on technologies that

we have developed as well as technologies

that are licensed to us by certain third

parties. As a result, evaluating the rights

related to the technologies we use or intend

to use is increasingly challenging, and we

expect to continue to face claims that we

could have allegedly infringed third parties’

IPR. Theuseof these technologies may also

result inincreased licensing costs for us,

restrictions on our ability to use certain

technologies in our products and/or costly

and time-consuming litigation.

■We have operations in a number of

countries and, as a result, face complex

tax issues and tax disputes and could

be obligated to pay additional taxes in

various jurisdictions.

■Our actual or anticipated performance,

among other factors, could reduce our

ability to utilize our deferred tax assets.

■We may be unable to retain, motivate,

develop and recruit appropriately

skilled employees.

■If any of the companies we partner and

collaborate with were to fail to perform

as expected or if we fail to achieve the

collaboration or partnering arrangements

needed to succeed, we may not be able to

bring our products, services or technologies

to market successfully or in a timely

manner or our operations could be

affected adversely.

■Our net sales, costs and results of

operations, as well as the US dollar value

of our dividends and market price of our

American Depositary Shares (“ADSs”),

are affected by exchange rate fluctuations,

particularly between the euro, which is

our reporting currency, and the US dollar,

the Japanese yen and the Chinese yuan,

as well as certain other currencies.

■An unfavorable outcome of litigation,

contract-related disputes or allegations

ofhealth hazards associated with our

businesses could have a material adverse

effect on our us.

■Our operations rely on the efficient and

uninterrupted operation of complex and

centralized information technology systems

and networks and certain personal and

consumer data is stored as part of our

business operations. If a system or

networkinefficiency, cybersecurity breach,

malfunction or disruption occurs, this

couldhave a material adverse effect on

ourbusiness and results of operations.

■We may not be able to achieve targeted

benefits from or successfully implement

planned transactions, such as acquisitions,

divestments, mergers or joint ventures,

forinstance due to issues in successfully

selecting the targets or failure to execute

transactions or due to unexpected liabilities

associated with such transactions.

■Our efforts aimed at managing and

improving financial or operational

performance, cost savings and

competitiveness may not lead to targeted

results or improvements.

■We may not be able to optimize our capital

structure as planned and re-establish

our investment grade credit rating.