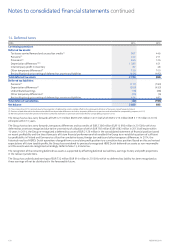

Nokia 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157

Financial statements

NOKIA IN 2014

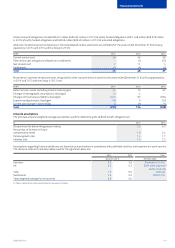

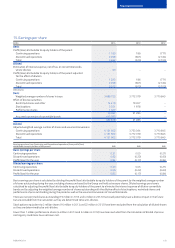

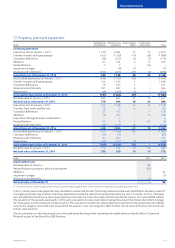

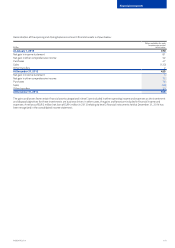

17. Property, plant and equipment

EURm

Buildings and

constructions

Machinery and

equipment

Other tangible

assets(1)

Assets under

construction Total

Continuing operations

Acquisition cost at January 1, 2013 1 129 3 694 77 73 4 973

Transfer to assets of disposal groups (422) (1 528) (10) (38) (1 998)

Translation dierences (44) (122) (3) (5) (174)

Additions 21 154 411 190

Reclassications 7 7 – (14) –

Impairment charges –(6) (1) –(7)

Disposals and retirements (355) (451) (27) (3) (836)

Acquisition cost at December 31, 2013 336 1 748 40 24 2 148

Accumulated depreciation at January 1, 2013 (469) (3 043) (30) –(3 542)

Transfer to assets of disposal groups 150 1 335 4 – 1 489

Translation dierences 19 107 1 – 127

Disposals and retirements 191 397 6 – 594

Depreciation (48) (200) (2) –(250)

Accumulated depreciation at December 31, 2013 (157) (1 404) (21) –(1 582)

Net book value at January 1, 2013 660 651 47 73 1 431

Net book value at December 31, 2013 179 344 19 24 566

Acquisition cost at January 1, 2014 336 1 748 40 24 2 148

Transfers from assets held for sale 76 3 4 – 83

Translation dierences 25 103 – 1 129

Additions 28 205 –15 248

Acquisitions through business combinations – 2 – – 2

Reclassications 12 6 1 (21) (2)

Disposals and retirements (39) (213) (4) –(256)

Acquisition cost at December 31, 2014 438 1 854 41 19 2 352

Accumulated depreciation at January 1, 2014 (157) (1 404) (21) –(1 582)

Translation dierences (13) (75) 1 – (87)

Disposals and retirements 30 202 – – 232

Depreciation (40) (157) (2) –(199)

Accumulated depreciation at December 31, 2014 (180) (1 434) (22) –(1 636)

Net book value at January 1, 2014 179 344 19 24 566

Net book value at December 31, 2014 258 420 19 19 716

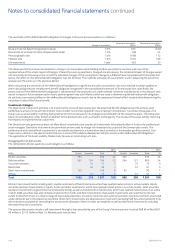

EURm 2014 2013

Assets held for sale

Net book value at January 1 89 –

Reclassications to property, plant and equipment (83) –

Additions –94

Impairment charges –(5)

Disposals and retirements (6) –

Net book value at December 31 –89

(1) Land and water areas and other tangible assets have been combined as other tangible assets in 2014 and have been combined for comparability purposes in 2013.

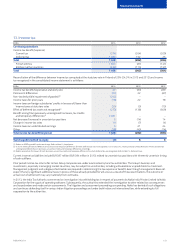

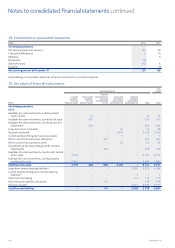

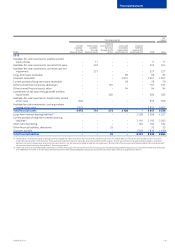

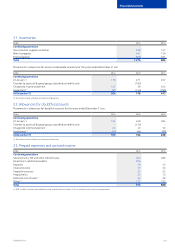

In 2013, certain real estate properties were classied as assets held for sale. These long-lived assets had been identied for disposal as part of

the ongoing restructuring activities. The Group expected to realize the sale of these properties within the next 12 months. In 2014, the Group

has concluded that there are no real estate properties that meet the criteria for assets held for sale (the fair value in 2013 was EUR 89 million).

The valuation of these assets was based on third-party evaluations by real estate brokers taking into account the Group’s divestment strategy

for these assets as well as relevant market dynamics. This evaluation included non-observable inputs and hence these assets were considered

to be level 3 category assets that were measured at fair value on a non-recurring basis. Refer to Note 19, Fair value of nancial instruments for

the fair value hierarchy.

The tax authorities in India have placed a lien which prohibited the Group from transfering the mobile devices related facility in Chennai to

Microsoft as part of the Sale of the D&S Business.