Nokia 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

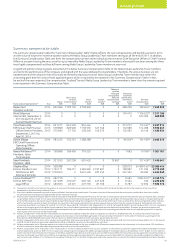

100 NOKIA IN 2014

(8) All other compensation for Mr. Elhage in 2014 includes: EUR 140 325 for international assignment related allowances; EUR 3 750 for car allowance; EUR 4 420 tax services; EUR 5 688 for premiums

paid under supplemental medical and disability insurance and mobile phone. Pension payments for Mr. Elhage include amounts paid to the company International Retirement Savings Plan in respect

of his assignment to Germany and payments to the mandatory TyEL Finnish pension in respect of his service in Finland.

(9) Salaries, benets and perquisites for Mr. Haidamus and Ms. Pentland were paid and denominated in USD. Amounts were converted using year-end 2014 USD/EUR exchange rate of 1.25. For years

2013 and 2012 disclosure, amounts were converted using the respective year-end USD/EUR exchange rates, 1.37 and 1.28, respectively.

(10) Mr. Haidamus and Ms. Pentland participated in Nokia’s U.S Retirement Savings and Investment Plan. Under this 401(k) plan, participants elect to make voluntary pre-tax contributions that are 100%

matched by Nokia up to 8% of eligible earnings. 25% of the employer’s match vests for the participants during each of the rst four years of their employment. Participants earning in excess of the

Internal Revenue Service (IRS) eligible earning limits may participate in the Nokia Restoration and Deferral Plan, which allows employees to defer up to 50% of their salary and 100% of their short-term

cash incentive. Contributions to the Restoration and Deferral Plan are matched 100% up to 8% of eligible earnings, less contributions made to the 401(k) plan. Nokia’s contributions to the plan are

included under “All Other Compensation Column” and noted hereafter.

(11) All other compensation for Mr. Haidamus in 2014 includes: EUR 10 796 for mobility related allowances.

(12) All other compensation for Mr. Fernback in 2014 includes: EUR 2 428 for car and fuel and EUR 125 000 sign on payment in lieu of bonuses forfeited on leaving his previous employer.

(13) All other compensation for Mr. Elop in 2014 includes: housing of EUR 12 217; EUR 12 102 for tax services; home security EUR 74; and EUR 1 071 for premiums paid under supplemental medical and

disability insurance and for mobile phone and driver. Severance payment in the amount of EUR 24 248 059. Payment in lieu of untaken vacation in line with local legal requirements EUR 215 620.

According to the terms of the purchase agreement with Microsoft entered into in connection with the Sale of the D&S Business, 30% of the total severance payment amounting to EUR 7.3 million,

was borne by Nokia and the remaining 70% was borne by Microsoft.

(14) All other compensation for Ms. Pentland in 2014 includes: EUR 3 365 provided under Nokia’s international assignment policy in the UK and Severance payment in the amount of EUR 2 832 548.

(15) A signicant portion of equity grants presented in the Summary Compensation Table to the Nokia Group Leadership Team members are tied to the performance of the company and aligned with the

value delivered to shareholders. Therefore, the amounts shown are not representative of the amounts that will actually be earned and paid out to each Nokia Group Leadership Team member (but

rather the accounting grant date fair value of each applicable grant, which is required to be reported in the Summary Compensation Table). In fact, for each of the years reported, the compensation

“realized” by each Nokia Group leadership team member is lower than the amount required to be reported in the Summary Compensation Table.

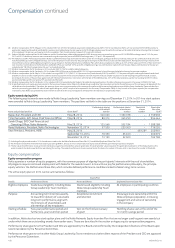

Equity awards during 2014

The following equity awards were made to Nokia Group Leadership Team members serving as of December 31, 2014. In 2014 no stock options

were awarded to Nokia Group Leadership Team members. The positions set forth in the table are the positions at December 31, 2014.

Name and principal position Grant Date(1)

Performance shares

at threshold

number

Performance shares

at maximum

number

Restricted

shares

number

Grant date

fair value

EUR(3)

Rajeev Suri, President and CEO May 28, 2014 340 020 1 360 078 –3 759 936

Timo Ihamuotila, EVP, Group Chief Financial Ocer May 28, 2014 86 313 345 250 –954 444

Samih Elhage, EVP, Chief Financial and

OperatingOcer,Nokia Networks May 28, 2014 125 546 502 184 –1 388 288

Ramzi Haidamus, President, Nokia Technologies November 12, 2014 57 500 230 000 –716 220

Sean Fernback, President, HERE May 28, 2014 48 126(2) 253 961

September 10, 2014 16 350 65 400 202 675

November 12, 2014 13 150 52 600 163 796

(1) Including all equity awards made in 2014. Awards were made under the Nokia Performance Share Plan 2014 and Nokia Restricted Share Plan 2014.

(2) Mr. Fernback received the restricted share award upon joining HERE in January 2014 as compensation of equity awards forfeited upon leaving his previous employer.

(3) The fair value of performance shares and restricted shares equals the estimated fair value on grant date. The estimated fair value is based on the grant date market price of the Nokia share less the

present value of dividends expected to be paid during the vesting. The value of performance shares is presented on the basis of a number of shares, which is two times the number at threshold.

Equity compensation

Equity compensation program

Nokia operates a number of equity programs, with the common purpose of aligning the participants’ interests with those of shareholders.

All programs require continued employment with Nokia for the awards to vest. In line with our pay for performance philosophy, the principle

equity vehicle is the Performance Share Plan, which includes dened performance conditions linked to Nokia’s long-term success.

The active equity plans in 2014 can be summarized as follows:

Details

Equity Plan

Performance Shares Restricted Shares Employee Share Purchase Plan

Eligible employees Grade based eligibility including Nokia

Group Leadership Team members

Grade based eligibility including

Nokia Group Leadership Team

members

All employees in participating countries

Purpose Annual long-term incentive awards,

to reward for delivery of sustainable

long-term performance, align with

the interests of shareholders and

aid retention of key employees

Exceptional recruitment

and retention

Encourage share ownership within the

Nokia employee population, increasing

engagement and sense of ownership

in the company

Vesting schedule Two-year performance period and

further one-year restriction period

Vest on the third anniversary

ofgrant

Matching shares vest at the end of the

12-month savings period

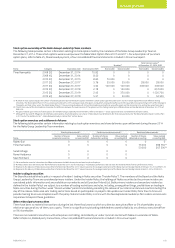

In addition, Nokia also has two stock option plans and the Nokia Networks Equity Incentive Plan that are no longer used to grant new awards but

under which there are outstanding awards from earlier years. These are described in the section on legacy equity compensation programs.

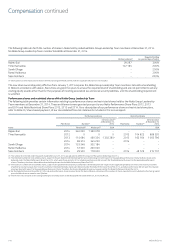

Performance share grants to the President and CEO are approved by the Board and conrmed by the independent directors of the Board upon

recommendation by the Personnel Committee.

Performance share grants to the other Nokia Group Leadership Team members and other direct reports of the President and CEO are approved

by the Personnel Committee.

Compensation continued