Nokia 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOKIA IN 201474

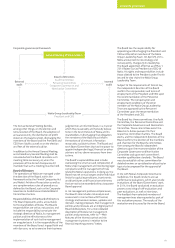

Shares and

share capital Dividend

Nokia has one class of shares.

Each Nokia share entitles the

holder to one vote at general

meetings of Nokia.

On December 31, 2014 the total number of

Nokia shares was 3 745 044 246 and Nokia’s

share capital equaled EUR 245 896 461.96.

On December 31, 2014 Nokia and its

subsidiary companies owned a total of

96 900 800 Nokia shares, which represented

approximately 2.6% of the total number of

the shares and voting rights of the company.

In 2014, Nokia did not cancel any shares.

In 2014, under the authorization held by the

Board and in line with the capital structure

optimization program, Nokia repurchased a

total of 66 903 682 shares, which represented

approximately 1.8% of the total number of

shares and voting rights on December 31,

2014. The price paid for the shares was based

on the current market price of the Nokia share

on the securities market at the time of the

repurchase. As expected, the repurchased

shares were cancelled, eective as of

February 4, 2015.

In 2014, Nokia issued 49 904 new shares

upon the exercise of stock options issued

to personnel. The shares were issued in

accordance with the Nokia Stock Option

Plan 2011, approved by the Annual General

Meeting on May 3, 2011. The issuance of new

shares did not impact the amount of share

capital of the company. The issuance of

shares did not have any signicant eect

on the relative holdings of the other Nokia

shareholders nor on their voting rights.

The Board proposes

a dividend of EUR 0.14

per share for 2014.

The proposed dividend is in line with our

capital structure optimization program.

We distribute retained earnings, if any, within

the limits set by the Finnish Companies Act

(as dened below). We make and calculate the

distribution, if any, either in the form of cash

dividends, share buy-backs, or in some other

form or a combination of these. There is no

specic formula by which the amount of a

distribution is determined, although some

limits set by law are discussed below. The

timing and amount of future distributions

of retained earnings, if any, will depend on

our future results and nancial conditions.

Under the Finnish Companies Act, we may

distribute retained earnings on our shares

only upon a shareholders’ resolution and

subject to limited exceptions in the amount

proposed by the Board. The amount of any

distribution is limited to the amount of

distributable earnings of the parent company

pursuant to the last accounts approved by our

shareholders, taking into account the material

changes in the nancial situation of the

company after the end of the last nancial

period and a statutory requirement that the

distribution of earnings must not result in

insolvency of the company. Subject to

exceptions relating to the right of minority

shareholders to request a certain minimum

distribution, the distribution may not exceed

the amount proposed by the Board.

In 2014, under the authorization held by the

Board, Nokia transferred a total of 2 570 499

Nokia shares held by it as settlement under

Nokia equity plans to the plan participants

and personnel of the Nokia Group, including

certain Nokia Group Leadership Team

members. The shares were transferred free of

charge and the amount of shares represented

approximately 0.07% of the total number

of shares and voting rights on December 31,

2014. The issuance of shares did not have

any signicant eect on the relative holdings

of the other Nokia shareholders nor on their

voting rights.

Information on the authorizations held by

the Board in 2014 to issue shares and special

rights entitling to shares, transfer shares and

repurchase own shares, as well as information

on related party transactions, the

shareholders, stock options, shareholders’

equity per share, dividend yield, price

per earnings ratio, share prices, market

capitalization, share turnover and average

number of shares are available in the

“Compensation of the Board of Directors

and the Nokia Group Leadership Team”,

“Financial Statements” and “General facts on

Nokia—Shares and shareholders” sections.