Nokia 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48 NOKIA IN 2014

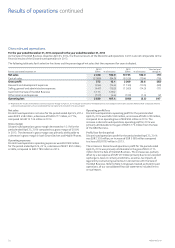

Operating expenses

Our R&D expenses for Continuing operations in 2014 were EUR 2 493

million, a decrease of EUR 126 million, or 5%, compared to EUR 2 619

million in 2013. R&D expenses represented 19.6% of our net sales

in 2014 compared to 20.6% in 2013. The decrease in R&D expenses

was primarily attributable to the decrease in R&D expenses in HERE

and Nokia Networks, partially oset by higher R&D expenses in

Nokia Technologies.

The decrease in R&D expenses in HERE was primarily attributable to

signicant purchase price accounting related items of EUR 168 million

in 2013 arising from the purchase of NAVTEQ, the majority of which

were fully amortized in 2013. The decrease in R&D expenses in Nokia

Networks was primarily attributable to lower subcontracting costs,

partially oset by higher investments in targeted growth areas,

most notably LTE, small cells and Telco Cloud. The increase in R&D

expenses in Nokia Technologies was primarily attributable to

investments in business activities, such as the Technology and Brand

licensing opportunities, which target new and signicant long-term

growth opportunities.

R&D expenses included purchase price accounting related items of

EUR 36 million in 2014 compared to EUR 188 million in 2013. In 2014,

R&D expenses included EUR 23 million of transaction related

personnel costs related to the Sale of the D&S Business compared

to EUR 15 million in 2013.

Our selling, general and administrative expenses for Continuing

operations in 2014 were EUR 1 634 million, a decrease of

EUR 37 million, or 2%, compared to EUR 1 671 million in 2013. Selling,

general and administrative expenses represented 12.8% of our net

sales in 2014 compared to 13.1% in 2013. The decrease in selling,

general and administrative expenses was primarily attributable to

the decrease in selling, general and administrative expenses in Nokia

Networks. The decrease was partially oset by an increase in selling,

general and administrative expenses in Group Common Functions

and Nokia Technologies.

The decrease in selling, general and administrative expenses in Nokia

Networks was primarily attributable to structural cost savings from

Nokia Networks’ global restructuring program. The increase in selling,

general and administrative expenses in Group Common Functions

was primarily attributable to transaction related costs resulting from

the Sale of the D&S Business. The increase in selling, general and

administrative expenses in Nokia Technologies was primarily

attributable to increased activities related to anticipated and

ongoing patent licensing cases.

Selling, general and administrative expenses included purchase

price accounting items of EUR 40 million in 2014 compared to

EUR 93 million in 2013. In 2014, selling, general and administrative

expenses included EUR 31 million of transaction related costs related

to the Sale of the D&S Business.

A goodwill impairment charge of EUR 1 209 million was recorded in the

third quarter 2014. Refer to Note 10, Impairment, of our consolidated

nancial statements included in this annual report.

Other income and expenses for Continuing operations in 2014 was a

net expense of EUR 132 million, a decrease of EUR 404 million, or 75%,

compared to a net expense of EUR 536 million in 2013. The decrease

in other income and expenses was primarily attributable to lower

restructuring and associated charges at Nokia Networks, partially

oset by lower other income in Group Common Functions. In 2014,

other income and expenses included restructuring and associated

charges of EUR 57 million at Nokia Networks, charges related to the

HERE cost reduction program of EUR 36 million and anticipated

contractual remediation costs of EUR 31 million at Nokia Networks.

In2013, other income and expenses included restructuring and

associated charges of EUR 602 million, and transaction related costs

ofEUR 18 million related to the Sale of the D&S Business.

Operating prot/loss

Our operating prot for Continuing operations in 2014 was

EUR 170 million, a decrease of EUR 349 million, or 67%, compared

to an operating prot of EUR 519 million in 2013. The decrease in

operating prot was primarily attributable to the goodwill impairment

charge relating to HERE and the higher expenses in Group Common

Functions. The decrease was partially oset by an increase in operating

prot in Nokia Networks and Nokia Technologies. Our operating prot

in 2014 included a EUR 1 209 million goodwill impairment charge

relating to HERE. In addition, it included purchase price accounting

items, restructuring charges and other special items of EUR 253 million

compared to EUR 917 million in 2013. Our operating margin in 2014

was 1.3% compared to 4.1% in 2013.

Net nancial income and expenses

Financial income and expenses for Continuing operations was a net

expense of EUR 395 million in 2014 compared to a net expense of

EUR280 million in 2013, an increase of EUR 115 million, or 41%.

The higher net nancial expense in 2014 was primarily attributable

to EUR 123 million of one-time expense related to the redemption of

materially all of Nokia Networks’ borrowings, and a non-cash charge of

EUR 57 million related to the repayment of EUR 1.5 billion convertible

bonds issued to Microsoft in the second quarter 2014. These charges

were partially oset by reduced interest expenses during the second

half of the year and lower net losses related to foreign exchange.

Refer to “ —Liquidity and capital resources” below.

Results of operations continued